Technical analysis plays a vital role in helping many forex traders identify potential trading opportunities. A classic chart pattern that currency traders frequently encounter on exchange rate charts is the Triple Top pattern.

The insights shared in this article aim to equip forex traders with the knowledge and practical strategies needed to confidently incorporate the Triple Top pattern into their trading repertoire.

By skillfully identifying and trading the Triple Top pattern, forex traders can enhance their ability to capitalize on market reversals that can ultimately assist them in making better trading decisions.

What is the Triple Top Pattern?

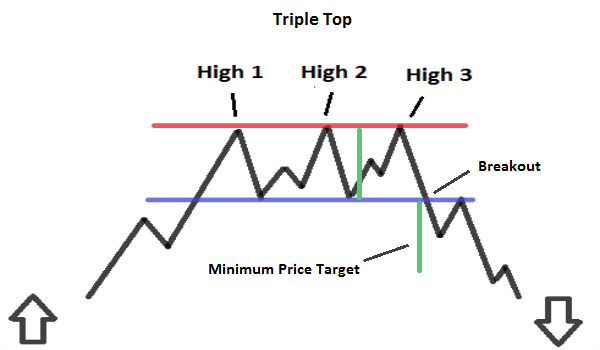

The Triple Top pattern is a well-known chart pattern that indicates a potential trend reversal in the forex market to those skilled in technical analysis. It typically forms after a sustained uptrend and consists of three distinct peaks that each reach a similar resistance level to form a horizontal trend line at that level. Two retracements from that resistance level create a second support line drawn through the two reaction lows commonly known as the pattern’s neckline.

The schematic image below shows what a Triple Top chart pattern looks like in theory. It shows how its minimum exchange rate or price target is obtained by projecting the difference between the pattern’s upper and lower trendlines downward from the breakout point. This difference is shown by vertical green lines.

What Does the Triple Top Pattern Tell You?

The Triple Top chart pattern conveys valuable information to forex traders since it indicates a potential bearish trend reversal in the currency market that has previously been trending higher.

The appearance of this classic chart pattern signifies a struggle between buyers and sellers where sellers ultimately gain control. The predominant selling activity in a currency pair causes the exchange rate to fail to break above the resistance level indicated by the Triple Top pattern’s three peaks.

Forex traders generally interpret the Triple Top pattern as a warning sign that the prevailing uptrend may be losing strength and that a downtrend could be imminent. Since the Triple Top pattern suggests a potential shift from an uptrend to a downtrend, it presents an opportunity for forex traders to enter short positions and profit from the subsequent downward exchange rate movement that accelerates once the pattern’s supportive neckline breaks.

By learning to recognize the Triple Top pattern, forex traders can anticipate a potential downside reversal and adjust their trading strategies accordingly. They may consider entering short positions as the exchange rate breaks below the pattern’s neckline with the goal of profiting from the anticipated downward market movement. Also, forex traders often use supporting technical indicators, such as trading volume and momentum oscillators, to validate the Triple Top chart pattern and strengthen any trading decisions based upon it.

Example of Trading the Triple Top Pattern

In practice, trading the Triple Top pattern should involve a comprehensive approach that combines technical analysis tools, risk management strategies and proper trade execution. This section will illustrate how to trade a Triple Top pattern, including how to set trade entry, stop-loss and take profit levels.

Traders will learn how to identify confirmation signals that strengthen their trading decisions based on the Triple Top pattern. Practical tips for managing risk and adjusting trade parameters will be discussed to help traders navigate potential market fluctuations and improve their trading outcomes.

Now consider an example of trading the triple top pattern for forex traders.

Identification of the Triple Top Pattern

A forex trader first identifies a Triple Top pattern in the exchange rate of a currency pair. They notice three exchange rate peaks that reach a similar resistance level, forming a horizontal resistance line. They also observe two intervening lows that form a support line known as the pattern’s neckline. The trader first confirms that the chart pattern meets the criteria of a Triple Top, with each peak being approximately equal in height and the neckline being clearly defined.

Trade Entry

The trader now waits for a confirmation signal to enter a short position. They look for a neckline breakdown where the exchange rate falls below the support level established by reaction lows within the Triple Top pattern. A sustained breakdown is seen as a significant bearish signal that prompts the trader to enter a short position anticipating further downside activity toward the pattern’s initial target. The trader will want to size the new position appropriately based on the money management principles incorporated into their trading plan.

