Day trading in the foreign exchange market involves buying and selling foreign currency pairs to make short-term profits before closing out all positions by the end of the trading day. Because of the substantial amount of attention involved, forex day trading isn’t for everyone.

While the forex market’s significant volatility makes it suitable for earning forex profits even as a retail day trader, you’ll still need a good strategy and quick responses to be successful.

In this article, we'll explain how day trading forex works, what the top trading patterns are, day trading strategies and how to day trade forex as a retail trader once you feel confident with your strategy and have opened an account with a forex broker.

What Is Forex Day Trading

Forex day trading is a type of trading strategy where the trader executes transactions on an intra-day basis to capitalize on small moves in a currency pair. A key element of day trading is that the day trader establishes and liquidates all positions before the end of their chosen trading session so they do not run the risks associated with holding positions overnight.

The foreign exchange market stays open 24 hours a day during the trading week that stretches from 5 p.m. on Sunday to 5 p.m. on Friday New York time, so forex day traders must clarify exactly which session or time frame they consider a “day.”

Depending on the day trading strategy you select, you might also find that the best conditions for trading tend to occur during certain time frames. Choosing the appropriate time frame or forex trading session to operate in can make a big difference in the day trading opportunities you can take advantage of as a foreign exchange trader.

For example, some day traders like to establish forex positions based on the opening behavior of the professional foreign exchange markets based in Tokyo, London and New York. Other day traders who focus mainly on exploiting the market volatility that can occur after news events might prefer to operate around the release of key U.S. economic data, which usually occurs between 8:30 and 10 a.m. New York time.

How Does Day Trading Forex Work?

A typical forex day trader will select a time frame to operate in and a currency pair or pairs to trade within that time frame. Ideally, a day trader will have a well-defined and objective trading strategy incorporated into their overall trading plan that they test and then follow in a disciplined manner to achieve profitable results.

Most day traders who operate in the foreign exchange market rely on performing technical analysis of price movement to generate trading signals that suggest suitable market entry and exit points. Successful forex day traders typically display a high degree of strategic thinking and discipline in following a well-tested and defined trading strategy to achieve profitable results.

Some day traders, commonly known as news traders, prefer to rely on significant economic news releases to trade around. Other day traders with fast reflexes might scalp the market by entering and exiting it frequently with the goal of making small profits while taking even smaller losses.

What day traders all have in common, however, is that they avoid taking the risk of holding trades overnight by closing out all open positions by the end of their chosen trading session. This means they can go to bed at night without the stress of wondering what the forex market has been doing in its other trading sessions.

Regardless of the type of day trading strategy applied, employing prudent money and risk management techniques and having a sound knowledge base about the foreign exchange market and what moves it by taking sufficient relevant forex training can significantly increase the likelihood of successfully day trading the FX market.

How to Start Day Trading Forex

If you’re still interested in day trading currencies, then you can follow the steps below to get started operating in the forex market on your own as a retail forex trader.

Step 1: Choose a Forex Broker

You will first want to select a forex broker suitable to your needs. Ideally, since day traders tend to be fairly active in the market, you’ll want a broker with tight dealing spreads to keep costs down.

Some forex brokers offer negative balance protection, which lets you avoid losing more than you have deposited if your position has gone against you. Others charge a commission per trade instead of a dealing spread, while some offer discounts for higher trading volume.

Other important factors to check out include the broker’s minimum deposit, customer service and trading platform. In addition to providing their own proprietary trading platforms, many brokers run the MT4 and MT5 platforms, letting you open a demo account without committing your own funds. This is an excellent way to evaluate a broker’s general execution services.

Step 2: Decide on Your Trading Strategy

Deciding on a trading strategy depends on your trading personality and your threshold of pain or how fast you get out of losing trades. A trading personality suitable for day trading would be a person who acts without hesitation and can pull the trigger when their signals are met.

Whether you’re a technical or fundamental trader also matters when deciding upon a suitable trading strategy. Technical traders tend to initiate trades off market signals, while fundamental traders base their decisions on underlying economic conditions and relevant news items that move the market. Once you’ve decided on a strategy, you can practice in a demo account and create a trading plan.

Step 3: Create a Trading Plan

As a forex day trader, you’ll need to decide upon the hours of the day you’ll be trading as an important part of creating your overall trading plan. Most forex day traders pick the New York or London sessions since their overlap typically gives day traders the most volatile and liquid market conditions in the major currency pairs. On the other hand, if you prefer to trade the USD/JPY pair, then trading the Tokyo session might be more suitable.

Other elements of a forex day trading plan can include the specific technical indicators or fundamental data you plan to trade on and the position sizing method that determines the amount of risk you plan on taking with each trade.

As a practical way to incorporate your profit goals and risk tolerance into your trade plan, you can set the amount of pips profit you plan on taking with each trade, as well as how many pips you wish to risk before liquidating a position at a loss. Doing this analysis will help you set stop-losses and take-profit levels on each trade.

Step 4: Learn How to Manage Your Risk and Money

Managing your risk when day trading can be as important to your success as finding optimal entry levels for trades. Incorporating a risk management component into your trading plan can save you plenty of money and frustration.

Some useful risk management tools include entering stop-loss and limit orders. Placing stop-loss orders to protect your open positions can save you plenty if the market turns against you, especially when exchange rates shift with extraordinary speed. Limit orders let you exit positions or get into trades at a more favorable level than the market currently trades at.

When it comes to your money management process, you could size each trade in relation to the amount of money in your trading account and how successfully you have traded in the recent past.

Forex trading has more in common with strategic gambling than with investing, so you want to avoid trading in excessive amounts that could result in a string of losses your account may never recover from. Having a prudent and fixed percentage of your account at risk at any given time can therefore make a lot of sense.

You can learn how to apply sound risk and money management principles by opening a demo account with an online forex broker. This option lets you test your trading strategy and practice trading it using virtual money.

Step 5: Start Placing Trades

Once you feel confident that you’ve developed a winning forex day trading strategy and have the ability and discipline to implement it, you'll be ready to fund a trading account with an online forex broker and begin placing live trades in the forex market.

Is Day Trading Forex Profitable?

Day trading the forex market can be profitable, although substantial differences in the typical degree of success observed exist between the two main types of professional day traders that operate in the forex market.

The first type of professional day trader includes those who work for a hedge fund or the proprietary trading desks of large financial institutions, and they tend to trade forex profitably. Such traders are usually very well-capitalized and have access to ultra-fast news feeds, the best forex trading tools, costly market analysis and trading software, direct dealing lines and the very tight dealing spreads typically quoted in the Interbank foreign exchange market.

The second type includes those retail forex traders who operate via online forex brokers and typically use a free trading platform like MetaTrader 4 or 5 (MT4/5). They generally work alone and trade with their own risk capital from home. This type of day trader tends to lose money overall when trading forex.

Retail forex traders are typically less successful because they only have access to slower Internet-based news feeds, lack insider market flow information and have to deal on the wider dealing spreads most online forex brokers quote. Retail day traders operate at a distinct disadvantage to the first group when milliseconds and dealing spreads really matter. These facts help explain why most retail traders do not operate on a consistently profitable basis over the long term.

On the other hand, professional traders operating at financial institutions can often pick up easy profits by exploiting arbitrage opportunities, seeing large customer flows and trading around news events that they learn about from professional news wires and can respond to quickly. The extensive resources available to them allow them to profit from less risky day trading opportunities well before retail traders can even react.

5 Top Day Trading Forex Strategies

If you’re a retail trader still thinking of getting into day trading currencies as a business opportunity, then you will want to develop a decent foreign exchange trading strategy to incorporate into your trade plan so that you can operate with greater ease and confidence in the forex market. Benzinga has compiled a list of the five top forex day trading strategies that are described further below.

