Those who actively engage in forex trading know that the market can shift decisively in milliseconds and that it can maintain a directional bias or trend for months if not years. Among the many types of trading strategies available to forex traders, the various trend trading strategies hold a prominent position among those many traders succeed with.

This comprehensive guide to trend trading strategies aims to illuminate the intricacies of trend trading by unveiling its core principles, explaining how to identify trends, detailing effective trend trading strategies and highlighting the indispensable role of technical indicators that can help guide strategic trend traders through the tumultuous sea of exchange rate fluctuations.

What is Trend Trading?

Trend trading has long been considered a core strategy among traders in the financial markets that aims to capitalize on assessing and following the overall direction of exchange rate movements with trading positions. Trend traders generally aim to profit from trend or position trades by going long in upward trends and short in downward trends, although trends can also progress in a sideways direction.

Aptly encapsulated by the old market adage “the trend is your friend,” effective trend trading involves seeking out and navigating the waves of established trends, whether they consist of bullish uptrends, bearish downtrends or sideways ranges, in pursuit of the sustained and substantial profits this strategy can yield to the careful and strategic market analyst.

Unlike the transient ripples of short-term market moves that day traders and scalpers look to profit from, trend trading adopts a broader timeframe sometimes stretching over years. Trend traders also often take a fundamentals-based perspective as they seek to align their positions with the prevailing direction of the forex market. They may also use technical indicators to help them identify trends, assess their strength and determine if the current trend is losing momentum.

As a strategic approach, trend trading tends to resonate best with traders who possess the resolve and the sufficiently deep pockets to weather the short-term volatility of exchange rates in pursuit of potentially prolonged and greater gains over the long run.

How to Identify a Trend

A central element of the art of effective trend trading is the ability to discern forex trends and their stages with precision. Keep in mind that distinguishing between genuine market trends and fleeting fluctuations necessitates a keen eye and the discernment that often comes with experience.

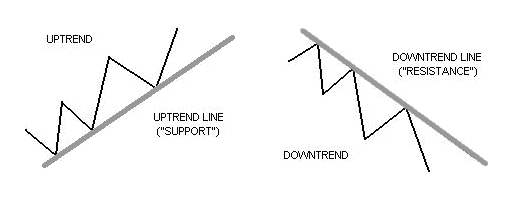

As shown in the image below, an upward trend is defined in practice by a sequence of higher highs and higher lows that together help define an upward-sloping line or trendline that provides support to the market. In contrast, a downward trend is defined by a set of lower highs and lower lows that define a downward-sloping trendline that offers resistance to the market.

Uptrends and downtrends. Source: BabyPips.

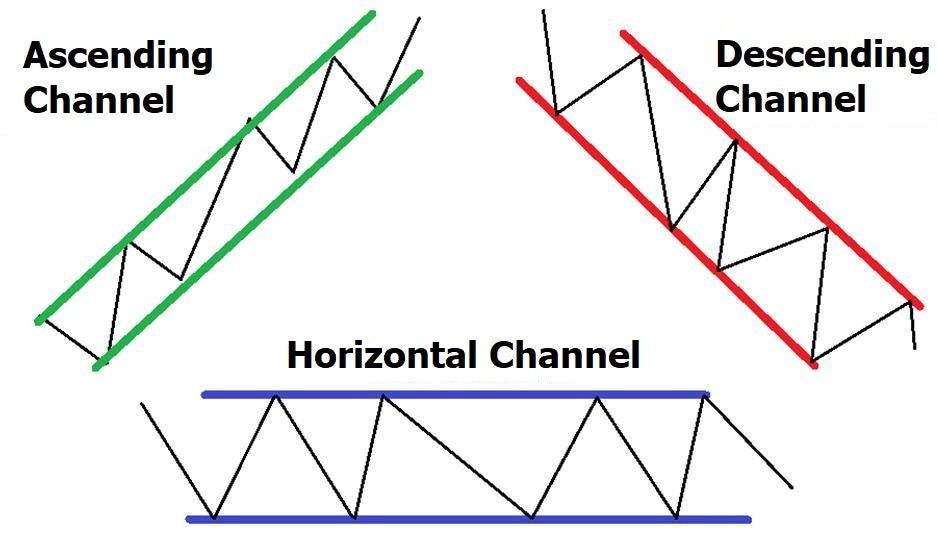

A trend can also often be encapsulated between two trend lines that form a channel pattern if the lines are parallel. As the image below shows, ascending channels occur in uptrends and descending channels occur in downtrends. If the market is not trending in either direction, then it may be trending sideways in a horizontal channel, which means that a trading range can emerge.

Three different types of channel patterns. Source: IQTradingPro.com

In any case, as soon as a trend veers significantly away from its established directional trajectory and loses momentum, an astute trend trader will typically aim to square their trend-following positions and wait for another trend to emerge in the forex market.

