Timing exits in forex trading can be challenging for many traders, often resulting in missed opportunities or premature stop-outs. Addressing this problem requires a reliable and adaptable exit strategy. The chandelier exit is a simple yet powerful tool that helps manage risks and optimize trade exits.

This article introduces you to the chandelier exit technical indicator. It covers the chandelier exit, how to identify it, how to trade it and the pros and cons of this strategy. It offers valuable insights into using the chandelier exit to ride major trends while safeguarding your profits.

What is the Chandelier Exit?

The chandelier exit is a technical indicator used by traders to set a trailing stop-loss based on market volatility. Developed by Chuck LeBeau and popularized by Alexander Elder's book, its purpose is to help traders stay in a trend and avoid leaving too soon as long as the trend continues.

The chandelier exit uses a multiple of the average true range (ATR) to calculate a trailing stop-loss level that follows the price as it moves in your favor. The idea is to keep the stop-loss at a safe distance from the price fluctuations but close enough to lock in some profits if the trend reverses. In a downtrend, the chandelier exit will typically be above prices; in an uptrend, it will be below prices.

How to Identify the Chandelier Exit

The chandelier exit can be calculated using the following formula:

Chandelier Exit (Long) = Highest High - ATR * Multiplier

Chandelier Exit (Short) = Lowest Low + ATR * Multiplier

The highest high and the lowest low are the highest and lowest prices reached during a specified period, usually 22 days. The ATR is the average true range of the price over the same period. The multiplier is a factor that determines how far away the chandelier exit is from the price. A common value for the multiplier is 3, but you can adjust it according to your risk tolerance and trading style.

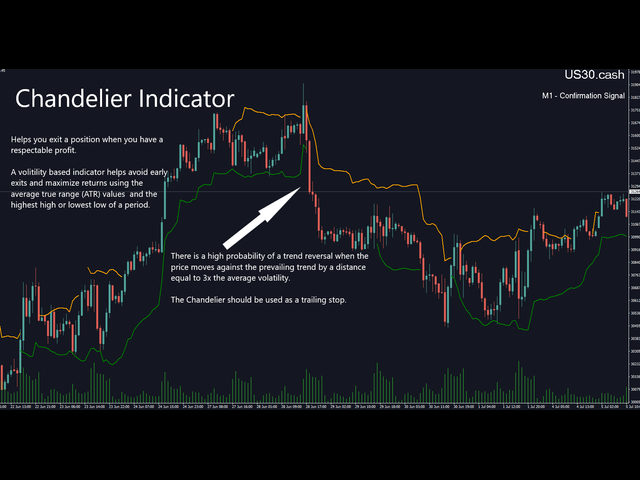

The chandelier exit can be plotted as a line on a price chart, below the price for long positions and above the price for short positions. Here is an example of how the chandelier exit looks like:

Example of Trading the Chandelier Exit

Suppose you are in a long position in the EUR/USD currency pair and want to set a trailing stop loss to protect your profits and exit the trade when the trend reverses. You can use the chandelier exit formula to calculate the stop-loss level for each day.

Chandelier Exit (long) = 22-day High - ATR(22) x 3

Let's say the 22-day high of the EUR/USD exchange rate is 1.20, and the ATR(22) is 0.01. Using the formula, you can calculate the chandelier exit as:

Chandelier Exit (long) = 1.20 - 0.01 x 3

Chandelier Exit (long) = 1.17

You should set your stop loss at 1.17, below the highest point of the current uptrend. If the exchange rate continues to rise, you can adjust your stop loss upward by recalculating the chandelier exit using the new 22-day high and ATR(22). This way, you can lock in your profits and follow the trend as long as it lasts.

However, if the exchange rate falls below 1.17, you should exit the trade and take your profits, as this indicates that the trend has reversed and the exchange rate may continue to decline. By following this approach, you can avoid returning your profits and minimize your losses.

How to Trade the Chandelier Exit in Forex

The chandelier exit indicator can be used as a standalone exit strategy or together with other technical indicators. Here are some general guidelines on how to trade the chandelier exit in forex.