Scalping

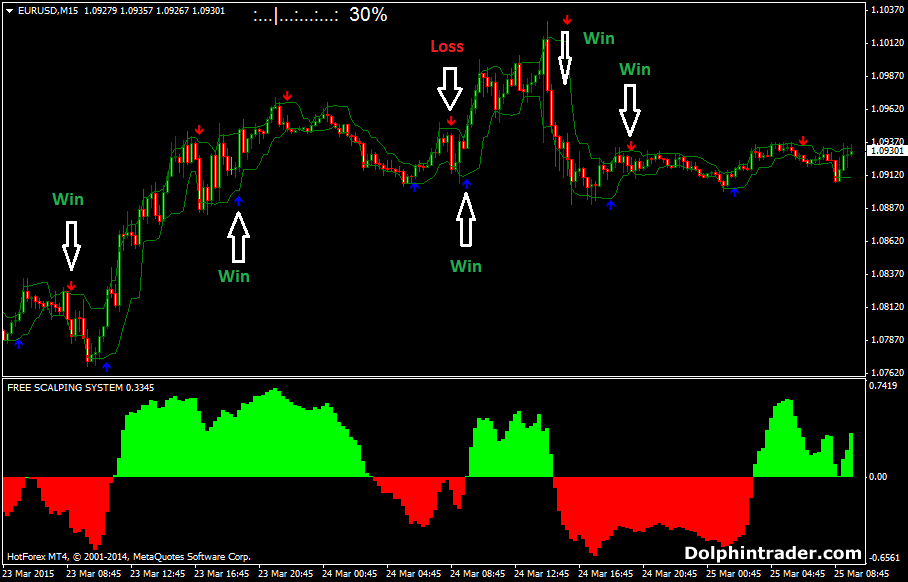

Example of forex scalping trades in EUR/USD. Source: DolphinTrader.com

One of the most popular day trading strategies retail forex day traders employ is scalping. Scalping can be defined as a strategy where the trader aims to skim profits using small exchange rate movements from many trades to produce a profitable outcome.

The prime directive when scalping is to take small profits or even smaller losses on positions that only remain open for a few seconds to a few minutes. You may think that scalping sounds easy since all you have to do to make money is buy low and sell high, but the strategy actually requires the trader to maintain an intense focus on the market and have quick reflexes that let them enter and exit a foreign exchange trade in seconds.

Some scalpers set pip goals per trade and many use technical analysis to generate signals for initiating their trades. For example, a scalper might watch a 1-minute chart and have a goal of making 5 pips per trade.

The type of technical signals popular with scalpers could include using the stochastic oscillator to gauge market momentum combined with watching for crossovers in a pair of long- and short-term exponential moving averages (EMAs) that can signal directional movements.

For example, a scalper might first observe a bullish EMA crossover where the short-term EMA moves above the long-term EMA for a currency pair. They might then wait to buy that currency pair until confirmation was received by the stochastic oscillator also reaching a certain level they selected as part of their trading strategy.

Scalpers can also pick the most favorable trading session to scalp a particular currency pair. For example, when both the London and New York forex trading sessions are active, the higher volatility often seen in currency pairs like GBP/USD can provide more profit opportunities to an astute scalper.

Some forex scalpers also employ forex robots to fully automate their trading plans. The bots can be programmed to generate trade signals for the trader to manually respond to or they can even automatically trade without human intervention after scanning the forex market for trading opportunities.

Many retail forex traders use the MT4/5 forex trading platforms from MetaQuotes to run off-the-shelf or proprietary trading algorithms that are known as expert advisors (EAs). The MetaQuotes website also provides access to a large community of MT4/5 users where you can download free trading platforms, obtain forex robots, follow more experienced traders and participate in discussion forums to learn more about scalping and other day trading strategies.

News Trading

News trading consists of a short-term day trading strategy that uses breaking news about currencies or the nations that issue them to suggest trading opportunities. Positive news can create a buying opportunity, while negative news suggests a selling opportunity.

Such news can include the release of key economic indicators or reports, changes in central bank management and important geopolitical events such as natural disasters and elections.

News tends to focus on anticipated recurring stories that are scheduled in advance like economic data releases or speeches or unanticipated stories that can shift the forex market sharply when they break, like natural disasters or the resignation of key politicians. Forex day traders can often profit from the notable volatility that follows an important news event when the news deviates substantially from the market’s expectations. Accordingly, news traders might regularly review calendars of economic data releases and news feeds to identify possible trading opportunities.

Arbitrage

Chart showing short-term variations between two markets that can be exploited by an arbitrageur.

Arbitrage is a day trading strategy that exploits short-term valuation disparities in a financial market or between financial markets where the same asset is quoted. For forex traders, arbitrage can be done in various ways, but it generally involves buying and selling one or more currency pairs when exchange rates temporarily diverge from fair value and are likely to rapidly revert to that value.

The opportunity to make such arbitrage transactions is generally fleeting and the profits are typically quite minute, so quick reaction times, the ability to deal in large amounts and access to the best dealing spreads are essential for an arbitrageur’s success.

Many professional cross-currency traders actively engage in arbitrage between their particular cross-pair, such as EUR/JPY for example, and the associated exchange rates for the component currencies quoted versus the U.S. dollar, such as USD/JPY and EUR/USD in this instance.

Mean Revision

Image showing how AUD/USD overextends and then reverts to the mean thereby suggesting trade opportunities. Source: DailyPriceAction.com

The mean reversion trading strategy is centered around the idea that a currency pair’s exchange rate tends to revert back to its mean or average level. A mean reversion strategy tends to function best in choppy and volatile market conditions where swings in exchange rates occur around a central level.

