Investors were betting on Bitcoin to fall further, but instead, Bitcoin pushed higher. On Sunday, July 25th, Bitcoin surged from $36,000 to over $40,000 in a matter of minutes. The majority of this volume came from ByBit, but the price of Bitcoin hit $48,000 on Binance for a brief moment, causing lower-leveraged short positions to also be liquidated.

With bearish movement from Bitcoin over the past month, Bitcoin short futures were piling up at a record rate. After Bitcoin broke through it’s psychological support of $30,000 around July 20th, investors were calling for a $20,000 Bitcoin in the near future.

Instead, the opposite happened and those betting against Bitcoin were liquidated.

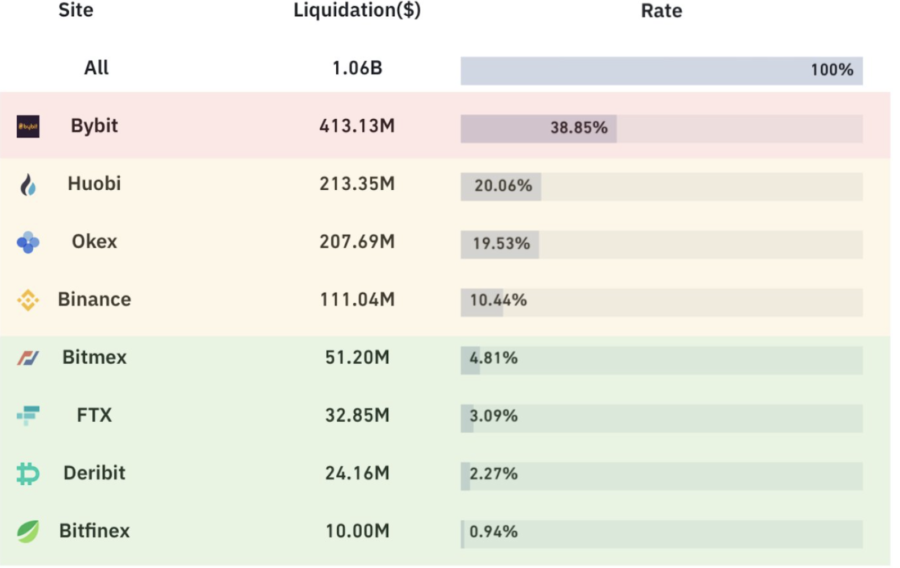

Liquidation Volume By Exchange: Bybt.com

The above data from Bybt shows the liquidation volume by cryptocurrency exchange. While Bybit had the most short positions liquidated, Binance saw the full effect of the short squeeze with Bitcoin hitting $48,000 on its BTC/USDT perpetual swap contract.

In aggregate, short sellers were liquidated to the tune of over $1 billion. This is among the largest short squeezes in the history of Bitcoin, and surely the largest short squeeze when accounting for the pace at which it happened.

In early 2021, we saw another short squeeze after Tesla CEO Elon Musk announced Tesla will accept Bitcoin as payment for its electric vehicles. Over the following days, Bitcoin short sellers had over $500 million of Bitcoin liquidated.

If you measure the short squeeze from when Musk added #Bitcoin to his Twitter bio, the squeeze accounted for over $1.2 billion of liquidations over a matter of days. Still, the $1 billion of cryptocurrency liquidated on July 25 seems to be among the largest short squeezes in the history of cryptocurrency.

Binance Perpetual Swap BTC/USDT Contract 1 Hour Candles: Binance

Due to this short squeeze, the price of Bitcoin surged to over $48,000 on Binance. Most other exchanges saw Bitcoin rise to about $40,000 before finding support around $37,000. But what is a short squeeze, and why does it cause the price to go up?

When an investor is short, they essentially sell Bitcoin to buy back at a lower price. If Bitcoin’s price appreciates from when a short seller enters a position, then the short position becomes worth less. To limit losses, short sellers must buy back Bitcoin at this higher price to close their short position.

This creates a cascading effect on the price of Bitcoin. As more short sellers are liquidated or sell to limit loss, more Bitcoin is bought at market price. These buy orders push Bitcoin’s price higher, causing more liquidations to push the price even higher.

Where To Buy BTC Today

Looking to get started investing in Bitcoin? There are plenty of U.S based exchanges that can help you get started today. Make sure to use an exchange that's reputable and secure; some of our favorites are Coinbase, eToro and Gemini. All these exchanges offer low fees and an easy to use user interface. Coinbase currently has a program called Coinbase Earn which pays you in crypto for learning about this innovative new industry!

See also: Is Bitcoin a Good Investment? and Learn About Cryptocurrency