The Gartley pattern, a powerful harmonic chart pattern, holds the key to identifying potential market reversals. Unlocking the secrets of this pattern can significantly enhance your trading skills, regardless of whether you're a seasoned expert or just starting out.

This article explains how to recognize and trade the Gartley pattern on forex charts. It covers effective strategies for trading the Gartley pattern and how to distinguish it from other harmonic patterns.

What is the Gartley Pattern?

The Gartley pattern is a harmonic chart pattern that consists of four price swings (X-A, A-B, B-C and C-D) and four Fibonacci retracement levels (0.618, 0.786, 1.27 and 1.618). This pattern forms when the price action follows a specific sequence of highs and lows, resembling the letter M or W. Traders consider the pattern complete once the price reaches point D, known as the potential reversal zone (PRZ). At this point, traders may enter a trade in the opposite direction of the previous trend.

How to Identify the Gartley Chart Pattern

To identify the Gartley pattern on forex charts, you must look for four price swings (X-A, A-B, B-C and C-D) and four Fibonacci retracement levels (0.618, 0.786, 1.27 and 1.618). The pattern can be bullish or bearish, depending on the direction of the initial swing X-A.

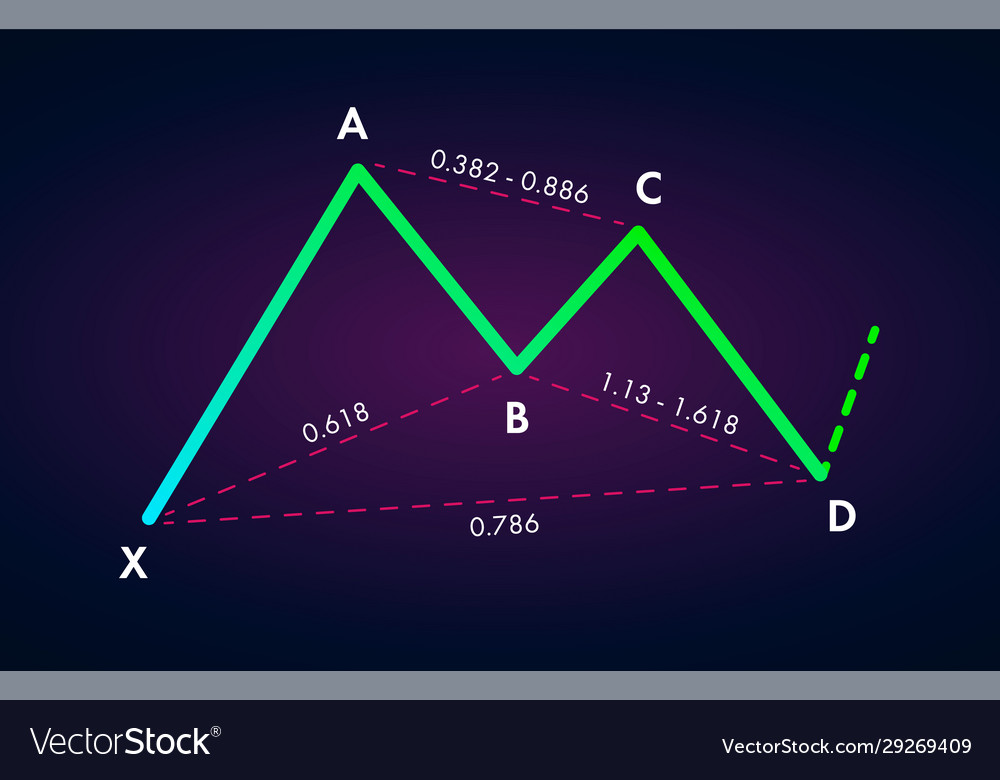

Bullish Gartley Pattern

A bullish Gartley pattern forms when the price moves up from X to A, retraces down from A to B, moves up again from B to C and finally reverses down from C to D. The Fibonacci retracement levels for a bullish Gartley pattern are as follows:

- X-A: This is the initial uptrend that defines the direction of the pattern.

- A-B: A retracement of X-A that should reach the 0.618 Fibonacci level of X-A.

- B-C: A continuation of the uptrend that should reach the 0.786 Fibonacci level of A-B.

- C-D: The final reversal of the uptrend that should reach the 1.27 Fibonacci extension of B-C or the 0.786 Fibonacci retracement of X-A. This is where traders can enter a long position anticipating a new uptrend.

