Get in Touch

We love to help & we love to listen. Please fill out the form

below and we’ll get back to you within a day

News

Jan 16, 2026The deal is structured as a five-year Indefinite Delivery/Indefinite Quantity contract with an initial value of about $168.9 million and potential task orders that could raise the total contract value to $250 million.

The award was announced on Tuesday, Jan. 13, on SAM.gov, the Department of Defense's contracting website.

CEO James Walker said, "This award reflects the U.S. government's commitment to revitalizing a long-neglected critical mineral supply chain. We are proud to support the U.S. government's strategic material reserves by supplying domestically sourced, high-grade acidspar. This contract confirms our leadership in rebuilding U.S. critical mineral capability and ensures our products directly contribute to national resilience, industrial strength, and long-term security. We are now a partner in America's strategic future."

The contract establishes Ares as a sole-source domestic supplier of acid-grade fluorspar to the U.S. government and the only U.S. producer positioned to deliver the material at scale.

The company said acid-grade fluorspar is a U.S.-designated critical mineral used to produce hydrofluoric acid and other fluorine-based materials that support defense systems, industrial manufacturing, and advanced technologies.

The contract is tied to Ares' Lost Sheep Fluorspar Project in Delta, Utah, which the company said is 100% owned and fully permitted.

Ares said the project spans 5,982 acres across 353 claims, has an NI 43-101 technical report identifying extensive high-grade fluorspar with low impurities, and has a mining plan approved by the Bureau of Land Management.

More broadly, the multi-year Pentagon contract highlights how critical minerals are emerging as a central strategic and investment theme for 2026.

Critical minerals — including rare earths and other strategic metals — are increasingly viewed by investors and policymakers as essential inputs for advanced defense systems, electronics, clean energy infrastructure and high-growth technologies.

For investors, the Pentagon's move to secure long-term supplies through contracts like the one awarded to Ares signals expanding government procurement as a demand catalyst and underscores the strategic premium markets are placing on companies positioned within the domestic critical minerals value chain.

Price Action: ARSMF closed 13.81% higher at $0.52 on Thursday.

Image via Shutterstock

News

Jan 16, 2026GTB-5550 TriKE is a B7-H3-targeted natural killer (NK) cell engager for B7-H3-expressing solid tumor cancers.

"The IND for GTB-5550 represents the third NK cell engager we plan to move into clinical development and a tremendous accomplishment for the company", said Michael Breen, Executive Chairman and CEO of GT Biopharma.

Initiation of a Phase 1 basket trial with GTB-5550 for multiple solid tumors is planned for 2026. The company looks forward to applying the clinical learnings from the GTB-3650 study to help inform the GTB-5550 program, which targets a patient population with B7-H3-expressing solid tumors.

The company is actively enrolling the Phase 1 trial with GTB-3650 in myeloid blood cancer, and expects the next data readout in the first half of 2026 that could provide potential evidence of clinical activity.

“The global market for B7-H3 expressing solid tumor cancers accounts for a portion of the estimated $362 billion global solid tumor cancers market…,” Breen said in a press release on Thursday.

The Phase 1a dose escalation portion of the trial will test up to 7 dose levels to identify the maximum tolerated dose (MTD).

The Phase 1b dose expansion component of the trial will confirm the MTD identified in the Phase 1a trial across 7 distinct metastatic disease cohorts, and further evaluate its tolerability, assuming the toxicity rates are similar across the groups.

GTB-5550 will be administered by subcutaneous (SQ) injection in the abdominal area for 5 consecutive days during Week 1 and Week 2, followed by 2 weeks of no treatment. One treatment cycle is 4 weeks in duration.

A minimum of 2 cycles is planned, and patient-appropriate disease reassessment is performed after 2 cycles and every 8-12 weeks thereafter. Treatment may continue until disease progression, unacceptable toxicity, patient refusal, or treatment is no longer in the best interest of the patient.

Patients are followed for 12 months to determine progression-free survival (PFS) and overall survival (OS).

Price Action: GTBP stock is up 12.92% at $0.75 during the premarket session at the last check on Thursday.

