2014 has been difficult for casino and gambling stocks, which have continued to miss estimates amid slowing global revenue. These multi-billion dollar enterprises have experienced strong growth over the last several years but are coming under fire as profit targets become harder to achieve.

The Market Vectors Gaming ETF (BJK) is the only dedicated exchange-traded fund in this industry group. BJK boasts 46 global holdings that include exposure to the United States, China, Malaysia, Australia, and other countries.

This ETF currently has $45 million in total asset and charges a net expense ratio of 0.65 percent. The majority of the BJK portfolio is made up of large cap stocks, with mid-caps representing 27 percent of the total asset allocation.

The most well-known holdings in BJK include: Las Vegas Sands Corp (LVS), Wynn Resorts (WYNN), and MGM Resorts International (MGM). This fund also includes exposure to separate international listings of those companies, which are traded on the Hong Kong exchange.

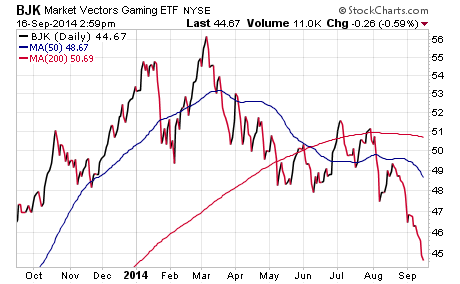

Just this week, BJK hit a new year-to-date low that coincided with a steep sell off among this industry group. In fact, this ETF is now down more than 16 percent this year and has now entered an oversold state based on its relative strength index.

Several Wall Street analysts have warned that the weakness in this group may persist as a slowdown in Macau revenue continues to weigh on growth prospects. This region is one of the top global hubs for gambling profits and may be hit by slowing Chinese economic data.

However, this sell off in gambling stocks may ultimately lead to a counter trend rally that sparks a short covering bounce. This can often occur when sentiment reaches an extreme bearish state.

It’s also worth noting that the Consumer Discretionary Select Sector SPDR (XLY) has begun to show stronger relative momentum over the last several months. A breakout in this sector may help pull BJK out of its slump as well.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.