Benzinga Money is a reader-supported publication. We may earn a commission from the advertisers associated with this article. Read our Advertiser Discloser.

As Nature reports, the Food and Drug Administration has proposed a ‘New Alternative Methods Program’ whose main purpose is to phase out animal testing. Every year, 111 million mice and rats are utilized for testing in U.S. labs. In 2019, 68,257 primates met the same fate. The push for higher ethical standards presents a unique opportunity to introduce alternatives. One San Antonio biomedicine startup called StemBioSys has developed a solution that could minimize the use of animal models and overtake a billion-dollar market. Its sales are up 55% year-to-date through July compared to last year. You can invest in StemBioSys with a minimum of $300 and acquire 100 shares.

(A Russian scientific institute unveiled a statue honoring the lab mouse, source: Irina Gelbukh / Wikimedia).

Animals have been used for research purposes since ancient Greece. Modern medicine would be unthinkable without them as their contribution to scientific research provides the vital bridge between experimental treatments and lifesaving cures for humanity. However, outcries for more ethical labs have been growing stronger. Now that technology exists to replace living animals with lab-grown human cells, government bodies will likely start cracking down on animal testing. This could be great news for current and future StemBioSys investors as its advanced cell technologies can test drugs more efficiently and accurately without animal models.

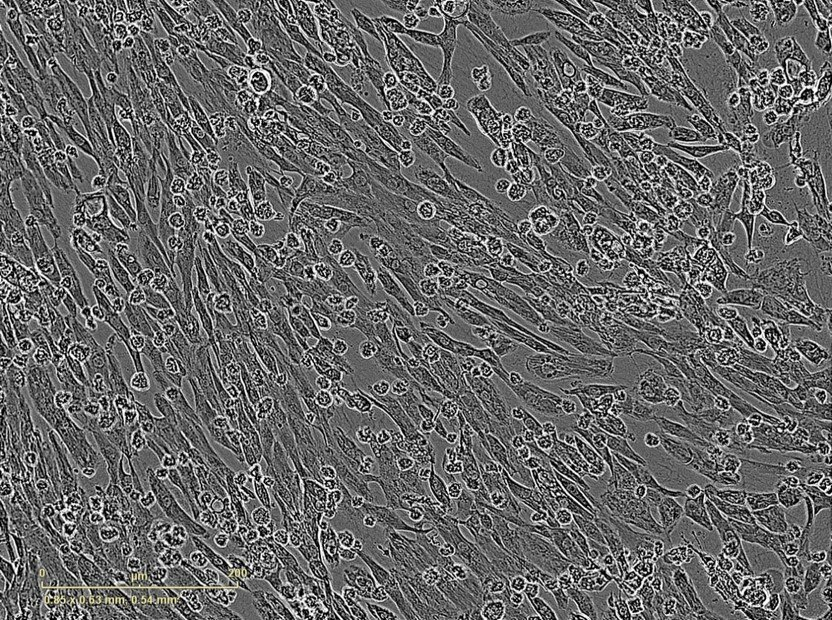

(photo courtesy of StemBioSys)

StemBioSys’ laboratory tools recreate human growth-niche environments by harnessing donated human material that doesn’t come from embryos. The ‘manufactured’ cells are biorelevant as they look and function more like naturally made human cells than most. The startup offers these technologies to academic institutions, biopharma companies and worldwide public and private research institutions. StemBioSys' 15 products are gaining attention as reflected in the strong July sales reports. More sales are in the pipeline, providing a robust basis for future growth.

With a wide array of products and patents, StemBioSys is tackling multiple markets. The global induced pluripotent stem cell (iPSC) market stood at $2.8 billion in 2021. However, with the rising popularity and awareness of stem cell research, experts believe it’ll reach $4.4 billion by 2026. Drug development in the iPSC market is worth $1 billion while the market for services and equipment for cardiac toxicity could be worth $360 million.

StemBioSys' team of scientists, led by a CEO with 25 years of experience in the field, aims to seize significant portions of these markets and possibly expand to others. For a limited time, you can invest in StemBioSys as Targeted Technology Funds, University of Texas Regents and BioBridge Global have already done.

Invest in StemBioSys at $3 per share.

More From Benzinga

Disclaimer: Please be advised that alternative investments carry a risk of monetary loss. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. We do not offer investment advice, personalized or otherwise. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation.