Scalping strategies are popular among currency traders who seek to profit quickly from small changes in exchange rates in the forex market.

This fast-paced approach to trading currency pairs generally demands quick thinking, precision, fast execution speeds and a deep understanding of technical analysis indicators and how to use them.

In this article, we explore some of the best forex scalping trading strategies and the various technical indicators that a typical scalper might use to maximize their chances of success. Understanding these trading strategies can significantly enhance your forex trading performance.

Key Takeaways

-

- Moving Average Strategy: Uses short-term moving averages to spot trends and reversals.

- RSI Strategy: Identifies overbought or oversold conditions for potential reversals.

- Scalping vs. Day Trading: Scalping focuses on quick, small trades; day trading holds positions longer.

- Pros and Cons: Quick profits but requires focus, speed, and can lead to high transaction costs.

What is Scalping?

Scalping is a trading strategy used by traders in many financial and commodity markets. It focuses on making numerous small profits on minor price changes throughout the day.

Forex scalpers aim to capitalize on minute fluctuations in exchange rates, often holding positions for a few seconds to minutes. This method requires quick analysis, high-speed trading, and precise execution. It leverages technical analysis and automated trading systems to quickly enter and exit trades.

Scalping is distinct from most other forex trading strategies because it focuses on making small profits from many short-term trades rather than more significant profits from holding fewer long-term positions.

Best Scalping Trading Strategies

Scalping strategies are generally designed to take advantage of small movements in exchange rates. These fast-paced strategies rely heavily on technical indicators to identify optimal trade entry and exit points. Here are some of the most effective strategies used by forex market scalpers.

Moving Average Strategy

The Moving Average (MA) Strategy is one of the most popular scalping methods. A typical moving scalp strategy involves using short-term averages to identify trends and potential reversal points.

By monitoring the crossing of moving averages, traders can make quick decisions about when to enter and exit trades. For example, when a short-term moving average crosses above a long-term moving average, it signals a potential buy, while a cross below indicates a sell. The image below illustrates how this crossover signal can be used to trade a currency pair.

This is a candlestick chart of the USD/CAD exchange rate with 10-period and 20-period moving averages superimposed over it. Arrows indicate indicator crossovers, which scalpers can use as a trading signal. Source: Metatrader.

Relative Strength Index (RSI) Strategy

The Relative Strength Index (RSI) Strategy is another powerful tool for scalping the forex market. The RSI measures the speed and change of exchange rate movements, providing signals of overbought or oversold conditions.