Best Forex Trend Trading Strategies

To make money from trend trading, the theory of trends needs to be transitioned into tangible action taken in the forex market. This has resulted in a variety of trend trading strategies that include the following.

Breakout Trading

This forex trend trading strategy centers on spotting potential trend shifts as exchange rates breach pivotal resistance or support levels. Breakout traders monitor the forex market carefully for strong exchange rate movements beyond such key levels as they aim to harness the momentum of the breakout to amplify their profits.

Breakout trading requires fast executions and prudent money and risk management. For best results, it also requires additional analysis to confirm the breakout's authenticity to avoid trading on false trade signals that can yield disappointing losses.

Retracement Trading

Retracements are temporary exchange rate reversals that move against the dominant trend, and, for observant trend and swing traders with quick reactions, they offer fleeting windows of opportunity that traders can use to boost their trading profits.

Advocates of the retracement trading strategy aim to seize these brief moments of trend reversal activity and capitalize on the short-lived retreat before the overall market direction reasserts itself. This activity lets them profit from the trend and from its retracements to increase their overall trading gains.

The key to success with the retracement trading strategy lies in accurately predicting the market’s short-term reversal points and avoiding the trap of confusing a mere retracement with a full-scale trend reversal. Retracement traders will often use momentum indicators to gauge market momentum and help them identify valid retracements.

Range Trading

In horizontal trending periods characterized by sideways exchange rate movements, the range trading strategy emerges as a sensible choice for trend traders. Range traders typically meticulously pinpoint distinct support and resistance levels on either side of the trading range.

They then aim to execute trades within this confined range by selling high and buying low or by buying low and selling high. Profits accrue as the trader astutely exploits recurring exchange rate oscillations within the range’s pre-defined boundaries. Executing this strategy well generally necessitates an intimate understanding of market dynamics within the specified range.

Like breakout traders, range traders also need to watch for breakouts of the prevailing upper and lower horizontal trend lines of the range they are trading. They can profit from observing such events since they typically yield a substantial follow-on move equal to the vertical width of the trading range.

News Trading

The news trading strategy leverages the forex market's often rapid and sharp reactions to new economic data releases. News traders might pore over economic indicators and aim to anticipate market movements catalyzed by the influx of fresh information, especially if it differs from the market’s current consensus.

Trading this type of strategy effectively generally demands swift decision-making and a comprehensive grasp of the economic context underpinning the news event and how it will likely impact the forex market’s evaluation of affected currency pairs.

Price Action

Price action strategies have long been used by stock market traders, but they can also apply to the exchange rate action seen in the forex market. Rather than relying on technical indicators, price action strategies focus instead on the historical movements of an asset’s price or exchange rate.

For example, price action traders might peruse charts to look for candlestick patterns, classic chart formations and support/resistance levels. These discoveries are then further analyzed to make astute trading decisions.

Executing this type of strategy well typically requires a deep understanding of market dynamics and a knack for deciphering the nuanced language of market movements as displayed on charts.

Best Forex Trend Indicators

Navigating the choppy waters of the forex market as a trend trader becomes substantially easier when augmented with the use of technical indicators. Some of the best trend and momentum indicators commonly used by trend traders include the following.

Moving Average Trend Indicator

A moving average is a key trend indicator that smooths out exchange rate fluctuations by taking some type of average of historical data and then plotting it over time. This indicator provides trend traders with a clearer view of the prevailing trend's overall trajectory.

Also, the convergence or divergence of short-term and long-term moving averages and their crossovers often serve as useful signals for potential trend shifts. For example, when a short-term moving average crosses above a long-term moving average, that sends a bullish signal. When the opposite occurs, a bearish signal arises.

Although moving averages are considered a lagging indicator since they are based on historical exchange rate data, their use often serves trend traders as a steadfast compass to guide the direction of their position-taking choices.

Average Directional Index (ADX) Trend Indicator

The ADX indicator gauges the strength of a trend that can range from weak to robust. This indicator was developed by J. Welles Wilder, and it transcends the confines of mere exchange rate data analysis.

It serves as a trend compass guiding traders through periods of market noise and short-term fluctuations. By quantifying trend strength, the ADX offers a coherent framework for traders to comprehend the dynamics at play, providing them with a decisive edge in formulating strategic decisions.

The numerical values produced by the ADX range between 0 and 100, reflecting both the absence or weakness of a trend with its low values between zero and 25, and the presence of a potent trend with its high values between 75 and 100. Levels between 25-50 signal a moderate trend, while those between 50-75 suggest a strong trend is in motion.

While the ADX does not provide information about the direction of the trend, it emphasizes the magnitude of the trend's force. This metric gives traders a general view of the forex market's dynamics.

