- Low commissions

- Advanced trading platforms

- Access to new issues

- Enhanced asset protection

- High inactivity fees

- Monthly fee for data feeds and platforms

- Maintenance fee on U.S. dollar accounts

Virtual Brokers Ratings at a Glance

Who’s Virtual Brokers for?

Virtual Brokers caters to all types and levels of both traders and investors, provides research resources and educational material for beginners and a practice account where traders can try out execution services before funding an account.

Virtual Brokers also has a special program for high net-worth individuals: You’ll get assigned to a dedicated professional account manager to ensure that requests are addressed promptly. Active traders who maintain a minimum balance of CA$5,000 are eligible for the broker’s commission-free online trading plan, although you must pay for a platform subscription with the program.

Professional wealth managers and institutional traders can get comprehensive trading solutions through Virtual Brokers’ team of investment counselors and portfolio management (ICPM) professionals. ICPM features back-office and settlement services and bulk trade execution, as well as customized reporting and dynamic collection of management fees.

All accounts can be funded and maintained with both Canadian and U.S. dollars, although registered Canadian accounts carry administrative fees and U.S. dollar accounts also incur a fee. Virtual Brokers does not accept clients who do not reside in Canada.

Virtual Brokers allows clients to access equities traded on the TSX, the TSX Venture Exchange (TSX-V), the Nasdaq Canada Exchanges 1 and 2 (CXC and CX2), the TSX-Alpha Exchange, Aequitas Neo Exchange, the Canadian Securities Exchange (CSE), and Omega. The lack of forex trading is not surprising in a Canada-based broker since Canadian forex brokers can be hard to find, so you might want to open an account with an international forex broker like Interactive Brokers or FOREX.com if you want to trade currencies.

Virtual Brokers features several high-quality trading platforms. These include:

- WebTrader and Webtrader Light: This platform is offered free of charge — you can toggle between the full and light trading versions of the software. WebTrader allows you to trade stocks, options, bonds and mutual funds from a single web page. The platform includes real-time streaming quotes, charts, watch lists, alerts and a news feed. Screenshot of Virtual Brokers’ WebTrader trading platform. Source: Virtual Brokers.