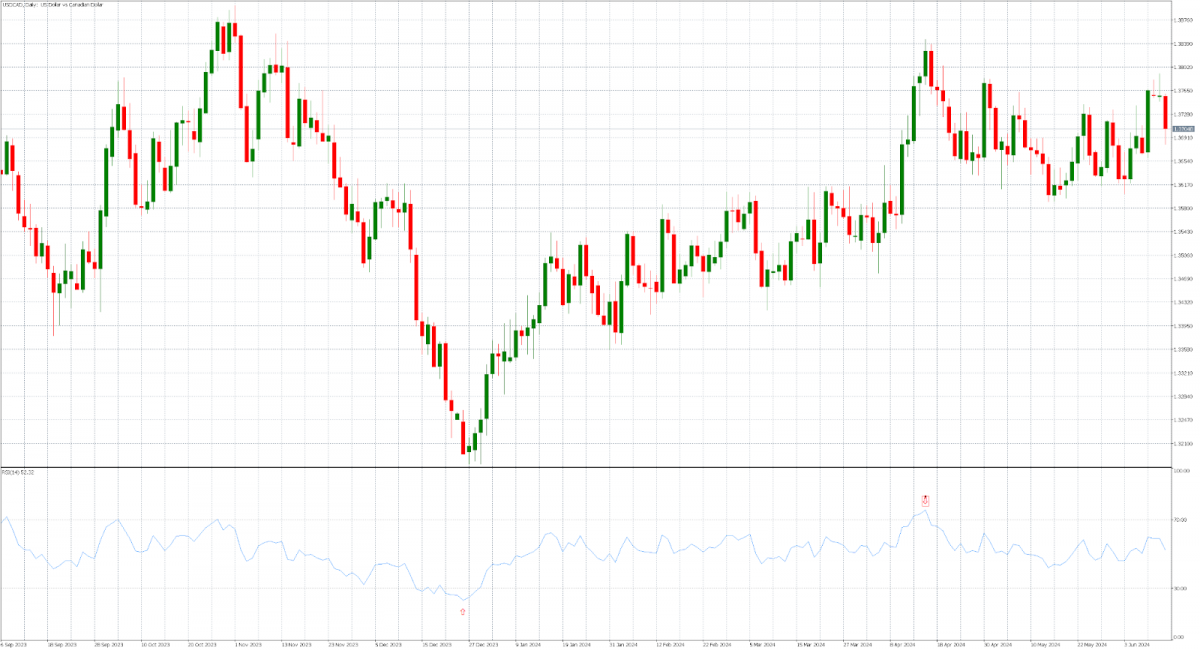

Scalpers often use the RSI to identify potential market reversal points before they occur. An RSI above 70 typically indicates an overbought condition, suggesting a selling opportunity, while an RSI below 30 indicates an oversold condition, suggesting a buying opportunity. The image below illustrates how such extreme RSI readings can be used as signals when scalping a currency pair.

A candlestick chart of the USD/CAD exchange rate showing the 14-period RSI in blue in the indicator box below the exchange rate chart. Arrows indicate extreme points in oversold or overbought RSI regions, which scalpers can use as a trading signal. Source: Metatrader.

Multiple Chart Scalping

Multiple Chart Scalping involves using various time frames to make more informed trading decisions as a scalper. This approach helps forex scalpers avoid trading on false signals and make more accurate trades.

