Viking Therapeutics VKTX, a clinical-stage company focused on developing novel therapeutics for metabolic and endocrine disorders, has been in the news, owing to updates from its obesity program.

The company, with a market cap of about $8 billion, is developing its lead candidate, VK2735, a dual GLP-1/GIP agonist. The candidate is being developed both as a subcutaneous injection and as an oral pill in a mid-stage study and an early-stage study, respectively.

The investigational drug is expected to reflect blockbuster potential, having demonstrated superior weight reduction capabilities in both clinical studies, coupled with the massive demand for obesity drugs. Biotech firms have been competing fiercely to enter the obesity market due to the huge untapped opportunity it represents amid increasing demand.

In early 2024, Viking Therapeutics reported that the phase II VENTURE study, which evaluated a subcutaneous formulation of VK2375, achieved its primary and all secondary endpoints, with statistical significance. Patients treated with this formulation achieved a mean weight reduction of 14.7% after 13 weeks compared with 1.7% in the placebo group.

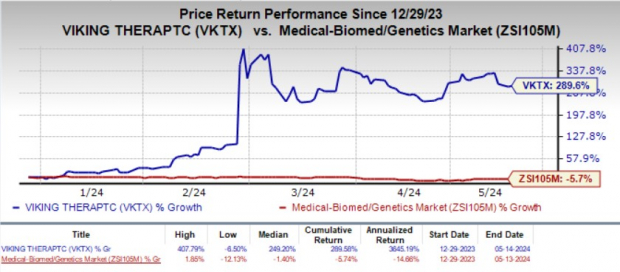

Year to date, shares of VKTX have skyrocketed 289.6% against the industry's 5.7% decline.

Image Source: Zacks Investment Research

What's particularly impressive is that weight loss in all treated cohorts gradually progressed through 13 weeks and did not show evidence of plateauing.

This suggests that VK2375 has the potential to induce further weight loss over a longer treatment period and at higher doses.

Based on such encouraging results, Viking Therapeutics plans to advance both formulations into further development later this year.

Consequently, the company also reported data from the phase I study evaluating the oral formulation of the drug in March 2024, which demonstrated promising dose-dependent reductions in mean body weight after 28 days of daily dosing.

Patients who received the drug at the highest dose level (i.e., 40mg) lost up to 5.3% of their body weight compared with 2.1% in the placebo group. In fact, 57% of patients who received the 40mg dose lost at least 5% of their body weight.

Notably, in both studies, VK2735 was well-tolerated across all doses, with no serious adverse events.

Such impressive results should instill faith in investors regarding the potential of Viking's VK2735 development program for obesity.

Of the two formulations of VK2735, which are currently being investigated, the oral formulation is more interesting as it is much easier to use. Patients will most likely prefer a daily weight loss pill to a weekly injection, thereby having the potential to increase the company's customer base, which will contribute to strong sales, subject to approval.

Viking Therapeutics also enjoys a comfortable cash position. It had cash, cash equivalents and short-term investments of $963 million as of Mar 31, 2024, which should be able to fund the company's clinical program for VK2735, along with other pipeline programs, simultaneously. The company currently has no debt (short + long term) in its balance sheet, which is also encouraging.

VKTX's pipeline comprises two other promising candidates, which are undergoing clinical-stage development. This ensures that its entire growth prospect is not just dependent on the success of its obesity program.

Viking Therapeutics is evaluating its investigational candidate, VK2809, in an ongoing mid-stage study for the treatment of non-alcoholic steatohepatitis. On the other hand, a separate ongoing early-stage study is currently evaluating VK0214 for X-linked adrenoleukodystrophy.

However, there are several risk factors that investors should consider before making a decision.

One cannot simply overlook the tremendous competition in the obesity market, especially from pharma bigwigs like Eli Lilly LLY and Novo Nordisk NVO.

Both Eli Lilly and Novo Nordisk have massive infrastructures and resources, far greater than that of Viking Therapeutics, which will likely allow these large caps to outmaneuver competition in the obesity market in the long run.

Wegovy, a GLP-1 agonist, is NVO's blockbuster chronic weight management injection approved for adults with obesity or overweight. The drug received FDA approval in 2021 and has witnessed stellar performance ever since. In 2023, Wegovy sales were up 407% to DKK 31.3 billion compared with the DKK 6.2 billion recorded in 2022 on a reported basis.

Wegovy is seeing strong prescription trends and is generating impressive revenues and profits for Novo Nordisk. NVO recently announced that the FDA has approved Wegovy for reducing the risk of serious heart problems in obese/overweight adults in March 2024. In the first quarter of 2024, Novo Nordisk generated revenues of DKK 9.4 billion from Wegovy sales, representing a surge of 107% year over year.

Eli Lilly launched its obesity drug, Zepbound, a dual GIP and GLP-1 receptor (GLP-1R) agonist in November 2023. Zepbound has seen strong uptake since its launch. The drug generated revenues of $175.8 million in 2023. The first quarter of 2024 marked the first full quarter of commercialization following Zepbound's launch generating $517.4 million in revenues.

Amgen AMGN also has a GLP-1 receptor candidate, MariTide (maridebart cafraglutide), for obesity in its pipeline. Earlier this month, Amgen stated that it was "very encouraged" with the interim data from the phase II study on MariTide. Top-line 52-week data from the phase II study is expected in late 2024. AMGN is planning to conduct a comprehensive phase III program on the candidate across obesity, obesity-related conditions and diabetes.

Despite the intense competition, the obesity market is still far from being saturated, which will likely provide enough breathing room for Viking Therapeutics to operate in the market and develop additional medicines.

However, in the absence of a marketed product, VKTX does not have a regular income stream to support clinical activities. All pipeline candidates are still a few years away from commercialization. Any developmental setback for the company's pipeline programs will be detrimental to the stock, driving up operating expenses that will significantly increase loss margins. The pharma industry is especially prone to such failures.

These above-discussed factors indicate that Viking Therapeutics is a good stock to hold on to. In fact, any major dip in stock price can be used as an opportunity to buy the stock. This could drive significant growth for investors' portfolios as the company targets a lucrative market space. It has consistently reported positive results from the clinical studies of VK2735 for the obesity indication.

Zacks Rank

VKTX currently carries a Zacks Rank #3 (Hold).

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.