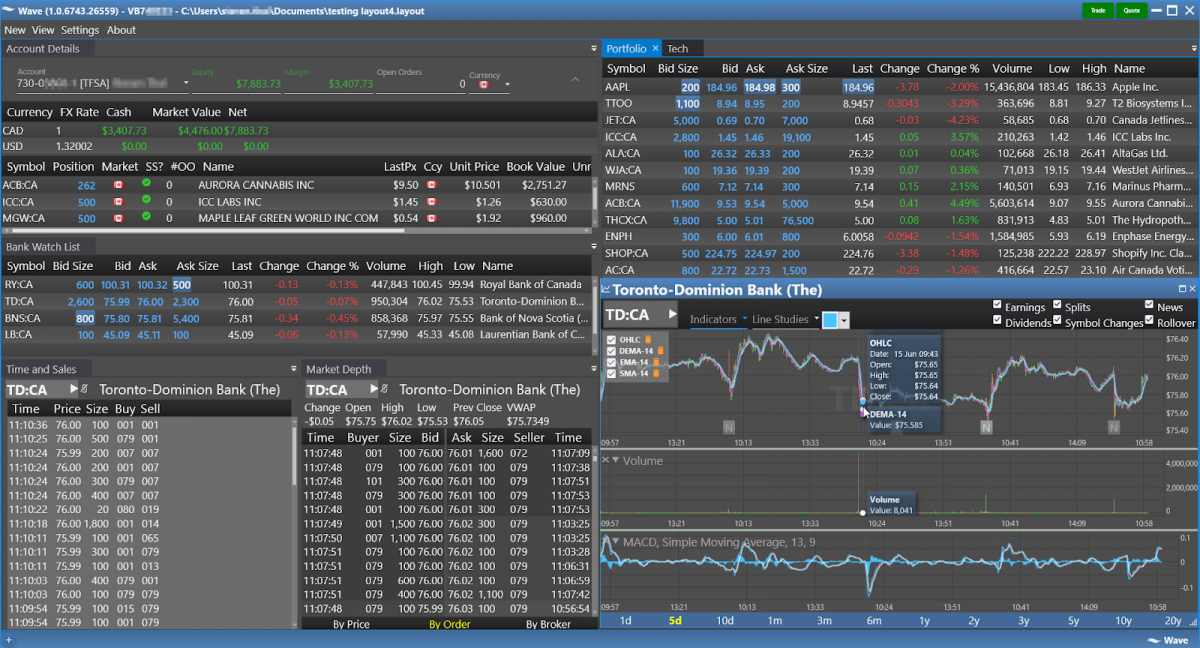

- VB Wave: Virtual Brokers’ newest premium platform caters to intermediate and advanced traders and costs CA$75 per month with a standard commission schedule. The platform features account information, the status of orders, Level 2 quotes for equities and options and custom audio alerts and watch lists.

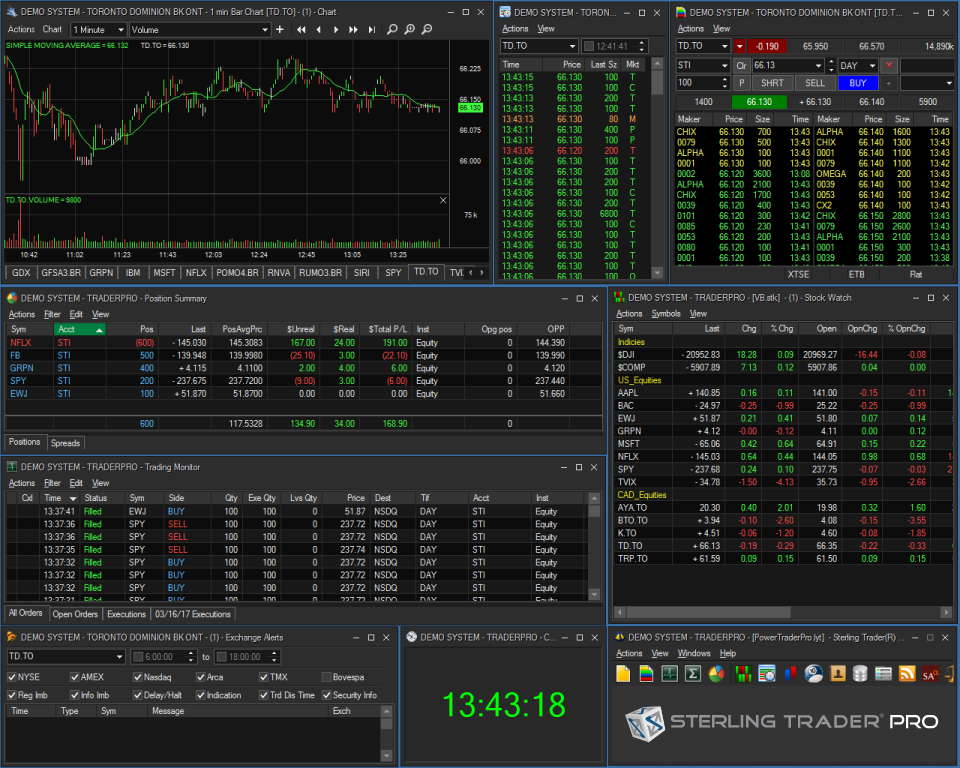

- PowerTrader Pro: The PowerTrader Pro trading platform gives you access to a diverse range of advanced trading tools, including in-depth charting, hotkeys, baskets of tradable assets and Top 10 reports. The completely customizable platform is designed for quick decisions and has an intuitive interface. The platform costs $250 per month and it provides Level 1 TSX quotes in U.S. dollars.

- RealTick EMS: This premium trading platform is designed for traders who need fast access to liquid markets with advanced real-time analytics. Professional fund managers and high net-worth individuals can manage positions and entire portfolios dynamically across global equity, options and futures markets. This platform is available with monthly fees starting at $400.

