Oppenheimer’s newest technical analysis report is in, and it’s not quite as bullish as past reports. According to analyst Ari Wald, while Oppenheimer does not yet see evidence of a major top in the market, there are several reasons why traders should approach stocks with caution for the time being, including expanding downside breadth and weak seasonal trends in mid-July.

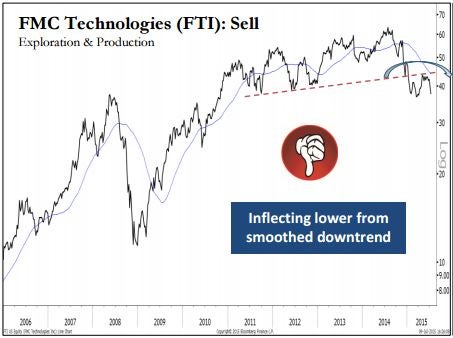

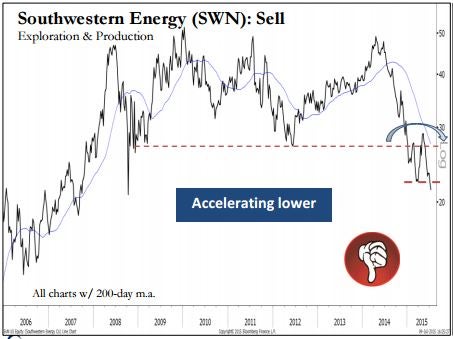

Sell E&Ps

Despite the major price weakness in the Energy sector in the past year, Oppenheimer believes the charts show more downside remaining for exploration and production (E&P) stocks.

Oppenheimer sees downward inflection in FMC Technologies, Inc. FTI’s chart after a support line going all the way back to 2011 was broken early this year.

Southwestern Energy Company SWN also broke below long-term support earlier this year.

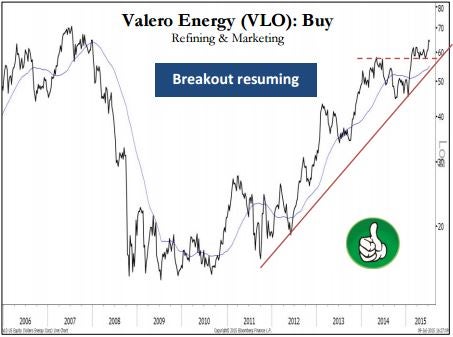

Buy Refiners

The charts indicate that Energy traders should instead be looking to buy refiners to take advantage of low oil prices.

With all the doom and gloom in the Energy sector in recent months, Oppenheimer analysts find it hard to believe that Tesoro Corporation TSO’s beautiful chart belongs to an energy company.

Valero Energy Corporation VLO is another refiner with a strong technical chart showing a rising support line in place since 2011.

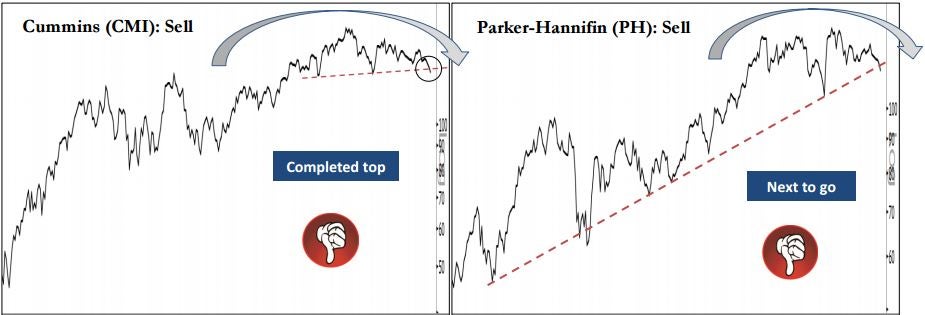

Sell Chemicals And Machinery

In addition to weakness in the E&P space, Oppenheimer also sees technical weakness in Chemicals and Machinery.

Oppenheimer specifically mentions Praxair, Inc. PX and Airgas, Inc. ARG as two chemical companies that have recently broken through support levels.

In the Machinery space, Oppenheimer highlights Cummins Inc. CMI and Parker Hannifin Corporation PH as two stocks that have been forming broad tops over the past two years or so and could be positioned for further downside from current levels.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.