Trading binary options on Nadex is different from trading with other brokers. Nadex is an exchange, not a broker, and is regulated by the Commodity Futures Trading Commission (CFTC) as a Designated Contract Market and Derivatives Clearing Organization. The CFTC is a US government agency overseeing futures, options and swaps trading.

At Nadex, traders are able to exit a binary trade at almost any time before expiration provided there is an opposing side to the trade. Nadex matches buyers and sellers and does not participate in trades. Most brokers lock traders into their trades. Because of this freedom of entry and exit, the strategy of scalping is possible.

Scalping is a term used by traders for short-term quick trades. The trade is not held until expiration. The idea is to enter the trade, have it increase in value a certain amount and then exit. It is taking advantage of quick, small moves or time decay. It is good for part-time traders.

An example of scalping is buying a binary at $30 and exiting at $60 for a 100 percent return on investment. This is such a fast trade that money invested is doubled in a matter of minutes.

At first, it may be only making $30. As the strategy is repeated over and over and the account grows, the amount of contracts traded may be increased from one to two or three, and then to ten. At that time, it will be $300 profit each time the trade is successful.

It is important to focus on the percentages and the returns instead of the dollars. Instead of dwelling on the trade only profiting $30, focus instead on only $30 was risked to make $30. That is a 1:1 risk to reward ratio or a 100 percent return, probably achieved in a matter of minutes.

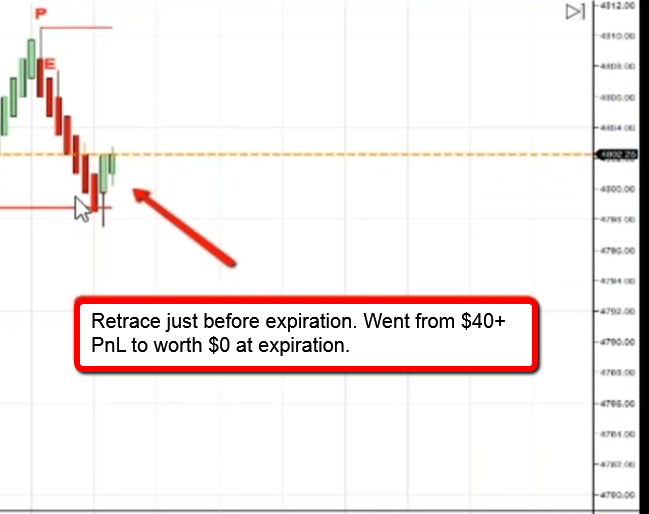

Here are two examples of scalping 20-minute binary options using Nadex NQ (E-mini NASDAQ-100 Futures). The first is US Tech 100 >4799.5 sold for 79.50. The risk on this trade is only $20.50 on an out of the money (OTM) contract. The second example has more risk. Since it is US TECH 100 >4803.5 sold at 45.75, it is an at the money (ATM) contract. At that time, the market was moving nicely and both trades were up in profit quite quickly. With a little over five minutes left until expiration, both trades were up $38.

To view a larger image, click HERE.

Both contracts had continued to gain more profit with a little under four minutes until expiration. For a larger image, click HERE.

However, the market popped up to 4800.75 at expiration causing the US TECH 100 >4799.5 trade to lose everything, while US TECH 100 >4803.5 remained profitable.

For a larger image, click HERE.

It may be tempting to hold the trade until expiration, hoping for a little more profit. Read the charts and the markets. See if the market is starting to pull back against the trade. Don’t get greedy. Know when to exit. Understand risk/reward ratios and time decay.

Setting a “take profit” order can remove the emotion and the greediness out of trading. It can help in risk management. When entering a trade, if there was a plan of having a 1:1 risk reward ratio and $20 was risked, then the plan would be to exit when the trade is up $20. On the trade above entered at 79.50, a take profit order could be set at 59.50 in order to make $20. Setting a take profit order like this is easy on Nadex. It will automatically exit out of the trade when the market reaches the set point. Likewise, if the plan was for a 2:1 risk reward ratio, set a take profit when it reaches 39.50 for $40 profit. The image below shows an example of a take profit order, which is simply an exit working order.

For a larger image, click HERE.

If the trade is profitable like in the two examples, but the trader elects to hold until expiration in order to make a little bit more, this is like risking what has been “made” for the little bit that might be made. In the example, one trade was up 39.75. Holding until expiration is like risking 39.75 to try to make $6 more. It is not really worth it.

Scalping is good especially for traders who do not want to sit at computers for hours waiting for trades. It can be done on Nadex binary options using five-minute, 20-minute, intraday or daily expirations. The best way to scalp is to place the trade and immediately set a take profit order.

This information and strategy may help a trader understand why some trades might not have been turning out profitable.

For free trading education, visit Apex Investing.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.