Setting a Stop Loss

To manage the risk on their new short position, the trader should place a sensible stop-loss buy order in the market. The level of this order can be set above the recent swing high, above the broken neckline or above the highest point of the Triple Top pattern. These placement points help protect the trader’s short position against unpalatable potential losses if the exchange rate unexpectedly reverses and breaks back above the pattern neckline to result in a false breakout signal.

Taking Profits

The trader aims to take profits by setting a target level based on the expected downward movement after the market breaks down from the Triple Top pattern. They will typically use the pattern’s traditional target of the distance between the neckline and upper resistance line projected down from the breakout point. They might also identify a support level in that region or use additional technical analysis tools like momentum oscillators to estimate the potential distance the exchange rate could move. The trader can use a trailing stop strategy to help protect accrued profits as the exchange rate continues to decline. This lets them capture more significant gains if the downtrend persists beyond the initial pattern target level.

Trade Management

Throughout the trade’s duration, the trader will monitor the market and consider adjusting their stop-loss and profit targets based on market conditions and their trading plan. They may watch for additional confirmation signals or technical indicators that support the bearish bias of the Triple Top pattern and provide further guidance for trade management.

Remember that not all Triple Top patterns will result in successful trades since forex market conditions can vary. Forex traders should take other market factors into account, such as overall trends and fundamental factors like news and economic events, before making trading decisions based on the Triple Top pattern.

Who Can Benefit From Using the Triple Top Pattern?

Forex traders who can best benefit from incorporating the Triple Top pattern into their strategy are those who feel comfortable using technical analysis, are able to identify trends and are willing to identify and act upon potential market reversals.

The Triple Top pattern is the inverse of the Triple Bottom pattern, so both patterns should be incorporated into a combined forex trading strategy. These reversal patterns seem most suitable for forex traders who seek to capitalize on changing market conditions, such as swing traders who need to be able to anticipate the end of a trend and remain willing to enter the market to profit from subsequent corrective market behavior.

By identifying the formation of three consecutive peaks at a common resistance level or three troughs at a similar support point, traders can potentially enter positions when the forming pattern’s neckline breaks. For optimal chances of success, a trader using the Triple Top or Bottom patterns needs to use appropriate risk and money management techniques.

Frequently Asked Questions

Is a Triple Top bullish?

No, a Triple Top pattern is not considered bullish in forex trading but is instead generally seen as a bearish reversal pattern that indicates a potential end to an uptrend. The pattern consists of three consecutive peaks formed at a common resistance level with two intervening lows that form the pattern’s neckline and generate a bearish signal when broken.

How reliable is a Triple Top?

The reliability of a Triple Top pattern can vary significantly. While generally considered a bearish reversal signal, the Triple Top pattern’s reliability depends on various factors such as the timeframe, market conditions, the presence of other confirming indicators and the strength of the pattern’s formation.

What happens after Triple Top pattern?

After the formation of a Triple Top pattern forex traders often anticipate a bearish reversal. Once the pattern is confirmed by the exchange rate breaking below the pattern’s neckline support level, it signals a potential downward pullback within the upward trend that preceded the pattern’s formation. The target of this move is typically set by projecting the distance between the pattern’s tops and neckline downwards from the breakout point.

Get a Forex Pro on Your Side

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and spreads, fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.0 with fixed $7 commissions per 100,000

- Powerful, purpose-built currency trading platforms like MT4, MT5, TradingView and NinjaTrader

- Monthly cash rebates with FOREX.com’s Active Trader Program

Learn more about FOREX.com powerful trading platform and how you can get started today.

About Jay and Julie Hawk

Jay and Julie Hawk are the married co-founders of TheFXperts, a provider of financial writing services particularly renowned for its coverage of forex-related topics. With over 40 years of collective trading expertise and more than 15 years of collaborative writing experience, the Hawks specialize in crafting insightful financial content on trading strategies, market analysis and online trading for a broad audience. While their prolific writing career includes seven books and contributions to numerous financial websites and newswires, much of their recent work was published at Benzinga.