ProShares has always been a fund company that isn’t afraid to introduce a new products designed to maximize short-term moves in the market.

Two of their latest ETFs are aiming to capitalize on the red-hot biotech space. On Tuesday, the UltraPro Nasdaq Biotechnology ETF (UBIO) and UltraPro Short Nasdaq Biotechnology ETF (ZBIO) made their trading debut. These new funds are designed to provide TRIPLE leveraged long and short exposure to a market cap weighted index of biotech companies.

Leveraged ETFs allow you to commit smaller amounts of capital in order to produce an enhanced return. These funds are primarily used by aggressive traders and institutional fund managers that are willing to bet big on a specific industry or sector.

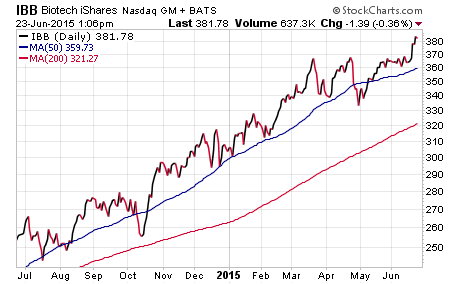

The NASDAQ Biotechnology Index is the same subset of stocks underlying the well-known iShares Nasdaq Biotechnology ETF (IBB). This includes overweight exposure to top industry names such as Gilead Sciences Inc (GILD) and Amgen Inc (AMGN).

As is the case with all leveraged funds, UBIO and ZBIO are structured to provide daily returns that are three times magnified to the original index. The company notes that the compounded returns over time may deviate from the benchmark.

Michael L. Sapir, cofounder and CEO of ProShares Advisors, LLC, noted in the press release that "We now offer investors four ETFs providing magnified or inverse exposure to the Nasdaq Biotechnology Index , including the first and only 3x ETF on the index."

ProShares introduced the 2x long and short versions of this strategy back in 2010. The Proshares Ultra NASDAQ Biotechnology ETF (BIB) and ProShares UltraShort NASDAQ Biotechnology ETF (BIS) were the first leveraged ETFs to track this index.

All four ProShares biotechnology-related ETFs charge an expense ratio of 0.95 percent.

The race to capitalize on investor interest in biotech stocks has also prompted the recent launch of the Direxion Daily S&P Biotech Bull 3X Shares (LABU) and Direxion Daily S&P Biotech Bear 3X Shares (LABD) as well.

Clearly leveraged ETF providers believe that additional tools will be well received in this high growth industry and are going all in to accommodate their core customers.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.