Take Jeff Bezos, for example. In 2020, the Amazon founder reportedly spent $70 million in one day to add art to his portfolio, according to Art Market Monitor, demonstrating its power as a strategic financial asset. And he’s not an outlier. Data from a 2024 UBS report suggests the richest High-net-worth (HNW) collectors can allocate up to 25% of their portfolios to art , with some of the world’s most successful investors relying on this timeless asset class to grow and preserve a portion of their overall wealth. Masterworks allows you to easily invest in multimillion dollar art by names like Banksy, Picasso, and Monet, without needing millions.

The Art Advantage

Art isn’t just about aesthetics—it’s a smart financial move. A 2024 Bank of America study found that in the last few years, the number of collectors who consider art as an asset class and part of their overall wealth strategy has increased. With a Deloitte study estimating the wealth of art and collectibles to exceed $2.8 trillion by 2026, this category could make up approximately 11% of the portfolios of ultra-high-net-worth (UHNW) individuals.

Why? Art as an asset class has shown resilience during economic downturns. From 1995 to mid-2024, contemporary art prices have outpaced the S&P 500 by a significant margin, delivering an average annual return of 11.4%. Even more compelling, the 2023/24 financial year saw a record of over 132,000 transactions even in a softer cycle, marking a new peak for Contemporary art sales in this metric.

Barriers to Entry—Until Now

Historically, investing in art was a luxury reserved for the ultra-rich. Pieces by iconic artists like Banksy or Basquiat could sell for millions, making the market inaccessible to most. Moreover, acquiring and maintaining fine art required deep pockets and expert knowledge.

Enter Masterworks, the revolutionary platform breaking down barriers to art investing.

Why Masterworks Is the Best Way to Invest in Art

Masterworks democratizes art investing by offering investment in shares in high-value works. Here's why it's the perfect solution for both novice and seasoned investors:

- Access to Blue-Chip Art: Masterworks allows you to invest in masterpieces featuring renowned artists like Picasso and Banksy —art that would typically be out of reach.

- Low Minimum Investment: With Masterworks, you can start investing with as little as $500, making the art world accessible to everyone.

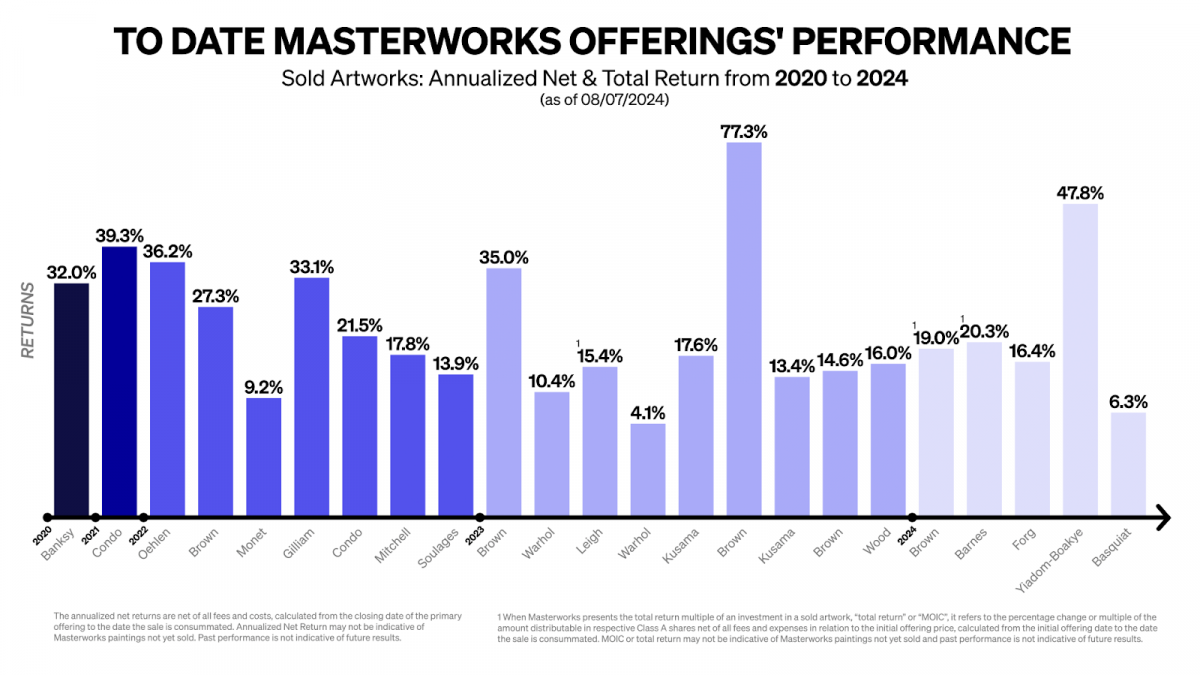

- Proven Track Record: The platform boasts over $60 million (including principal) in proceeds distributed back to investors through an asset class that has outpaced traditional markets (‘95-’24).

- Expertise You Can Trust: Their team of art market experts handles all aspects of purchasing, storing, and selling the artwork, allowing you to focus on enjoying your potential returns.

- Data-Driven Insights: Masterworks leverages art market analytics to target what they believe are the most promising investment opportunities long-term.

(image from Masterworks)

A Hedge Against Uncertainty

In a volatile economic landscape, art has offered a unique appeal. This is because the art market is less correlated to the upwards and downwards trends of traditional markets (‘95-’24), providing a potential alternative asset hedge for a slice of your portfolio.

Ready to Make Your Portfolio Stand Out?

If you're looking to diversify your investments, peek into the world of a historically uncorrelated asset, and tap into a market that the ultra-wealthy have trusted for decades, art is a potential answer. And with platforms like Masterworks, you no longer need millions to get started.Join the growing number of investors who are unlocking the power of art. Visit Masterworks.com today and take your first step toward building a portfolio as sophisticated as the art itself.

The content that follows is for informational purposes only and not intended to be investing advice. Advertiser Disclosure.

Disclaimer:

This is not an offer of a security or investment advice.

See important disclosures at masterworks.com/cd.

Past performance is not indicative of future returns. View all past offerings here.

This communication is sent exclusively from Masterworks and is not endorsed by or affiliated with UBS, Deloitte, or Bank of America. Masterworks did not contribute to the creation of that referenced content. The report is not intended to be regarded as investment advice, an offer, or solicitation of an offer to enter into any Masterworks offering.

Contemporary Art vs S&P Data and Art Correlation Data based on repeat-sales index of historical Post-War & Contemporary Art market prices and S&P 500 annualized return (includes dividends reinvested) from 1995 to 2024, developed by Masterworks. There are significant limitations to comparative asset class data. Indices are unmanaged and a Masterworks investor cannot invest directly in an index.

Amount ‘distributed back’ represents the total liquidation proceeds distributed back to investors, net of all fees, expenses and proceeds reinvested in Masterworks offerings, of all works Masterworks has exited to date. This metric is not considered a presentation of performance but rather a mathematical figure that displays a platform metric on size, scale, and operation of the platform.

Art sales price data is comparative only. Each painting is unique and historical data is not a direct proxy for any specific painting or investment. Data represents whole art not an investment into our offerings which includes fees and expenses. Past sales are not indicative of future results.