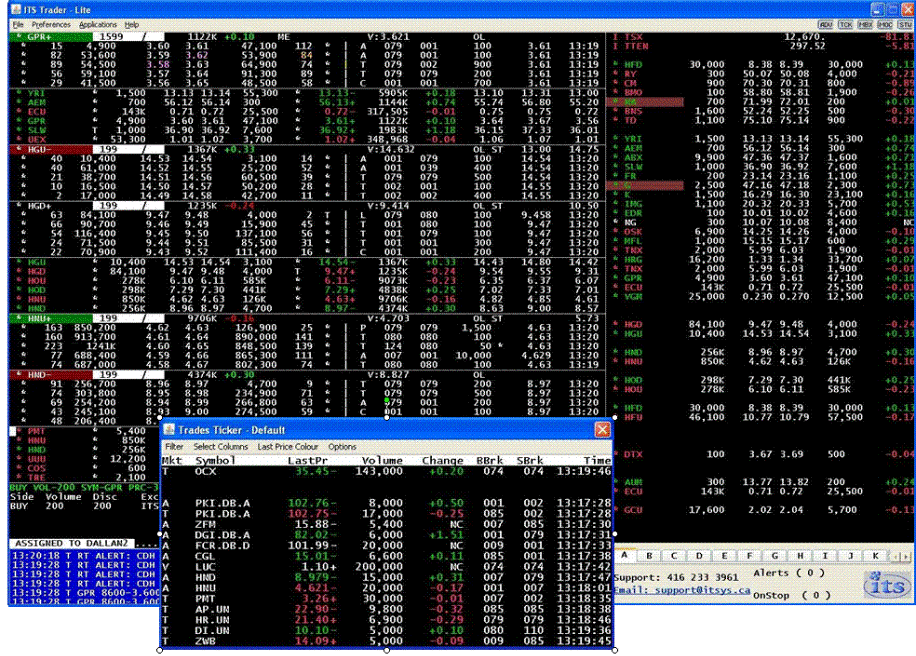

- ITS TraderLite: This high-performance trading platform gives you premium access to all Canadian marketplaces, although it will set you back at least $580 per month. You can customize and configure several displays based on your specifications and the platform offers multiple benefits that include a low system footprint. The platform also features U.S. order entry capability, U.S. market data and registered trader functionality.

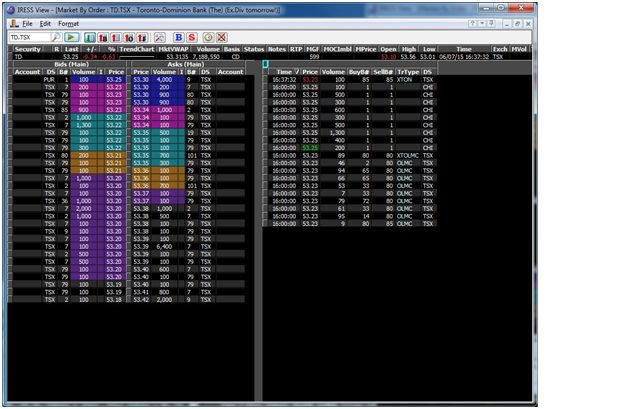

- Iress Platform: This premium trading platform gives you access to sophisticated equity order routing for best price execution on multiple U.S. and Canadian exchanges. You’ll get full market depth, powerful real-time charting, market summary information, a news feed and company reports. It also features a comprehensive historical time-series database for securities and commodity prices, exchange rates, economic data and market statistics. Clients need special approval to use the Iress trading platform and the monthly service costs a minimum of $1,120 per month.

Virtual Brokers provides a free mobile version of PowerTrader for iPhone, Blackberry and Android devices at no extra charge. Keep in mind that the RealTick EMS, ITS TraderLite and Iress trading platforms have a 20% platform handling fee markup with a minimum of $150 per month added to the rental price of the platform.

Think the price for these trading platforms might be a bit high? You also have to pay for data feeds on the platforms, which are charged separately. Level 1 consolidated feeds for the TSX and TSXV cost CA$20 per month and the consolidated TSX/TSXV feed costs CA$25 per month.

Data feeds for stocks, options, commodities and futures exchanges are available for non-pro and pro levels and range from CA$2.30 for the non-pro Dow Jones Index feed to CA$200 per month for the professional quality Chicago Board of Trade (CBOT) Level 1 options feed.

Virtual Brokers provides clients with a large collection of educational videos that cover a wide range of topics, from ETF basics to options pricing, as well as an extensive research center. Research resources include technical and fundamental analysis, research centers for each asset you can trade through the firm, financial planning tools and an advanced portfolio planner.

