Domain Money is an all-in-one wealth management program that is notable for managing customers’ entire financial life with a dedicated financial adviser. Unlike traditional advisors, Domain Money advisors provide members with a simple, judgment-free, financial plan covering investing, saving, and insurance. They don’t want you to transfer your assets, they don’t want to sell you funds and they don’t want to charge recurring fees, Domain Money simply wants to provide great advice at an affordable cost.

Domain Money reviews your existing investments, no matter where you hold them. They put the pieces of your financial puzzle together and provide you with a clear, actionable plan to take the stress out of money. All while charging customers a one time fee of $2500 which in comparison to the industry standard of charging a fee equal 1% of your assets per year is great value.

The service is a bit like having your own personal CFO, or what they call a “wealth management concierge”. Their human advisers take the time to get to know their clients and build financial plans around their goals.

The offering is an affordable, tech forward and convenient way to get your financial life in order, all from the palm of your hand.

At $2500, Domain may not be the cheapest option when it comes to planning for your financial future. However, for those who are ready for a more hands-on approach than those offered by DIY tools or robos, customers will find that the cost of this five-star platform is far less expensive than traditional financial advisors.

- Customers connect with a personal financial advisor to help with investment and money management

- Domain Money advisors are CFP certified professionals & experts in their field having worked at household names like Goldman Sachs & Morgan Stanley.

- Easy-to-use concise financial page plans make it easy to work towards multiple goals.

- No minimum investment amount is required.

- Moving assets to Domain Money is not required

- Bank-grade security & an excellent in-app experience

- $2500 one-time fee can be uncomfortable for some users, but is still less than paying 1% over the lifetime of the portfolio

Domain Money Ratings at a Glance

Domain Money Product Offering

Most people know that they should have a comprehensive financial plan in place to invest tax-efficiently , build an emergency fund, as well as save towards major life goals like retirement. However, unless you’re experienced in financial planning yourself, the idea of creating a holistic picture of your financial needs and wants can feel overwhelming.

If you’re currently in the space where you know you need to create a financial plan but you aren’t sure where to start, Domain Money might be able to help. Domain Money is an innovative financial and investment management platform, known for its ability to connect users with their own dedicated financial adviser. Domain Money does not incorporate AI in its investment recommendations, instead they connect you with a human advisor to build a financial plan to help you reach your goals.

AI can be useful for plenty of financial planning needs, but it isn’t ideal for those who need personalized advice. Domain Money assigns each of its customers a certified financial planner (CFP) to assist in providing advice moving forward.

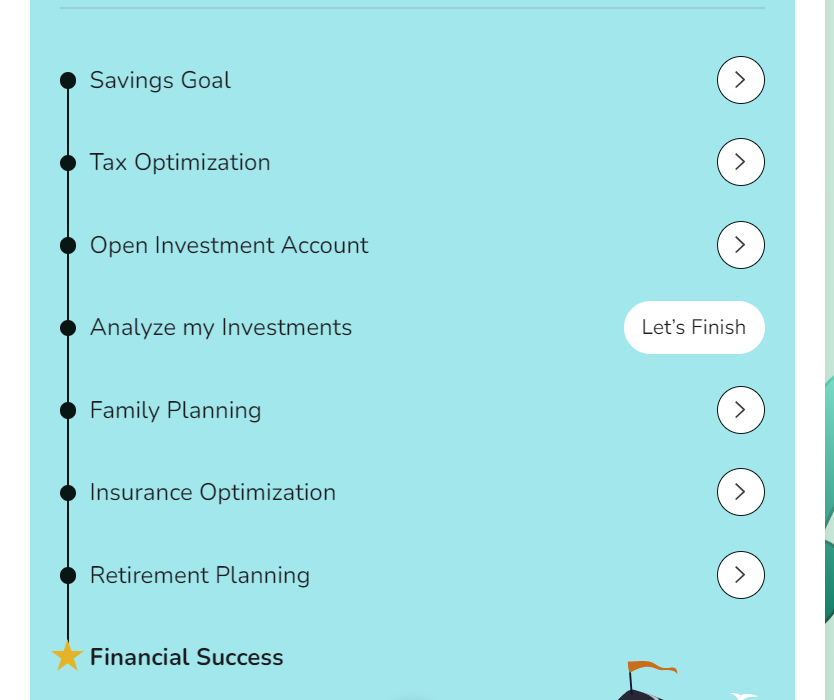

Domain Money’s online user platform makes it easy to connect with your dedicated adviser and begin sending financial information for them to consider when crafting your plan for the future. How it works, Domain Money will connect you with one of their world class expert CFP professionals for a complimentary no-obligation 30 minutes consultation where they will get to know you and learn what matters most. You then share relevant documents and the Domain Money team we spend hours reviewing every aspect of your finances and building the elements which will form your plan such as cash flow analysis, budgeting and investment allocation. Then, together, your CFP will analyze your whole financial picture, and build you a step by step plan that will help you achieve your goals. To wrap up your plan, together with your advisor, we’ll put your plan into action so you can live your best financial life.

