Ethereum, next to Bitcoin, makes up what most investors would consider the blue chip picks of the cryptocurrency space, especially at the point where Ethereum and Bitcoin are head and shoulders above all other cryptocurrencies (stablecoins included), both in terms of market capitalization and recognition.

Of these two blue chip tokens, Ethereum is generally considered to have the larger amount of upward mobility and is perceived as having more development potential from an innovation standpoint. This much is difficult to argue against, especially when looking at the depth and breadth of the suite of upcoming changes to the Ethereum Network.

With inflation running rampant in the fiat world, traditional monetary policy has shown how important control over money printers can be. With this context in mind, one might wonder how this principle applies to Ethereum’s tokenomic policy in comparison to Bitcoin’s well-known supply cap of 21 million Bitcoins.

Does Ethereum Have a Cap?

In short, no. Ethereum doesn’t have a cap on the total number of tokens that can exist at any one point in time. Yearly issuance rates have steadily decreased over time in a similar manner to Bitcoin, so in practice, inflation isn’t a concern in the same sense that it might be for fiat currencies.

The dates in the graph provided by Ethhub above use an older timeline estimation based around the Merge having happened in late 2021, so shifting the dates from 2020 onwards by around 6 months yields more accurate predictions.

How Many Ethereum Tokens Are There?

The question as to how much Ether exists is surprisingly nuanced. Sure, the total issuance is a straightforward enough figure (around 120,173,610 tokens of Ether exist at the time of writing), but this figure is fairly one dimensional. Indeed, this figure doesn’t capture or fully track the total number of ETH that are liquid or tradeable at any one given point.

ETH In DeFi

Much of the discrepancy between total supply and circulating ETH comes from how Ether can be staked with validators (in the buildup to the Ethereum Merge) for rewards (in a roughly similar sense to savings protocols where you can stake altcoins and stablecoins for interest), which generally requires a lockup period. The same broadly applies for many decentralized finance (DeFi) protocols, which is why the total value locked (TVL) of the Ether in DeFi is a relevant figure in determining how much Ether is currently liquid and circulating actively.

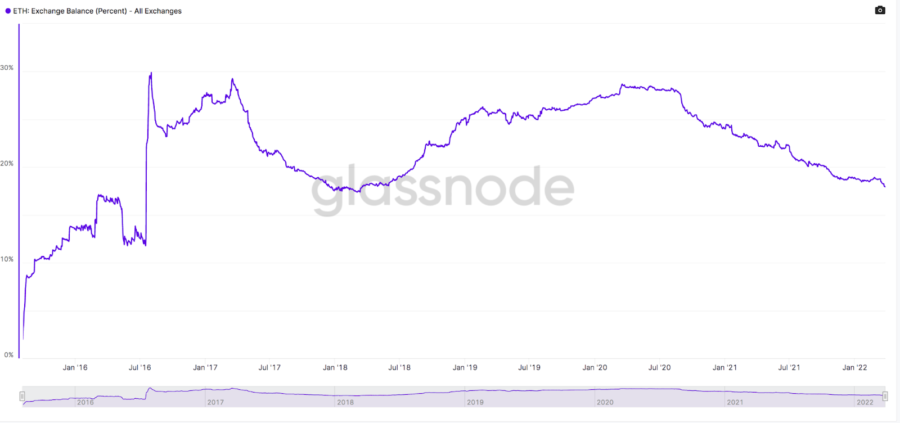

Percentage of Ether Held on Exchanges

Similarly, the Ether (and other tokens) that centralized exchanges (CEXs) control when people keep tokens in CEX accounts is a sizable portion of the total issuance. An increase in exchange balances may indicate investors are looking for liquidity, as most investors transfer their crypto to an exchange to sell or trade their assets.