The broker’s research center includes Market Watch, which includes a complete market summary, news, market movers, indices, futures, ETFs, initial public offerings, forex quotes, interest rates, an economic calendar, heat maps, earnings reports, corporate news and analyst ratings.

Virtual Brokers charges low commissions (all prices expressed in Canadian dollars):

| Equities | $0.01 per share, minimum of $1.99 and a maximum of $7.99 per trade$3.99 flat fee if you’ve made over 150 trades over the previous quarter |

| Options | $7.99 + $1.25 per contract$3.99 + $1.25 per contract if you’ve made over 150 trades over the previous quarter |

| ETFs | Free |

| Exchange-traded debentures | $24.99 + 1 per each 1,000 par value per side |

| Mutual funds | Free |

| Fixed-income securities | Virtual Brokers acts as principal so the quoted price includes commission |

You may be eligible for Virtual Brokers’ commission-free trading plan if you maintain a balance of CA$5,000 in your account. You can trade commission-free as long as you pay a monthly fee for a premium trading platform.

Commissions and fees may be low or free but the monthly cost of platform rental fees and a basic Canadian equities data feed could be higher than you anticipate.

Virtual Brokers’ parent firm, BBS Securities, is a member of the Canadian Investor Protection Fund (CIPF). Qualifying client accounts get CA$1,000,000 protection for each account. Cash and securities that belong to eligible clients of Canadian investment dealers are returned if the CIPF member dealer becomes insolvent.

Your account and personal information are also covered by Virtual Brokers’ guarantee that you’ll receive a 100% reimbursement for any losses you incur that result in unauthorized activity in your Virtual Brokers account, except under certain specified conditions.

Virtual Brokers’ customer support can be accessed via phone, email and live chat on its website. You can contact the firm to speak to its trading desk or support team and to open a new account.

Customer service hours are Monday through Wednesday and Friday from 8 a.m. to 8 p.m. EST and 8 a.m. until 5 p.m. EST on Thursday. The broker’s Saturday hours are from 11 a.m. until 6 p.m. EST.

We contacted the live chat service from Virtual Brokers’ website and the helpful agent answered all of our questions promptly.

You can trade U.S. and Canadian equities, options, ETFs, mutual funds, exchange-traded debentures and fixed-income securities. You can order data feeds for a variety of assets traded on other exchanges but be aware that you may not be able to trade those assets directly but might find an equivalent ETF you can trade through Virtual Brokers.

The company’s website is easy to navigate and its excellent customer service can address any issue you might have.

Virtual Brokers has been applauded by a number of credible sources in the Canadian press and its reviews on 3rd-party trading forums are positive. You could qualify for the company’s commission-free trading plan aimed at active short term traders or anyone who incurs more than CA$150 per month in commissions.

Virtual Brokers also provides considerable resources for Canadian fund managers and financial institutions. It might be worth your time to open a practice account with Virtual Brokers to assess its impressive range of platforms and services.

Frequently Asked Questions

What markets can I trade on with Virtual Brokers?

With Virtual Brokers, you can trade on various markets including stocks, options, ETFs (Exchange-Traded Funds), mutual funds, bonds, and GICs (Guaranteed Investment Certificates).

Do online brokers charge fees?

Yes, online brokers typically charge fees for their services. These fees can vary depending on the broker and the specific services being offered. Common fees include commission fees for executing trades, account maintenance fees, and fees for additional services such as research reports or access to advanced trading platforms.

Is Virtual Brokers Safe?

Virtual Brokers is generally considered to be safe. They are a reputable online brokerage firm that is regulated by the relevant authorities in the countries they operate in. They have implemented various security measures to protect their clients’ personal and financial information, such as encryption and firewalls.

Submit Your One Minute Opinion

About Jay and Julie Hawk

Jay and Julie Hawk are a married financial writing and authorship team who co-founded TheFXperts, a notable financial writing services provider. The Hawks each worked professionally in the financial markets and have more than 40 years of trading experience among them. Together, they write books, trade forex online for their own account and others, mentor traders, and have worked actively as professional freelance writers specializing in financial topics for over 15 years.