For example, when Benzinga told Domain Money that a financial goal was to save up a down payment for a first property, it recommended a high-yield savings account to achieve this goal. With a balance of return on investment and low-risk, liquid savings, this recommendation matches the goal well. These quick, straightforward recommendations combined with the power of a personal financial advisor can make Domain Money a strong choice for those who have an idea of what they want to accomplish but not how to get there.

Not sure where you are in your saving and investing journey? Domain Money provides online education and learning resources that can help determine where you should start based on your current level of investment knowledge, savings and goals. You can also connect directly with your adviser through your online profile.

Overall, Domain Money is an innovative and user-friendly platform suitable for most levels of investors. No matter your level of investing experience or your experience operating a money and investment management account, you’ll have a team of professionals standing by to assist you in creating a plan toward all of your goals, even if you have multiple things to save for at once. While Domain’s pricing makes it less accessible when compared to robo-advising platforms, its higher price point can be worth the expense for investors looking for more hand-holding and personalized solutions.

Domain Money’s primary route for customer service contact is its live message system. Live chat is available directly through Domain Money’s homepage; look for the chat bubble in the bottom right-hand corner of the screen to send a message. While live chat is not monitored 24/7, you can leave your email and receive a response if you need to contact a team member outside of normal business hours.

Another customer service area where Domain wins points is in the personal connection it provides with your financial planner relationship. After logging into your Domain account, you can directly message your financial planner or other team members and upload financial documents. This feature provides a more streamlined experience for you as well as a more direct connection when you have a pressing question or consideration.

The nature of Domain’s services means that you may need to upload information on your financial account, so finding a secure platform is a priority. Domain Money uses bank-grade encryption alongside Secure Sockets Layer (SSL) and Transport Layer Security (TLS) protocols, which provide another layer of separation between your personal data and potential online threats.

In addition to offering bank-grade security on account data, Domain Money users can rest assured that their data is not sold to third parties. The only way that financial data is used is to make individual recommendations based on your outstanding debt levels and future financial needs. This feature can b

Domain Money’s one time fee starts at $2500,, regardless of funds under management. This pricing structure differs from traditional financial advisers, who usually charge clients based on a percentage of the total value of their assets under management. If you’re an investor with multiple streams of income or you’ve already contributed heavily to an account like a 401(k), this flat-rate pricing could be very advantageous. However, if this is your first time investing, the $2500 price tag could be too high of a barrier to overcome to begin with.

Some traditional financial advising firms also have minimum client net worth. For example, you may not qualify for representation with an advising company if you have less than $100,000 in assets under management. Domain Money has no minimum investment holding, and you can open an account even if you’re still primarily working on tackling debt.

Domain Money offers an exceptionally simple user experience, ideal for anyone overwhelmed by the prospect of financial planning. Some of Domain’s most unique features that make it easy for users include the following.

- Direct financial assistance: While some platforms stop at recommending asset mixes, Domain takes a more active role in assisting you with financial planning and management. For example, Domain Money can help you find forgotten retirement savings and can help in tax filing.

- Truly holistic advice: Your Domain Money Plan will cover budgeting, cash-flow investment allocation all against the lens of your life goals this should allow you to unlock the full value of financial advice.

- Direct connection with a financial planner: Domain Money’s customers receive the benefit of a personal relationship with their own financial planner, who is knowledgeable about the investor’s situation. If you’re looking for personalized recommendations, this feature makes Domain stand out from the crowd.

- Streamlined financial planning: After logging into your Domain account for the first time, you can set multiple financial goals, which your personal team will make recommendations based around. This setup is ideal for anyone who previously found the idea of managing multiple goals at once overwhelming.

Domain Money vs. Competitors

While Domain Money does offer the rare benefit of providing all customers with a connection to a dedicated financial planner, its pricing may not make it the right option for everyone. If you’re on a strict budget but you still want to put away a little money for the future each month, robo-advising platforms can provide a more affordable option for investing guidance.

Benzinga offers insights and reviews on the following financial management platforms. Consider continuing your search for the right option with a few of the links below.

- Best For:Financial PlanningVIEW PROS & CONS:securely through Domain Money's website

- Best For:High Net Worth IndividualsVIEW PROS & CONS:securely through Empower's website

- Best For:Comparing AdvisorsVIEW PROS & CONS:securely through SmartAsset Financial Advisors's website

Overall, Domain Money is a strong choice for anyone searching for holistic assistance with their financial planning. While the service comes at a steeper cost of $2500 once, this price is less than you’ll pay with a traditional advising firm and offers the benefits of personalized investing assistance. Ideal for all levels of investors, Domain Money is worth considering if you have a more complicated financial situation that requires nuance.

Frequently Asked Questions

Is Domain Money legit?

Yes, Domain Money is a legitimate platform. The company connects users with their own dedicated financial planner, who helps them in creating a plan for future goals. Domain Money earns income from its monthly fee charged to all users on the platform and does not sell your data or share it except with your financial team members.

What can a financial adviser do for you?

A financial adviser can assist you in creating a comprehensive financial plan tailored to your unique circumstances and goals. They will assess your current financial situation; analyze your income, expenses and liabilities; and develop a roadmap to help you achieve your objectives. They might recommend specific investment products and options to help you get where you want to go.