Photo by Aunt Spray via Shutterstock

Biotech

Jan 15, 2026GT Biopharma targets a portion of the estimated $362 billion global solid tumor market with its B7-H3 Trike

Preliminary, unaudited cash balance of approximately $7 million as of December 31, 2025 anticipated to extend cash runway into Q3 2026

"The IND for GTB-5550 represents the third NK cell engager we plan to move into clinical

development and a tremendous accomplishment for the company", said Michael Breen,

Executive Chairman and Chief Executive Officer of GT Biopharma. "As we continue actively

enrolling the Phase 1 trial with GTB-3650 in myeloid blood cancer, we expect the next data

readout in 1H 2026 could provide potential evidence of clinical activity. Initiation of a Phase 1

basket trial with GTB-5550 for multiple solid tumors is planned for 2026. We look forward to

applying the clinical learnings from the GTB-3650 study to help inform the GTB-5550 program,

which targets a patient population with B7-H3 expressing solid tumors that is orders of

magnitude larger than the myeloid blood cancer patient population." The global market for B7-

H3 expressing solid tumor cancers accounts for a portion of the estimated $362 billion global

solid tumor cancers market (according to Data Bridge Market Research). B7-H3 expressing

solid tumor cancers are estimated to account for a significant portion of solid tumor cancers.

News

Jan 15, 2026Editor’s Note: This story has been updated to include a response from an Amazon spokesperson.

reportedly renegotiated prices with some suppliers as reduced U.S. tariffs on Chinese imports eased cost pressures across its e-commerce supply chain.An Amazon spokesperson told Reuters that it is engaging with sellers but highlighted its broader goal of keeping prices competitive for consumers.

In an emailed statement to Benzinga, an Amazon spokesperson said the company's annual vendor negotiation cycles remain unchanged and begin at varying times depending on the product category.

“Prices of products in our store have not increased outside of normal fluctuations and we continue to meet or beat other retailers' prices across our vast selection,” the spokesperson added.

Earlier in the day, the Financial Times reported that Amazon is looking to reduce the prices it pays suppliers for products sold on its e-commerce platform.

The company is reportedly seeking to roll back concessions made to offset the impact of U.S. tariffs imposed by President Donald Trump.

The pricing discussions follow an agreement reached in late October between Trump and Chinese President Xi Jinping to lower tariffs on Chinese goods entering the U.S.

The deal included commitments from Beijing to crack down on the illicit fentanyl trade, resume purchases of U.S. soybeans and ensure continued exports of rare earth materials.

As part of the agreement, average U.S. tariffs on Chinese imports were reduced to about 47%, down from roughly 57%.

During the height of the trade dispute, Amazon and other major retailers absorbed higher costs or allowed suppliers to raise prices in an effort to shield shoppers from sharp price increases.

With tariffs now lower, Amazon appears to be reassessing those arrangements as it seeks to protect margins while continuing to offer competitive pricing.

The U.S. Supreme Court is expected to issue rulings on Jan. 14 in several major cases, including challenges to the legality of Trump's sweeping global tariffs imposed under the International Emergency Economic Powers Act, Reuters noted.

If the court finds those tariffs unlawful, the U.S. government could be required to refund nearly $150 billion in duties already paid by importers, the report added.

Price Action: On Tuesday, Amazon shares slipped 1.57% during the regular session and gained 0.025%, according to Benzinga Pro.

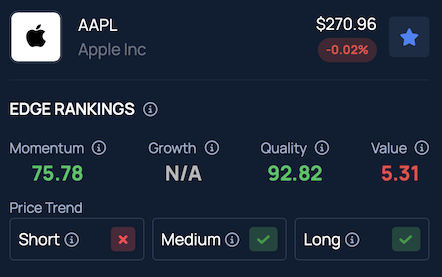

According to Benzinga Edge Stock Rankings, Amazon maintains a strong outlook across short, medium and long-term horizons. Click here to see how Apple compares with its industry peers.

Photo: bluestork / Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

News

Jan 14, 2026"With the launch of our over-the-counter ENFit Syringes, available in institutional and consumer-friendly packaging, we are expanding access to safe, affordable, and standardized enteral delivery tools…," said Doron Besser, CEO of ENvue Medical.

ENvue's ENFit Syringes are currently anticipated to be available at certain online retailers, including Amazon and Durable Medical Equipment suppliers, in 2.5 mL, 5 mL, 10 mL, and 60 mL sizes, without the need for a prescription.

The ENFit syringes are designed for reuse for up to seven days or 20 uses, helping support safe and consistent enteral delivery in both clinical and home care environments.

In December 2025, NanoVibronix Inc. changed its corporate name to ENvue Medical to better reflect its new strategic direction and primary focus on its ENvue feeding-tube placement system.

"Our strategy is now focused on scaling hospital utilization, strengthening our commercial footprint, and building a comprehensive enteral-feeding ecosystem around ENvue through both internal development and external business development opportunities," Besser said in a press release in December 2025.