Here is an example of a bullish Gartley pattern on a forex chart:

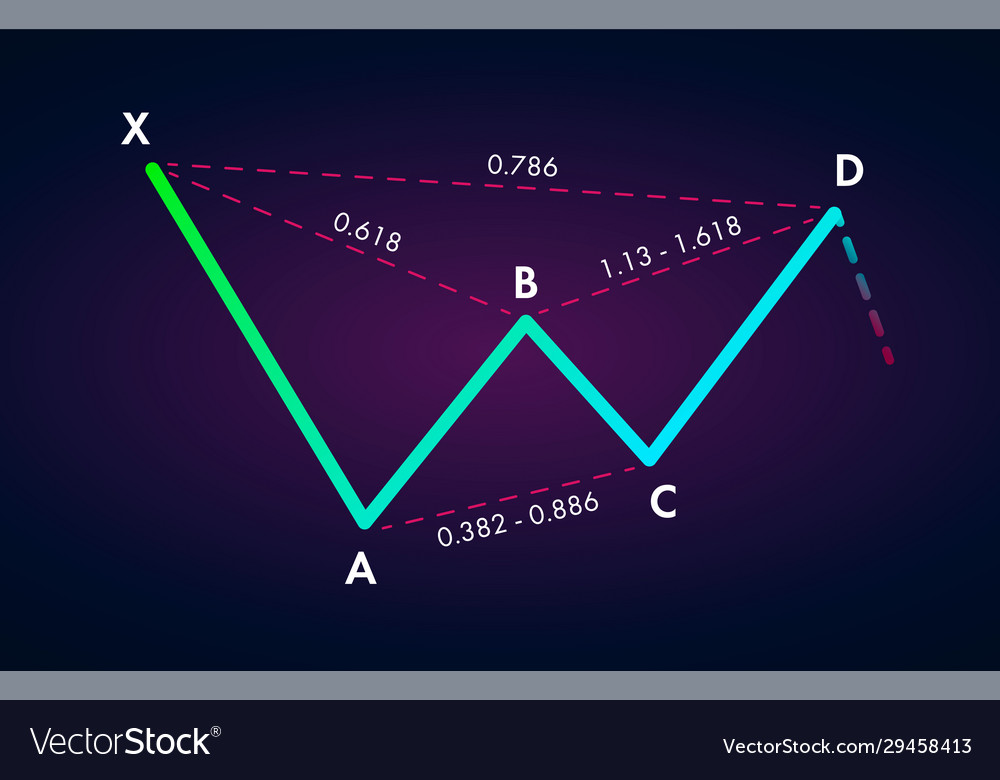

Bearish Gartley Pattern

A bearish Gartley pattern forms when the price drops from X to A, retraces up from A to B, declines again from B to C and finally reverses up from C to D. The Fibonacci retracement levels for a bearish Gartley pattern are as follows:

- X-A: This is the initial downtrend that defines the direction of the pattern.

- A-B: A retracement of X-A that should reach the 0.618 Fibonacci level of X-A.

- B-C: A continuation of the downtrend that should reach the 0.786 Fibonacci level of A-B.

- C-D: The final reversal of the downtrend that should reach the 1.27 Fibonacci extension of B-C or the 0.786 Fibonacci retracement of X-A. This is where traders can enter a short position in anticipation of a new downtrend.

Here is an example of a bearish Gartley pattern on a forex chart:

How to Trade Forex With the Gartley Chart Pattern

To trade forex with the Gartley pattern, you need to follow these steps:

- Step 1: Identify the Gartley pattern on a forex chart by looking for four price swings (X-A, A-B, B-C and C-D) and four Fibonacci retracement levels (0.618, 0.786, 1.27 and 1.618). The pattern can be bullish or bearish, depending on the direction of the initial swing X-A.

- Step 2: Wait for the price to reach point D, which is the PRZ where traders can enter a trade in the opposite direction of the previous trend. Point D should be at the 1.27 Fibonacci extension of B-C or the 0.786 Fibonacci retracement of X-A.

- Step 3: Enter a long position if the pattern is bullish or a short position if the pattern is bearish at point D. You can use a limit order or a market order, depending on your preference and risk tolerance.

- Step 4: Set your stop-loss order below point X if the pattern is bullish or above point X if the pattern is bearish. This will protect you from a false breakout or a continuation of the previous trend beyond point X.