Source: Glassnode

Ether in Circulation

Removing these other categories of Ether gives a rough approximation of the circulating supply of Ether, though even this action doesn’t make a distinction between lost Ether and Ether that is being held for the long term. Note the broadly linear growth trend up to August 2021, when Ether started being burned, as well as the flattening that followed the Ethereum Network’s London Fork (early August 2021), which introduced Ether’s burning mechanism.

Is Ethereum Deflationary?

Looking back at the projected issuance rate graph above, you can see that Ether currently has a net positive issuance rate and is not technically deflationary, even though over 1.3 million Ether has been burned since August’s London Hard Fork, where EIP-1559 introduced burning to the Ethereum ecosystem. A significant part of the upcoming Ethereum Merge is a drastic reduction in yearly issuance rate (sub 1%), so it’s likely Ethereum will eventually be deflationary after this occurs.

Bitcoin Supply vs Ethereum Supply

While Bitcoin has a strictly defined supply cap of 21 million tokens, the increasing difficulty and exponentially decreasing reward of each block means that the last of these 21 million tokens is only projected to be mined in the year 2140, which means that Ethereum’s issuance is surprisingly similar to that of Bitcoin despite the former lacking a strict supply cap.

Another comparative aspect worth noting between the two is Bitcoin’s status as the first major cryptocurrency, which has consequently meant that many early adopters have lost keys, wallets and hard drives containing quantities of Bitcoin whereas the same situation seems to be less common for Ethereum because the early adopters of Ethereum had a better image of the value of the space in comparison to those of Bitcoin. Similarly, many Silk Road operators have dormant wallets containing large quantities of Bitcoin that are gradually reentering the market as their owners finish serving their prison sentences.

How to Invest In Ethereum

To enter the blockchain world, consumers need to exchange fiat currency (such as the U.S. dollar) to purchase cryptocurrencies, much like how you might purchase foreign currency before traveling to another country. These trades are most often facilitated by CEXs, some of which include eToro, Gemini and Coinbase Global Inc. (NASDAQ: COIN). By virtue of its immense popularity relative to other options in the cryptocurrency space, Ether can be bought and sold at any CEX and has exchange pairs with any cryptocurrency or fiat currency imaginable.

Individuals typically use tools called wallets to securely store their Ether and other digital assets. These wallets are associated with a unique Ethereum address that Ether transactions are sent to and from. The most popular example of an always-connected hot wallet for the Ethereum network is MetaMask, which offers browser extensions for most major browsers. Browsers like Brave and Opera offer native wallets as well.

What Will the Max Supply of Ethereum Be?

Circulating Supply (note the logarithmic trend):

Recall from earlier that there is no clearly defined maximum supply of Ethereum, and that Ether will become more deflationary following the Ethereum Merge. As such, the supply at the time of the Merge will likely be very close to the stable supply of Ethereum. Assuming that the Merge takes place in Q2 2022, it’d be reasonable to expect a stable circulating supply somewhere between 120 and 125 million tokens.

FAQs

Currently, around 120 million tokens of Ether exist. This number doesn’t look at how TVL in DeFi, CEX holdings or lost ETH affect this supply, though.

The wave of Ethereum upgrades referred to as the Merge (and formerly known as Ethereum 2.0) is expected to launch to the Ethereum mainnet in Q2 2022 barring any bugs or security risks found in testing until then.

About Aadharsh Pannirselvam

Aadharsh Pannirselvam is a student at the University of Chicago studying Economics and Data Science while building with Blockchain Chicago and the Chicago DAO. Aadharsh works on creating easily digestible web3 and DeFi content at Benzinga while learning off of the bleeding edges of blockchains and digital assets and exploring a career in the space. He holds positions in Ethereum, Bitcoin, and various other DeFi protocols and ecosystems. Aadharsh was previously affiliated with Flipside Crypto and is currently affiliated with Galaxy Digital. Aadharsh’s opinions are his own and not financial advice. The best way to get in touch with Aadharsh is via Twitter, @aadharsh2010 or via LinkedIn.