Last week, ENvue Medical launched a new development and integration program leveraging vibration-based technology from its NanoVibronix division to address pain and discomfort associated with indwelling nasogastric tubes.

Nasogastric tubes are among the most widely used devices in hospital care and are frequently required to remain in place for extended periods. While clinically essential, indwelling NG tubes are commonly associated with nasal and throat discomfort during the dwell phase.

FEED Price Action: ENvue Medical shares were down 2.16% at $2.27 during premarket trading on Wednesday, according to Benzinga Pro data.

News

Jan 14, 2026News

Jan 14, 2026News

Jan 14, 2026The United States Patent and Trademark Office has issued U.S. Patent No. 12,514,854 B2, an Orange Book-listable patent covering Rezenopy (naloxone HCl) Nasal Spray 10 mg.

The company on Wednesday said the patent is effective January 6, 2026, with an expiry date of February 5, 2041.

The patent was issued to Summit Biosciences Inc., a subsidiary of Kindeva Drug Delivery L.P.

In March 2025, Scienture LLC, a wholly owned subsidiary of Scienture Holdings Inc. (NASDAQ:SCNX)

, inked a commercialization pact with Summit for the exclusive U.S. rights to Rezenopy.Under the terms of the collaboration, Summit will manufacture and commercially supply Rezenopy.

Pending certain commercial obligations, Scienture will own the new drug application (NDA) for Rezenopy in its name and be responsible for the sales, marketing, and distribution of the product in the U.S. through Scienture's commercial operations infrastructure.

The U.S. Food and Drug Administration (FDA) approved Rezenopy in April 2024. Rezenopy is the highest dosage of naloxone HCl nasal spray approved by the FDA.

Rezenopy (naloxone HCl) Nasal Spray 10mg is an opioid antagonist indicated for the emergency treatment of known or suspected opioid overdose, as manifested by respiratory and/or central nervous system depression in adult and pediatric patients.

It is intended for immediate administration as emergency therapy in settings where opioids may be present.

Rezenopy nasal spray is for intranasal use only and is supplied as a carton containing two blister packages, each with a single spray device.

The newly issued patent is eligible for listing in the FDA's Orange Book and, if listed, may provide additional intellectual property protection supporting the product's U.S. commercialization.

The product leverages the proven naloxone hydrochloride molecule and familiar nasal spray form factor, while delivering increased effectiveness against potent opioids.

According to IQVIA data, total annual U.S. naloxone sales reached approximately $154 million, with unit volume of 9.3 million units, underscoring the significant and growing market opportunity.

Scienture reported that third quarter net revenue increased from approximately $65 thousand to $590 thousand, while gross profit increased from roughly $4 thousand to $575 thousand.

In November 2025, Scienture announced that Arbli (losartan potassium) Oral Suspension, 10 mg/mL, has been added to the formularies of key national payors, expanding access through both multiple commercial coverage and Medicare supplement plans.

Arbli is the first FDA-approved, ready-to-use oral suspension formulation of losartan potassium, designed to provide a safe, consistent, and convenient therapeutic option for patients requiring an alternative to solid dosage forms.

SCNX Price Action: Scienture Holdings shares were up 0.13% at $0.54 during premarket trading on Wednesday. The stock is trading near its 52-week low of $0.46, according to Benzinga Pro data.

Photo via Shutterstock

News

Jan 14, 2026The shareholder letter explains how IQSTEL's AI initiatives are developed and commercialized through Reality Border, the company's proprietary AI innovation and product development platform, and are tightly integrated with IQSTEL's global telecom infrastructure and cybersecurity capabilities through its sibling company, Cycurion.

The letter further highlights IQSTEL's AI products already in market, including AIRWEB, IQ2Call, and its fully integrated AI-powered contact center services, as well as early commercial traction, an active sales pipeline, and a fiscal-year sales objective of seven digits of high-margin AI services for fiscal year 2027.

Reality Border's AI journey began in 2023 with an immersive, metaverse-style customer experience concept in collaboration with strategic partners.

Reality Border has built a fully proprietary AI platform, developed in-house, that underpins all current and future AI products.

The AI business within IQSTEL is structured around recurring subscription and service-based revenue models, with transparent, published pricing for both AIRWEB and IQ2Call, as well as fully managed AI-powered contact center services.

IQSTEL has already initiated the commercialization process for its AI products and services, and early adoption indicators are developing across multiple verticals.

Based on current pipeline visibility and early customer engagement, IQSTEL has established a sales objective of seven digits for fiscal year 2027 for its AI-powered, high-margin services.

