Exchange-traded funds that track some of the largest fixed-income indexes fell hard in April and have recently made new year-to-date lows on the back of rising interest rates.

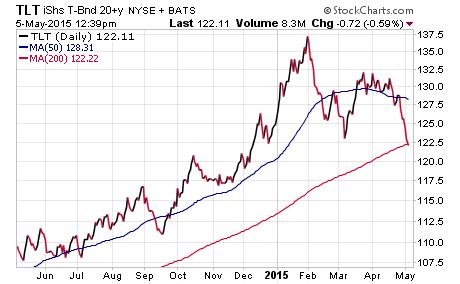

The iShares 20+ Year Treasury Bond ETF (TLT) tracks a basket of 29 long-dated U.S. Treasury securities and just recently fell below its 200-day moving average for the first time in well over a year. TLT has over $5.8 billion in total assets and is a closely watched metric for the direction of high quality bonds.

In 2014, long-term Treasury bonds were one of the best performing asset classes, which contributed to TLT gaining 27.35 percent in total return. Nevertheless, after peaking in late January, this index has fallen more than 11 percent from its high and erased its positive streak for the year.

The recent downturn in bonds is likely a representation of fears over the Federal Reserve’s intention to raise interest rates along with profit taking after a significant year of gains in 2014. Investors have been concerned for some time that the pace of gains in both bonds and stocks would likely have to disconnect as a result of monetary policy tightening or a slowdown in the U.S. economy.

Investment grade corporate bonds are another area of the fixed-income markets that have come under fire recently as well. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) tracks a basket of over 1,300 bonds of well-known companies such as Wells Fargo & Co (WFC) and Verizon Communications (VZ). This ETF has nearly $22 billion in total assets and currently yields 3.00 percent.

The majority of the bonds that makeup LQD are rated in the A and BBB categories, which fall on the quality end of the credit spectrum. That statistic, combined with an effective duration of 8 years, makes this ETF highly susceptible to changes in interest rates as well.

As you can see on the chart above, LQD also recently broke its long-term trend line and has experienced multiple down days over the last week.

Fixed-income investors should take note of this change in tenor as it may represent a significant turning point in the bond market this year.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.