In the ever-evolving world of trading, mastering the nuances of candlestick patterns can significantly enhance your market analysis and decision-making. One such intriguing pattern is the spinning top candle, often regarded as a signal of indecision in the market. Characterized by a small real body with long upper and lower shadows, the spinning top indicates that buyers and sellers are battling for control, leading to potential reversals or continuations in price movement.

In this article, we will delve into the characteristics of the spinning top candle, explore its implications in different market contexts, and provide actionable strategies for incorporating this pattern into your trading plan.

What is a Spinning Top Candle?

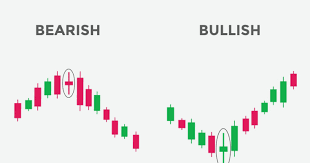

A spinning top candlestick is a pattern characterized by a small body and long upper and lower shadows, formed when open and close prices are near each other. It represents a state of equilibrium between buyers and sellers, indicating indecision in the market. This pattern can occur near support or resistance levels or at the end of a trend.

Traders interpret the spinning top candlestick as a potential reversal signal. It suggests that the market is undecided about its next direction and that a change in sentiment could be on the horizon. Confirmation from other technical indicators or price action signals is often sought before making trading decisions based on this pattern. A spinning top candlestick at the end of a trend may indicate exhaustion and a possible trend reversal. By understanding and correctly identifying the spinning top candlestick pattern, traders can get a glimpse into market trend changes and potential reversals.

How to Identify a Spinning Top Candle

To recognize a spinning top candle, examine the dimensions of both the body and the shadows. Ideally, the body should be small, indicating a small difference between the opening and closing prices, while the shadows should be lengthy, implying that the price fluctuated considerably throughout the period. The color of the body is insignificant, as it merely reflects whether the candle closed higher or lower than its opening. To help illustrate, the image below depicts an instance of a spinning top candle on a chart.

How to Trade the Spinning Top Candlestick Pattern

Trading the spinning top candlestick pattern requires careful analysis of the market context and consideration of other technical indicators. Here are some key points to keep in mind when trading this pattern:

Confirm the Pattern

Look for confirmation from other technical indicators, such as trend lines, support and resistance levels or momentum oscillators, to strengthen the reliability of the spinning top signal.

Determine the Market Bias

Assess the prevailing market trend. A spinning top candle in an uptrend suggests a potential reversal or consolidation, while a downtrend may indicate a pause or reversal.

Await Confirmation

Do not rush into a trade solely based on the spinning top candle. Wait for the next candle to confirm the pattern before taking action.

Set Stop-Loss and Take-Profit Levels

Establish appropriate stop-loss and take-profit levels to manage risk and secure potential profits. Consider placing the stop-loss above/below the spinning top's high/low point.

Consider Other Factors

Consider the overall market conditions, fundamental news and other technical analysis tools to validate the spinning top's potential outcome.

Example of Trading Using the Spinning Top Candle Pattern

Take a look at an example of how to trade using the spinning top candle pattern in forex. You have a EUR/USD pair on a four-hour time frame. The pair is in an uptrend, as indicated by the rising trend line and the 50-period moving average. The price reaches a resistance level at 1.19 and forms a spinning top candle, indicating indecision and a possible reversal. However, there is no confirmation from other indicators or price action, so you do not enter a short trade yet.

The next candle is another spinning top, followed by a bearish engulfing candle that breaks below the trend line and the moving average, confirming the reversal signal. This is where you enter a short trade with a stop loss above the resistance level and a target at the next support level at 1.17. The price moves in your favor and reaches your target, giving you a profitable trade.

Spinning Top Candle vs. Doji

Both spinning top candle and doji are candlestick patterns that indicate indecision and a possible reversal of the trend. There are some differences between them. A spinning top candle has a small body and long upper and lower shadows, while a doji has no body or a tiny body and long upper and lower shadows.

A doji shows that the opening and closing prices are equal or almost equal, while a spinning top shows that the opening and closing prices are close but not equal. A doji is considered a stronger reversal signal than a spinning top, as it shows more balance between the buyers and sellers. Still, both patterns require confirmation from other indicators or price action before entering or exiting a trade.

Mastering the Spinning Top Candlestick Pattern

The spinning top candle pattern is a valuable tool for forex traders to identify potential reversals or consolidations in the market. You can enhance your trading skills and profits by understanding how to identify and interpret this pattern. Consider the overall market context and use additional technical analysis tools for confirmation before executing trades.

Frequently Asked Questions

What does a spinning top tell traders?

A spinning top candle suggests indecision in the market, representing a temporary pause or potential reversal in price.

What is a bearish spinning top candlestick?

A bearish spinning top candlestick occurs when the open and close prices are near the top of the candle, indicating selling pressure and a potential reversal.

What is the difference between a spinning top and a high-wave candle?

A spinning top has a small body and long upper and lower wicks, while a high-wave candle has long upper and lower wicks with a relatively large body in the middle. The high-wave candle signifies increased volatility, while the spinning top represents indecision.

Get a Forex Pro on Your Side

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and spreads, fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.0 with fixed $7 commissions per 100,000

- Powerful, purpose-built currency trading platforms like MT4, MT5, TradingView and NinjaTrader

- Monthly cash rebates with FOREX.com’s Active Trader Program

Learn more about FOREX.com powerful trading platform and how you can get started today.

About Anna Yen

Anna Yen, CFA is an investment writer with over two decades of professional finance and writing experience in roles within JPMorgan and UBS derivatives, asset management, crypto, and Family Money Map. She specializes in writing about investment topics ranging from traditional asset classes and derivatives to alternatives like cryptocurrency and real estate. Her work has been published on sites like Quicken and the crypto exchange Bybit.