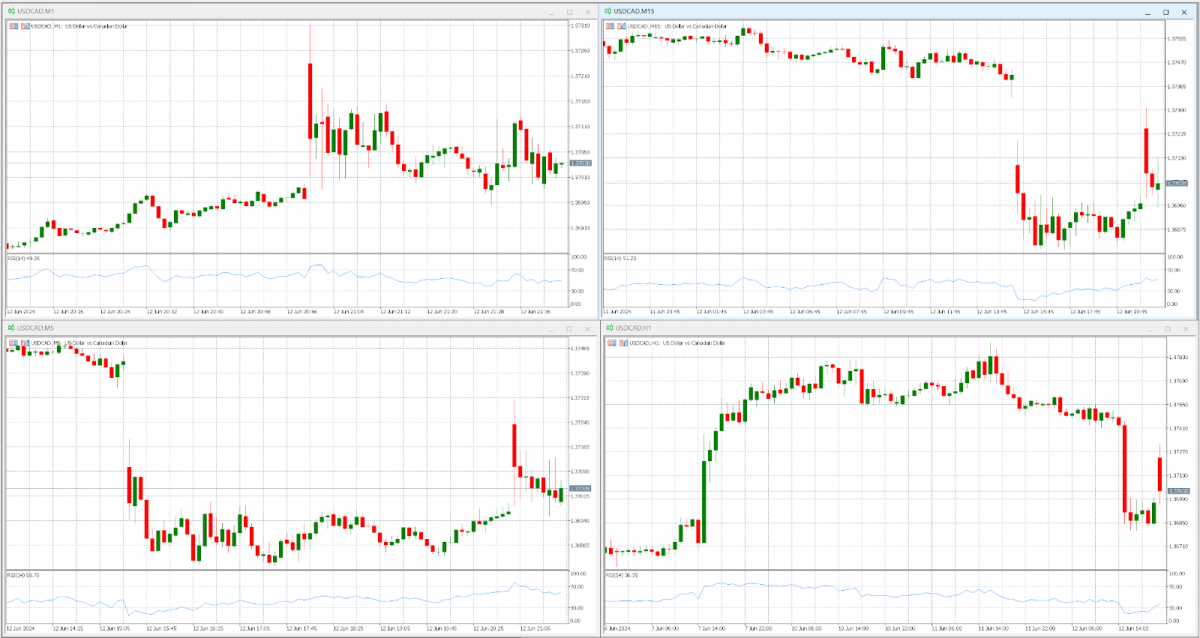

For example, by analyzing short-term exchange rate charts (like the 1-minute or 5-minute charts) alongside longer-term charts (like 15-minute or 1-hour charts), scalpers can better understand the overall market trend and pinpoint the best entry and exit points for a particular currency pair. The image below shows how multiple candlestick charts with RSI indicators can be viewed and used in multiple chart scalping strategies.

Four candlestick charts of the USD/CAD exchange rate showing the 14-period RSI in blue in the indicator box below the exchange rate chart for 1-minute, 5-minute, 15-minute and 1-hour time frames that can be used in multiple chart scalping strategies. Source: Metatrader.

Stochastic Oscillator Strategy

The Stochastic Oscillator Strategy uses the stochastic oscillator to identify potential market turning points. This indicator compares the closing price of a currency pair to its exchange rate range over a specific period.

When the stochastic lines cross in the overbought or oversold regions of the indicator, it signals a potential market reversal for the currency pair. Scalpers use these signals to enter forex trades at the most opportune moments, aiming to achieve quick profits. The image below points out how forex scalpers can use crossovers in extreme Stochastic Oscillator territory as signals.

A 1-minute candlestick chart of the USD/CAD exchange rate showing the 5,3,3 period Stochastics Oscillator in blue and red in the indicator box below the exchange rate chart. Arrows indicate extreme points in the oscillator where crossovers occurred that can be used as trading signals by scalpers. Source: Metatrader.

Parabolic SAR Indicator Strategy

The Parabolic SAR Indicator Strategy is useful for identifying potential entry and exit points in trending markets. The Parabolic SAR (Stop and Reverse) places dots above or below the exchange rate in real time, with each dot indicating potential market reversal points.

When the dots switch from above to below the exchange rate, it signals a buying opportunity for the currency pair. Conversely, when they switch from below to above, it signals a sell opportunity.

Scalpers use this popular technical indicator to follow the trend and make rapid trading decisions in the forex market. The image below illustrates how the Parabolic SAR dots can be used by forex scalpers to establish long and short positions in the market.

A 5-minute candlestick chart of the USD/CAD exchange rate showing the 0.02 step and 0.2 maximum Parabolic SAR indicator in black dots superimposed over the exchange rate chart. A short position is suggested when the market is below the dots, while a long position can be established when the market is above the dots. Source: Metatrader.

Scalping vs. Day Trading

While both scalping and day trading involve making trades within a single trading day, they differ significantly in their approaches, execution, and requirements. Understanding these differences is essential for traders to determine which strategy best aligns with their trading style and goals.

Scalping

This strategy is characterized by executing numerous trades throughout the day, often within seconds to minutes, aiming to profit from small fluctuations in exchange rates.

Scalpers seek to capture tiny exchange rate movements and typically close all their positions by the end of the trading day. This strategy demands quick decision-making and execution, often facilitated by advanced trading platforms and automated trading systems.

Scalping requires quick responses, a high level of concentration and the ability to analyze and act on technical indicators rapidly.

Day Trading

On the other hand, day trading involves holding positions for longer periods, ranging from minutes to several hours within the same trading day. Day traders aim to capitalize on larger intraday price movements.

Unlike scalpers, who rely on high-frequency trading, day traders typically execute fewer trades, focusing on capturing significant market trends. Day trading allows for a more relaxed pace compared to scalping, providing traders more time to analyze forex market conditions and make sensible trading decisions.