Traders often view the ADX with its component indicators, which include the Positive Directional Indicator (+DI) and Negative Directional Indicator (-DI). This helps them ascertain the trend's direction alongside its strength.

When the +DI line crosses above -DI, it indicates a potential bullish trend, while the reverse suggests a bearish trend. The value of the ADX also helps validate the vigor of these directional indicators, thereby ensuring they align with a trend's strength.

Traders often combine the ADX with other indicators to validate a trend's momentum before executing trades. This trend trading tool can prove indispensable to traders who wish to identify sturdy trends while filtering out market noise.

Relative Strength Index (RSI) Trend Indicator

The Relative Strength Index (RSI) is a dependable momentum oscillator also developed by J. Welles Wilder that helps traders quantify overbought and oversold conditions within a market trend. This indicator furnishes an observant trader with insights into potential trend reversals or continuations. By keeping an eye on the RSI's value and if it diverges versus the exchange rate, forex trend traders can glean valuable information regarding market sentiment and potential exhaustion points.

The RSI is a bounded oscillator that ranges between 0 and 100 to display a market’s recent movements and their relative strength. This oscillating index serves to indicate whether a market is overbought or oversold, which is a key consideration for trend traders looking to determine whether they should hold or close out their trading positions.

When the RSI surpasses the threshold 70 mark, it signals that the currency pair might be overbought, implying that its exchange rate has surged so the potential for a reversal might be on the horizon. Conversely, when the RSI dips below the key 30 mark, it signifies an oversold condition that suggests the currency pair’s exchange rate has dipped significantly enough that a potential upward reversal could be imminent.

For forex trend traders, the RSI's value extends beyond these thresholds. In a bullish trend, the RSI can offer useful insights into the strength and longevity of the trend. As exchange rates climb during an uptrend, the RSI tends to stay above the 70 mark for extended periods. This indicates that the momentum of the upward movement remains robust. In contrast, during a downtrend, the RSI could consistently stay below the 30 mark as the exchange rate continues to decline.

Trend traders also watch the RSI carefully for situations where its peaks or troughs diverge from the exchange rate’s peaks or troughs. This phenomenon occurs when the RSI moves in a direction contrary to the exchange rate’s movement.

Positive or bullish divergence happens when the RSI forms higher lows while the exchange rate forms lower lows, and it suggests a potential upward reversal. Negative or bearish divergence, on the other hand, occurs when the RSI forms lower highs while the exchange rate makes higher highs, indicating a possible impending downside reversal.

Can Forex Traders Benefit from Trend Trading Strategies?

Trend trading strategies can definitely benefit forex traders, and many currency market operators consider one or more of the trend trading strategies described above to form the core of their trading strategies.

By harnessing established trends and trading along with them, trend traders can unlock the secret to earning sustained profits from their currency trading activities.

Still, keep in mind that success as a forex trader often depends on using more than strategy alone. It also demands a fusion of skill, disciplined execution and a deep understanding of the multifaceted dynamics and economics that underlie forex market movements.

Frequently Asked Questions

What is the most profitable trading strategy?

The profitability of a trading strategy hinges on a myriad of factors, encompassing market conditions, risk tolerance and individual preferences. Trend trading strategies are renowned for their potential to capitalize on prolonged market trends. They are also often favored by traders for their capacity to generate profits without having to watch the market closely.

Do forex trading strategies work for stocks?

While many trading strategies can be used interchangeably in the forex and stock markets, you really need to tailor any trading strategy to the distinctive characteristics of each market. Adapting strategies properly helps ensure their alignment with the nuances of each trading environment.

Which timeframe is best for trend trading?

The optimal timeframe for trend trading depends on the trader’s goals and trading style. Longer timeframes in the weekly or monthly range are typically chosen to capture broader trends with an occasional trading frequency, while shorter timeframes like hourly or daily may cater to traders seeking more frequent trading opportunities.

Get a Forex Pro on Your Side

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and spreads, fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.0 with fixed $7 commissions per $100k USD traded

- Powerful, purpose-built currency trading platforms like MT4, MT5, TradingView, cTrader and NinjaTrader

- Monthly cash rebates with FOREX.com’s Active Trader Program

Learn more about FOREX.com powerful trading platform and how you can get started today.

About Jay and Julie Hawk

Jay and Julie Hawk are the married co-founders of TheFXperts, a provider of financial writing services particularly renowned for its coverage of forex-related topics. With over 40 years of collective trading expertise and more than 15 years of collaborative writing experience, the Hawks specialize in crafting insightful financial content on trading strategies, market analysis and online trading for a broad audience. While their prolific writing career includes seven books and contributions to numerous financial websites and newswires, much of their recent work was published at Benzinga.