As commercialization progresses, IQSTEL expects AI to become an increasingly meaningful contributor to both revenue growth and adjusted EBITDA expansion.

Last week, IQSTEL laid out a 2026 plan focused on boosting profitability, expanding globally, and scaling higher-margin services.

The company targets a $15 million adjusted EBITDA run rate, plans to widen its telecom footprint to nearly 30 countries through acquisitions and new licenses, and aims to grow its Fintech, cybersecurity, and AI-driven businesses.

IQST Price Action: iQSTEL shares were up 0.75% at $2.68 during premarket trading on Wednesday. The stock is trading near its 52-week low of $2.63, according to Benzinga Pro data.

Photo via Shutterstock

News

Jan 14, 2026News

Jan 14, 2026News

Jan 14, 2026Apple has yet to launch a foldable iPhone, but Kuo, a TF International Securities analyst known for tracking Apple's supply chain, told Benzinga that timing alone does not put Cupertino at a strategic "disadvantage."

"Android foldables still haven't become mainstream in the premium segment," Kuo said, suggesting the market remains early and under-penetrated.

Because adoption has yet to accelerate meaningfully among high-end buyers, Apple's late arrival does not necessarily mean it has missed a critical window.

Kuo believes Apple's strength lies less in hardware novelty and more in execution. He pointed to software and user interface design as areas where current foldable devices continue to fall short.

"If Apple can truly nail the software and UI experience around foldables — an area where current Android foldables are still lacking — I believe most consumers would welcome a larger display," Kuo said, provided the device remains easy to carry.

Beyond Apple's own product cycle, Kuo sees broader implications for the smartphone industry. A successful foldable iPhone could push competitors to follow suit and help expand the category as a whole.

"If Apple delivers a great software and UI experience on a foldable iPhone," it could trigger a new upgrade cycle in the high-end segment, Kuo said, adding that it could offer the market a fresh source of growth.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Samsung, Apple's longtime rival and one of the more established players in foldables, struck an optimistic tone when asked about the market's trajectory.

In an emailed statement to Benzinga, the company said foldables are entering an "acceleration phase," citing TechInsights’ projections that shipments could surpass 20 million units in 2025.

Samsung highlighted that newer devices are thinner, lighter and more durable, moving the category beyond novelty toward everyday usability.

Consumers, Samsung added, are increasingly focused on what foldables enable — such as multitasking, large-screen productivity and AI-powered features — rather than the form factor itself.

As for Apple's potential entry, Samsung framed it as a natural evolution. New competitors, the company said, help validate and expand the category, even as it plans to maintain leadership through continued innovation.

In a December 2025 report, Counterpoint Research noted that global foldable smartphone shipments rose 14% year over year in the third quarter of 2025, hitting a record quarterly high, driven largely by strong momentum from Samsung's Galaxy Z Fold7 lineup.

Shipments for full-year 2025 are on pace for consistent mid-teens annual growth, with 2026 expected to see sharper acceleration as device hardware matures and Apple potentially boosts demand at the high end of the market.

Samsung's newly introduced Galaxy Z TriFold also serves as a strategic test case designed to strengthen the company's technological leadership before a wider commercial rollout in future product cycles.

Meanwhile, talk of a foldable iPhone has shifted from analyst reports and supply-chain rumors to actual market bets. On Polymarket, traders are now pricing in a 76% chance that Apple will launch a foldable iPhone before 2027, up from roughly 42% in mid-December.

On the other hand, Kalshi market data points to broad agreement that a foldable iPhone would sit at the top of Apple's pricing ladder.

Traders are assigning about a 92% probability that the device would carry a starting price of at least $1,800, an 80% chance it would exceed $2,000, and roughly 65% odds that pricing would reach $2,200 or higher.

Benzinga Edge Stock Rankings indicate that Apple maintains a solid medium and long-term outlook, even as its shares face short-term headwinds. Click here to compare Apple's performance with its industry peers.

Check out more of Benzinga's Consumer Tech coverage by following this link.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

News

Jan 13, 2026The Federal Reserve continues to frame inflation as a policy choice, but its growing debt burden is quietly narrowing the range of available outcomes for policymakers, a dynamic that remains supportive of gold and silver.

In an exclusive interview with Benzinga, macro analyst Tavi Costa said markets are underestimating how constrained the Fed has become as interest costs rise and fiscal pressures intensify.

Costa indicates the rally in precious metals is not a momentum trade, but rather a structural response to policy reality.