- Determine the period: Decide on the period you want to use for the chandelier exit. Common periods are 22, 30 or 50, but you can adjust it based on your trading strategy and timeframe.

- Calculate the chandelier exit: The chandelier exit formula combines the highest high over the chosen period and a multiple of the ATR. The formula is:

Chandelier Exit = Highest High - ATR * Multiplier. - Plot the chandelier exit on a chart: Use your trading platform's tools to plot the chandelier exit on your forex chart. The chandelier exit will appear as a line or a series of dots above or below the price chart, indicating potential stop-loss levels.

- Determine entry and exit points: When you enter a trade, the chandelier exit provides a reference point for your stop-loss level. Place your stop-loss order just below (for long positions) or above (for short positions) the chandelier exit level.

- Adjust the chandelier exit: As the market moves in your favor, the chandelier exit will move along with the highest high, modifying the stop-loss level. This trailing stop-loss helps you lock in profits while giving your trades room to breathe.

- Manage risk and trade management: The chandelier exit is a risk management tool, but it should be used with other indicators and technical analysis techniques. Consider factors such as support and resistance levels, trend analysis and overall market conditions to make sound trading decisions.

Pros of the Chandelier Exit Strategy

The chandelier exit strategy has some advantages that make it a useful tool for forex traders:

- Helps traders to capture the major trends and ride them until they reverse

- Provides a clear, objective exit trading signal based on volatility and price action

- Allows traders to adjust their stop-loss levels dynamically according to the market conditions

- Applies to any timeframe and any currency pair

Cons of the Chandelier Exit Strategy

The chandelier exit strategy also has some drawbacks you should know before using it:

- It can generate false exit signals when the market is choppy or range-bound.

- Traders miss out on some profits when the market makes a sudden spike or reversal.

- It can be too tight or too loose depending on the ATR multiplier and the period used.

- The strategy requires traders to monitor their trades closely and adjust their stop-loss levels frequently.

Mastering the Chandelier Exit Strategy in Forex Trading

The chandelier exit is a simple and effective way to trade forex with volatility-based trailing stops. It can help capture large price movements and avoid being stopped prematurely. However, it is not a perfect indicator and may generate false signals or lag behind fast-moving markets. The best practice is to use it with other technical tools and fundamental analysis.

Frequently Asked Questions

What is the best chandelier exit setting for day trading?

There is no definitive answer since different settings may work better for different timeframes, currency pairs, market conditions and trading styles. However, a general rule of thumb is that shorter periods and lower multipliers work better for day trading since they provide tighter stop-loss levels that suit shorter-term trades.

What is the success rate of the chandelier exit?

The success rate of chandelier exit depends on various factors, such as the market trend, the ATR multiplier, the chandelier exit period and the trader’s discipline and risk management. While there is no direct answer to what the success rate of chandelier exit is since traders may have different results and experiences, the strategy has been known to perform well in terms of profitability and risk-adjusted returns.

How long is the chandelier exit period?

The trader typically sets the chandelier exit period based on their trading strategy, which can vary depending on their preferences and timeframes. Common choices for the chandelier exit period range from shorter periods, like 14 days, to longer periods, like 30 days or more.

Get a Forex Pro on Your Side

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and spreads, fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.0 with fixed $7 commissions per 100,000

- Powerful, purpose-built currency trading platforms like MT4, MT5, TradingView and NinjaTrader

- Monthly cash rebates with FOREX.com’s Active Trader Program

Learn more about FOREX.com powerful trading platform and how you can get started today.

About Anna Yen

Anna Yen, CFA is an investment writer with over two decades of professional finance and writing experience in roles within JPMorgan and UBS derivatives, asset management, crypto, and Family Money Map. She specializes in writing about investment topics ranging from traditional asset classes and derivatives to alternatives like cryptocurrency and real estate. Her work has been published on sites like Quicken and the crypto exchange Bybit.