In this situation, the exchange rate can snap back to its average level quite quickly. This movement provides a mean reversion trader with numerous opportunities for profitable trading during an active day.

Mean reversion day traders typically enter into positions when they think the forex market has overextended either above or below a currency pair’s average exchange rate. They might use technical momentum indicators like the Relative Strength Index (RSI) or the Money Flow Index (MFI) to gauge how overbought or oversold a currency pair is.

Swing Trading

Swing trading is a popular approach to forex trading that involves taking advantage of short-term price movements and trends. It requires a keen eye for market analysis, as well as the discipline to stick with your trading plan. If done correctly, swing trading can be an effective way to make money in the currency markets.

To successfully swing trade forex decide on the currency pairs you will be trading, the timeframe, and your entry and exit points. It’s also important to set a stop-loss and profit targets for each trade. The next step is to learn how to read charts and identify chart patterns. Knowing how to identify trends and support and resistance levels can help you determine when a currency pair is likely to break out of a range or trend, allowing you to enter the market at an advantageous price.

Once you’ve identified a potential trading opportunity, monitor the market closely and be ready to enter and exit trades quickly.

Is Forex Day Trading for You?

If you feel as though you’re ready to day trade the forex, keep in mind the following:

- Make a point of gaining as much knowledge about the forex market as you can by educating yourself properly.

- Don’t trade with your mortgage money. Trading involves strategic speculation much like gambling, so avoid trading with funds you can’t afford to lose. Many a trader has blown out trying to get back that month’s mortgage or their next car payment. Trade only with risk capital you do not need for living expenses and have a good idea of your threshold of pain or risk tolerance so you can exit losing trades well before they become disasters.

- Set reasonable goals for your trading results. Keep a trade journal and review your trading activities periodically to see how well you are doing compared to your expectations.

- Take the time to practice in a forex demo account until you feel completely confident in your ability to trade and your chosen day trading strategy. Use the demo account to backtest and perfect your strategy before you begin operating in a live account.

- Once you’ve funded your account, start small. Trade in mini or micro lots to gain confidence in your strategy and to make any adjustments if things don’t go as expected.

- Maintain a cool head and do your best to keep your emotional reactions firmly out of your trading decisions. Develop the discipline to stick to your plan.

- Use prudent money management so that you never have more than an affordable percentage of your account at risk at any given time. Size your day trading positions accordingly.

- Stay on top of market movements and forex news

If you follow the above recommendations and manage to develop a viable trading strategy as part of your overall trading plan, then you could eventually become successful as a forex day trader.

Best Forex Brokers for Day Traders

- Best For:Earning Cashback on TradesVIEW PROS & CONS:securely through Forex.com's website

- Best For:Professional TradersVIEW PROS & CONS:Securely through Interactive Brokers’ website

- Best For:Funding BonusVIEW PROS & CONS:securely through tastyfx's website

Frequently Asked Questions

Is it possible to day trade forex?

Yes, it is possible to day trade forex, as the forex market operates 24 hours a day, allowing for frequent trades within a single day.

Is forex good for day trading?

Yes, the forex market demonstrates significant volatility suitable for day trading, and it also allows retail traders to operate easily and without regulatory restrictions on both the long and the short side of the market.

How much money do you need to day trade forex?

You can get started day trading the forex market with under $100 in most cases, although you can also open a free demo funded with virtual money to practice day trading and see if you like it and are good at it before putting any of your hard-earned money at risk.

How many hours a day should I trade forex?

The number of hours a day to trade forex depends on your strategy, but many traders focus on key market sessions, typically trading 2-4 hours a day.

Get a Forex Pro on Your Side

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and spreads, fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.0 with fixed $7 commissions per $100k USD traded

- Powerful, purpose-built currency trading platforms like MT4, MT5, TradingView, cTrader and NinjaTrader

- Monthly cash rebates with FOREX.com’s Active Trader Program

Learn more about FOREX.com powerful trading platform and how you can get started today.

About Jay and Julie Hawk

Jay and Julie Hawk are the married co-founders of TheFXperts, a provider of financial writing services particularly renowned for its coverage of forex-related topics. With over 40 years of collective trading expertise and more than 15 years of collaborative writing experience, the Hawks specialize in crafting insightful financial content on trading strategies, market analysis and online trading for a broad audience. While their prolific writing career includes seven books and contributions to numerous financial websites and newswires, much of their recent work was published at Benzinga.