"There's many reasons why metals are very cheap historically speaking despite the nominal rise that we're seeing in terms of prices," Costa said, adding that gold and silver remain "in an early stage of a secular bull market."

On Monday, gold and silver climbed to fresh record highs after the Department of Justice opened a criminal investigation into Fed Chair Jerome Powell over renovation costs at the Federal Reserve's headquarters.

Powell said the probe is merely a "pretext" for escalating pressure from the Trump administration to push interest rates lower.

“Monetary policy is no longer about inflation or jobs. It's about one thing: Making government debt affordable. This has played out many times in history. Debt only becomes a problem when interest costs reach extreme levels,” Costa commented in a post on social media X.

Wild times.

— Otavio (Tavi) Costa (@TaviCosta) January 12, 2026

Monetary policy is no longer about inflation or jobs.

It's about one thing:

Making government debt affordable.

This has played out many times in history.

Debt only becomes a problem when interest costs reach extreme levels.

At 5–7% of GDP, policymakers lose… https://t.co/qPzpNR8lx4

Costa said the scale of U.S. debt fundamentally changes how monetary policy works. As interest rates rise, interest payments absorb a larger share of federal spending, reducing the government's fiscal flexibility.

Costa said that dynamic makes it increasingly difficult for the Fed to keep policy tight for long periods.

"The path of least resistance will continue to be inflation, inflating our way out of the debt problem," Costa said.

He indicated that once interest payments become too large, the Fed's traditional mandate starts to lose relevance.

"When you're in that situation, it gets to a point where the whole mandate of the Fed being focused on stability of inflation and labor markets becomes irrelevant," Costa said.

"All you need to care is you need to lower rates just to make the government breathe."

Costa said similar debt-driven constraints emerged in the UK during the 1800s, when interest costs began to dictate policy decisions.

Costa said currency debasement – the gradual loss of purchasing power caused by excessive money creation and debt financing – plays a central role in today’s metals rally.

"I think it has to do a lot with the debasement," he said, pointing to declining purchasing power across fiat currencies.

He highlighted that investors often treat debasement as an abstract concept while ignoring its real-world consequences.

"Do people really think that we're going to go from sustainably high metal prices moving forward and that's just not going to lead to inflation?" Costa said.

has rallied 130% over the past six months. “It’s not normal to see this type of change in prices of silver like we’re seeing today,” he added.According to Costa, consumers are underestimating the risk of a hyperinflation scenario.

Gold and silver, he said, tend to react early because they reflect shifts in purchasing power before inflation shows up clearly in consumer data.

Costa said markets are misjudging how aggressive future rate cuts may be. While Fed futures price in just two rate cuts in 2026, he said he strongly disagrees with expectations of only modest easing.

“I think we are going to see a lot more,” Costa said.

"If there is a recession or any type of downturn, they're going to take it to zero," he added.

In his view, the Fed’s goal will not be fine-tuning inflation. It will be relieving debt pressure and freeing fiscal capacity.

Costa said gold and silver are not flashing a speculative warning as supply remains tight despite higher prices.

"Production for silver is not on the rise," he said. "I don't see any new mines coming online."

"If you look at capex adjusted for gold prices, we are not only at a historical low, we're collapsing," Costa said.

Instead, precious metals are reacting to structural constraints facing monetary policy.

"When you're in that situation, this is where you want to own hard assets," he said.

As debt continues to box in the Fed, Costa said currency debasement becomes the default path, and gold and silver remain among the clearest expressions of that reality.

Photo: corlaffra via Shutterstock

Analyst Color

Jan 12, 2026After two years of strong inflows, AI-focused exchange-traded funds (ETFs) are entering a tougher phase. Broad exposure that once amplified gains is now leaving investors concentrated in a small group of dominant tech stocks.

Jack Fu, chief executive of Draco Evolution, says many AI ETFs are still built for excitement, not durability.

“A lot of investors think they're buying diversified AI exposure,” Fu told Benzinga. But in many cases, they’re buying the same few big tech stocks in different wrappers, he explained.

Billions of dollars have flowed into U.S.-listed technology and thematic ETFs over the past two years, as investors chose exposure to the AI theme in a single trade, removing the need to pick individual winners.

Most AI ETFs are heavily weighted toward a small group of mega-cap technology companies. That concentration helped drive strong returns as AI enthusiasm surged.

In fact, those companies have the cash, scale, and computing power to stay ahead, and they are often the first to turn AI spending into revenue, Fu noted.

But the flip side is risk. When a handful of stocks dominate a fund, any stumble from earnings misses, regulation, or valuation pressure can have an outsized impact on returns.