Summary Table

Understanding these differences can help forex traders choose the currency trading strategy that best fits their personality, trading style, risk tolerance and financial goals. A summary table appears below that provides a comparison of these popular intraday forex trading strategies that you can use to decide between them:

| Scalping | Day Trading | |

| Account type needed | Standard, ECN | Standard, ECN |

| Time frame traded | Seconds to minutes | Minutes to hours |

| Speed | Typically hundreds of trades per day | Fewer trades, typically around 5-10 per day |

| Risk | High, due to the volume of trades and small margins | Medium to high, depending on the strategy |

| Trade size | Small, focused on small gains from each trade | Larger, aiming for significant intraday movements |

Pros and Cons of Scalp Trading

The use of scalping as a forex trading strategy comes with its own set of advantages and disadvantages. Understanding these can help currency traders decide if this strategy suits their personality and style. Some of the pros and cons of scalp trading include:

Pros:

- Opportunity for quick profits.

- The high volume of trades can increase potential gains.

- Eliminates overnight risk since scalping trades are closed within the day.

- No rollover fees.

- Can be automated for more efficient and error-free trading.

Cons:

- Scalping requires significant time and attention unless automated.

- High transaction costs are involved due to the large number of trades.

- High stress can wear out a scalper due to the rapid pace of trading.

- Scalping involves constant market and position monitoring when active.

- Risk of significant losses from scalping if trades or orders are improperly entered or executed.

Important Considerations Before Scalp Trading

Before engaging in scalping the forex market, anyone new to scalping should consider several key factors that are listed below:

1. Risk Management: Scalping involves high-frequency trading, leading to significant losses if the associated risks are not managed properly. Placing stop-loss orders and adhering in a disciplined manner to a tested trading plan are key ways to mitigate the risks involved.

2. Capital Requirements: Scalping often requires substantial capital to cover the frequent trades and transaction costs. Although scalping requires less trading capital when operating in the online forex market than in the stock market, make sure you have adequate funds in your trading account to engage in this short-term trading strategy effectively.

3. Understanding the Market: A deep understanding of the forex market and the technical indicators used in scalping is helpful for long-term success as a scalper. Continuous learning and staying updated with forex market trends will enhance your trading performance.

4. Trading Platform and Broker: A reliable and fast trading platform and a broker that supports scalping are vital for a forex scalper. The platform should provide real-time market data, quick execution speeds, advanced charting tools, and technical indicators.

Frequently Asked Questions

Is scalping still profitable?

Yes, despite the market risks and significant transaction costs, scalping can still be a profitable forex trading strategy if trades are consistently executed with discipline within an effective trading plan.

Which time frame is best for scalping?

The best time frames for scalping are typically very short, with a typical analysis time frame ranging from reviewing one-minute to five-minute charts. This allows traders to use a scalping strategy to capitalize on small market movements.

Why is scalping so difficult?

Scalping is difficult due to the need for quick decision-making, constant monitoring of the market, and the high level of precision required to execute numerous trades successfully and without errors. The fast-paced nature and high transaction costs add to the challenges scalpers generally face.

Get a Forex Pro on Your Side

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and spreads, fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.0 with fixed $7 commissions per $100k USD traded

- Powerful, purpose-built currency trading platforms like MT4, MT5, TradingView, cTrader and NinjaTrader

- Monthly cash rebates with FOREX.com’s Active Trader Program

Learn more about FOREX.com powerful trading platform and how you can get started today.

About Jay and Julie Hawk

Jay and Julie Hawk are the married co-founders of TheFXperts, a provider of financial writing services particularly renowned for its coverage of forex-related topics. With over 40 years of collective trading expertise and more than 15 years of collaborative writing experience, the Hawks specialize in crafting insightful financial content on trading strategies, market analysis and online trading for a broad audience. While their prolific writing career includes seven books and contributions to numerous financial websites and newswires, much of their recent work was published at Benzinga.