- Step 5: Set your take-profit order at point B if the pattern is bullish or at point A if the pattern is bearish. This will allow you to capture most of the potential reversal movement from point D to point B or A.

- Step 6: Monitor your trade and adjust your stop-loss and take-profit orders as needed. You can also use trailing stops or partial exits to lock in profits and reduce risk.

Example of Trading the Gartley Pattern in the Forex Market

Here is an example of trading the Gartley pattern in the forex market:

- Consider a GBP/USD 1-hour chart showing a bullish Gartley pattern.

- The price moved up from X to A, retraced down from A to B, moved up again from B to C and finally reversed down from C to D.

- The Fibonacci retracement levels for this bullish Gartley pattern are as follows:

- X-A: This is the initial uptrend that defines the direction of the pattern.

- A-B: This is a retracement of X-A that reached the 0.618 Fibonacci level of X-A.

- B-C: This is a continuation of the uptrend that reached the 0.786 Fibonacci level of A-B.

- C-D: This is the final reversal of the uptrend that reached the 1.27 Fibonacci extension of B-C and the 0.786 Fibonacci retracement of X-A. This is where traders can enter a long position anticipating a new uptrend.

- A trader following the steps above would have entered a long position at point D at 1.3650 with a limit or market order.

- The trader would have set their stop-loss order below point X at 1.3580 and their take-profit order at point B at 1.3770.

- The trade would have been successful as the price moved up from point D to point B within two days, reaching the take-profit target and generating a profit of 120 pips (1.3770 - 1.3650).

- The trader would have exited their position at point B or used trailing stops or partial exits to capture more profits as the price continued to increase beyond point B.

Gartley Patterns vs. Harmonic Patterns

The Gartley pattern is a well-known harmonic pattern used by forex traders. Harmonic patterns encompass a broader category of chart patterns that employ Fibonacci ratios and geometric shapes to identify potential reversal points in the market. These patterns can be further classified into two types: internal patterns and external patterns.

Internal patterns, including the Gartley, Bat, Butterfly and Crab patterns, consist of a single initial impulse leg (X-A) followed by three corrective legs (A-B, B-C and C-D). While these patterns share similar shapes and structures, they vary in terms of the specific Fibonacci ratios and the placement of point D within the pattern.

On the other hand, external patterns encompass harmonic patterns with two initial impulse legs (X-A and A-B) and two corrective legs (B-C and C-D). Examples of external patterns include the Shark pattern, 5-0 pattern and Cypher pattern. These patterns possess distinct shapes and structures compared to internal patterns, but they also rely on Fibonacci ratios and geometric shapes to identify potential reversal areas in the market.

Tune Your Forex Trading Strategy with Gartley Harmonic Pattern

The Gartley pattern is a powerful tool for forex traders seeking to identify potential trend reversals. Learning how to identify and understand the trading strategies associated with it can increase your chances of profitable trades. Incorporate this pattern into your trading arsenal and unlock its potential to enhance your forex trading journey.

Frequently Asked Questions

How reliable is the Gartley pattern?

The Gartley pattern can be a reliable harmonic pattern with a high success rate when traded correctly.

Can Gartley harmonic patterns be used with Hakka nashi?

Yes, Gartley harmonic patterns can be used with Hakka nashi, a type of candlestick chart that filters out market noise and shows the trend more clearly.

How was the Gartley pattern invented?

The Gartley pattern was invented by H.M. Gartley, a prominent technical analyst and trader who published his book “Profits in the Stock Market” in 1935. In his book, he described the Gartley pattern as one of the best trading opportunities in the market.

Get a Forex Pro on Your Side

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and spreads, fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.0 with fixed $7 commissions per 100,000

- Powerful, purpose-built currency trading platforms like MT4, MT5, TradingView and NinjaTrader

- Monthly cash rebates with FOREX.com’s Active Trader Program

Learn more about FOREX.com powerful trading platform and how you can get started today.

About Anna Yen

Anna Yen, CFA is an investment writer with over two decades of professional finance and writing experience in roles within JPMorgan and UBS derivatives, asset management, crypto, and Family Money Map. She specializes in writing about investment topics ranging from traditional asset classes and derivatives to alternatives like cryptocurrency and real estate. Her work has been published on sites like Quicken and the crypto exchange Bybit.