For instance, Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ)

, Roundhill Generative AI & Technology ETF (NYSE:CHAT) and Dan Ives Wedbush AI Revolution ETF (NYSE:IVES) have heavy exposure to the “Magnificient 7” stocks, particularly Nvidia Corp.(NASDAQ:NVDA), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) alongside other chip stocks like Taiwan Semiconductor Manufacturing Co. (NYSE:TSM) and Micron Technology (NASDAQ:MU).On the other hand, Draco’s AI ETF (NYSE:DRAI) has a more diversified, multi-asset base with major holdings in First American Funds Inc X Government Obligations Fund (NASDAQ:FGXXX) and other debt funds, as well as ETFs like the tech-heavy ProShares UltraPro QQQ (NASDAQ:TQQQ) and Direxion Daily S&P 500 Bull 3x Shares (NYSE:SPXL).

Over the past year, it rose by over 30%, as per data from Benzinga Pro.

Fu believes the next phase of AI investing will test how these funds are built. Many AI ETFs simply track companies linked to AI, without adjusting for market conditions or risk.

Over the past year, fixed income exposure in mixed-asset AI funds largely played a stabilising role, helping portfolios remain invested during bouts of volatility rather than forcing investors to reduce risk at inopportune times, Fu explained.

But as stock prices move in different directions and market conditions grow less predictable, Fu expects static AI ETFs to face more strain.

Attention and concentration will move toward the networking, power, and grid equipment sectors, along with firms that use AI to drive “measurable productivity.”

"AI is still a powerful long-term trend,” Fu said. But managing risk around that trend will “increasingly determine outcomes.”

This could push investors toward AI ETFs that are more flexible— adjusting exposure rather than holding every stock with an AI label.

And as investors become more cautious, simply owning an “AI ETF” may no longer be enough.

DRAI offers one example of that flexibility. Unlike most AI ETFs, it is not fully equity-only. During April’s tariff headlines and the tech selloff late last year, the fund reduced equity exposure and shifted toward defensive assets such as Treasuries, bonds, gold, and the U.S. dollar, helping offset some of the impact from broader market swings.

If there is one signal that could quickly change the outlook for AI ETFs, Fu points to spending plans from the largest cloud and technology companies.

As long as those companies keep investing heavily, the broader AI ecosystem remains supported. But if spending slows for several quarters, expectations could reset quickly.

“The money going into chips and data centers is still massive,” Fu said. “But the market will care more about return on that spend, not just the headlines,” he added.

The comments come as Big Tech is ramping up AI investment at an unprecedented scale, with the “Magnificent 7” expected to pour nearly $400 billion this year into AI infrastructure.

Image via Shutterstock

Analyst Color

Jan 11, 2026Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week ending January 9:

: Space stocks continue to be a hot theme in the early days of 2026 and Momentus soared 25% over the last week. The stock saw strong interest from Benzinga readers after announcing it had produced a 3D-printed fuel tank that will be tested in space on a service vehicle. The tank was developed through a partnership with Velo3D Inc. Momentus called the fuel tank a "major achievement" and said additive manufacturing can create new possibilities for the space sector. Investors will likely be closely following the space theme heavily in 2026 with a reported SpaceX IPO. Momentus is a stock to watch with further testing of the 3D-printed fuel tank.

Nu Holdings (NYSE:NU): The Latin American digital banking company saw strong interest during the week with minimal news flow. The company reported quarterly results back in November with earnings per share and revenue each beating analyst estimates. Analysts raised their price targets in November and December after the quarterly results. Nu Holdings has reported strong growth in recent years with expansions from its Brazil origins to Mexico and Colombia. With strong interest from readers, investors may want to monitor the stock ahead of upcoming quarterly financial results set for Feb. 25.

SoFi Technologies (NASDAQ:SOFI): The fintech company saw strong interest from readers with several recent analyst notes potentially driving the price action. Shares traded down during the week, but remain up over 90% in the last year. Goldman Sachs maintained a Neutral rating and lowered the price target from $27 to $24. Barclays maintained an Equal-Weight rating and raised the price target from $23 to $28. Bank of America resumed coverage on the company with an Underweight rating and a price target of $20. Bank of America said there could be M&A activity in the financial sector, but cautioned after the recent surge in the share price. SoFi is set to report fourth-quarter financial results on Jan. 30. Analysts expect the company to report earnings per share of 12 cents per share and record quarterly revenue of $982.68 million. The company has beaten analyst estimates for both earnings per share and revenue in five straight quarters. Shares remain on watch ahead of the upcoming earnings report.

Zenas BioPharma Inc (NASDAQ:ZBIO): The clinical stage biotech stock is up 98% over the last year, but saw shares decline over the past week. The company released results from its Phase 3 trial of obexelimab for IGG4-RD, an immune system disorder. The results showed obexelimab met the primary endpoint and Zenas BioPharma presented the results as a win. Investors and analysts didn't see a big win. Morgan Stanley downgraded the stock from Overweight to Equal Weight and lowered the price target from $37 to $19. Zenas is expected to submit a Biologics License Application to the FDA in the second quarter of 2026 and a Marketing Authorization Application to the European Medicines Agency in the second half of 2026. Zenas is also expected to report more results for obexelimab for a different Phase 2 study in the fourth quarter of 2026. Zenas could be a stock to monitor in 2026 with several upcoming catalysts.

NIO Inc (NYSE:NIO): The electric vehicle company drew the spotlight in recent weeks after sharing it reached the one million vehicle production milestone at its F2 NeoPark factory in China and announced fourth-quarter vehicle figures. Nio said the company is aiming for annual sales growth of 40% to 50%. Nio reported record deliveries for December, the fourth quarter and the full year. Fourth-quarter deliveries were 124,807 vehicles, up 71.7% year-over-year. Nio's full year deliveries totaled 326,028 vehicles, up 46.9% year-over-year. Nio stock could be one to watch given its growth in China while some companies like Tesla have struggled in the region.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Long Ideas

Jan 10, 2026As 2026 gets underway, markets don't feel euphoric — but they're far from cheap. And according to Danny Moses, that leaves investors with very little room for error. In an exclusive interview with Benzinga, Moses described a market in an uneasy balance—one where even a modest shock could trigger something bigger.

"There are definitely many moving parts as we begin 2026," he said. Valuations may not be "priced to perfection," but the market is also not offering much margin for safety.

Moses warned it "would not take much" to spark a correction—or a rotation out of growth, particularly technology, and into more value-oriented sectors like Consumer Staples and Energy.

That shift, he said, would be healthy over the long term. The problem is timing.

Given how heavily major indices are weighted toward a small group of mega-cap tech stocks, even a partial rotation could cause near-term "dislocation and indigestion." To avoid that outcome, Moses said markets will need to see continued earnings growth and margin expansion — especially from the names carrying the most weight.

As with The Big Short, Moses believes the real blind spot isn't obvious. This time, it's credit.

"There are clearly no systemic issues at the moment," he said — but recent bankruptcies showed how quickly stress can ripple through credit markets. That matters because a massive amount of optimism, particularly around AI, is "predicated on access to debt."

If AI supply and demand move closer to equilibrium, or if power and energy constraints begin to cap growth, Moses expects the impact to reverberate well beyond tech.

Moses is clear: AI is a genuine secular growth story, comparable to the internet boom of the late 1990s. But that doesn't mean every company wins.

"There will be a period of time when the economics begin to matter," he said.

How much will consumers pay for AI subscriptions? Can Nvidia Corp (NASDAQ:NVDA)

sustain mid-70% gross margins as competition rises? Is there enough power to meet projected demand?Those questions, Moses warned, will shape the next phase of the AI trade — and could ultimately determine whether today's growth darlings stay leaders, or become casualties of the great rotation.

Image: Shutterstock

Top Stories

Jan 09, 2026For years, prediction markets lived on the fringes of finance — interesting, occasionally accurate, but easy for investors to dismiss. Danny Moses says that complacency is becoming a mistake in 2026.

In an exclusive interview with Benzinga, Moses was blunt: prediction markets are no longer noise. As liquidity improves, he says they're turning into a real signal — one investors ignore at their own risk.

• CME Group stock is trading in a tight range. What’s ahead for CME stock?

Tell-tale signs include:

Moses says the biggest change is structural. "I think we will see liquidity continue to increase in prediction markets," he said, a prerequisite for anything to move from curiosity to tradable asset.

Event contracts, in his view, are simply another way to express conviction. "Using event contracts to express an opinion is no different than trying to find a stock to express the same theme," Moses said.

That mindset shift — from novelty to utility — is what turns markets into markets.

The second sign is validation from the incumbents.

, owner of the New York Stock Exchange, investing billions into prediction market infrastructure. Platforms such as Polymarket and Kalshi are raising capital at multi-billion-dollar valuations. And the CME Group Inc (NASDAQ:CME) — the world's largest commodity exchange — is partnering with FanDuel to build prediction markets.That's not experimentation. That's endorsement.

The final signal is subtle but powerful: how investors consume information.

"I glance through event contracts now like I do the FT [Financial Times] or the WSJ [Wall Street Journal] each day," Moses said, using them as a real-time check on what markets might be missing.

As liquidity improves, he expects that habit to spread — and trading to follow.

In 2026, prediction markets aren't just predicting outcomes.

They're becoming part of how markets think.

Photos: Danny Moses, courtesy D. Moses; Prediction courtesy of Shutterstock

Top Stories

Jan 09, 2026Gold has spent years being treated as insurance — useful, but rarely exciting. Danny Moses, best known as one of the traders featured in The Big Short, thinks that framing is already outdated. In an exclusive interview with Benzinga, Moses made a blunt call that cuts against market comfort: "Gold prices will double from here over the next few years."

For Moses, this isn't a future pivot — it's a trend already in motion.

"I think that already happened in 2025," he said, pointing to gold and silver outperforming most asset classes. In his view, precious metals have quietly shifted from hedge status to leadership assets, helped by macro forces that are no longer temporary.

Moses draws a clear distinction between silver and gold. Silver's rally, he said, is being driven by hard math: "The current demand for silver far outweighs the supply and there is no quick fix," with solar, EVs, and AI data centers pulling metal into industrial use.

Gold's story is less about scarcity and more about trust. "Global central banks have been the biggest purchaser of physical gold as a hedge against their own incompetencies," Moses said — a buying trend he doesn't see slowing in 2026. On top of that, investor demand through ETFs continues to grow, creating what he calls ongoing "market dislocations."

Moses isn't selling a straight-line rally. "Of course, you could see a pullback, and we will no doubt have continued volatility," he cautioned. But the long-term setup, in his view, remains intact as gold works its way into more portfolios — whether through ETFs, mining stocks, or direct exposure.

Calling for gold to double sounds extreme — until it doesn't.

Moses made his reputation by recognizing stress before markets were forced to price it in. This time, he's watching currencies, central banks, and confidence — and betting that gold's role is about to expand again, in a very big way.

Image: Shutterstock/Edited via Canva

Long Ideas

Jan 08, 2026The Bureau of Labor Statistics (BLS) confirmed to Benzinga on Wednesday that it is grappling with a staffing crisis, validating growing concerns among top economists that the quality of government data has deteriorated following the federal shutdown in late 2025.

In an email to Benzinga, the BLS press office confirmed that “agency staffing has decreased by about 25% over the last year, and approximately 40% of leadership positions are currently vacant.”

The confirmation follows the comments from the former BLS Commissioner William Beach, who stated at the 2026 ASSA conference that the Department of Labor leadership “does not seem to support the Bureau.”

The revelation adds concrete weight to suspicions held by market skeptics like economist David Rosenberg. In a social media post earlier this week, Rosenberg criticized recent economic data as a “fugazi,” noting a massive disconnect between “headline strength” in GDP and the underlying reality of the industrial sector.

Rosenberg noted that while the third-quarter GDP report showed a robust 4.3% growth rate, the ISM Manufacturing report revealed that only 11% of U.S. industries grew in December—a breadth of expansion tied for the second-lowest reading since April 2009.

The staffing exodus correlates directly with the recent instability in Washington. The Bureau of Economic Analysis (BEA) explicitly stated in its recent GDP release that “the federal government shutdown that occurred in October and November resulted in delays in many of the principal source data.”

The BEA admitted that due to these delays, recent estimates relied on a “combination of data and methods” rather than the standard, robust data sets.

This “data fog” poses a significant risk to investors. According to Bank of America's latest Global Fund Manager Survey, 94% of investors are currently betting on a “soft landing” or “no landing,” with cash allocations crashing to record lows.

These bets rely on the accuracy of federal reports. But with the BLS hollowed out and the government just emerging from a shutdown that disrupted data collection, the market's aggressive optimism may be built on numbers that are susceptible to massive future revisions.

and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were trading higher on Wednesday. The SPY was up 0.24% at $693.48, while the QQQ advanced 0.59% to $627.31 at the time of publication, according to Benzinga Pro data.Photo: FOTOGRIN on Shutterstock.com

Government

Jan 07, 2026Quick Contact

Address

1 Campus Martius Detroit,

MI 48226, United States

Phone

Get in Touch

We love to help & we love to listen. Please fill out the form

below and we’ll get back to you within a day

© 2023 Benzinga APIs | All Rights Reserved