While the U.S. market is reeling from its worst 3-day start to the New Year since 2008, Chinese stocks are continuing to show excellent relative strength.

The Deutsche X-trackers Harvest CSI 300 China A-Shares ETF ASHR recently hit new all-time highs and has jumped 2 percent higher in the early start of 2015. This ETF tracks 300 of the largest and most liquid China A-Share listed companies.

ASHR just recently crossed above $1 billion in total assets as international investors expand their China exposure away from traditional benchmarks such as the iShares Large Cap China ETF FXI.

Related Link:

FXI is by far the largest China-focused ETF with $6 billion in assets, but has limited exposure to just 50 companies that trade on global exchanges. This makes the sample size in FXI relatively small compared to other broad-based alternatives.

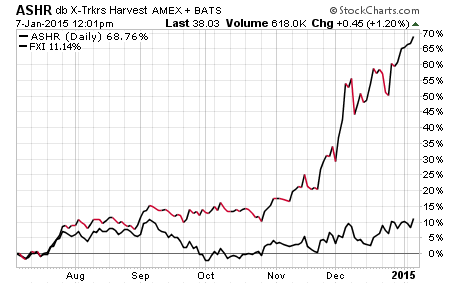

The unique mix of stocks in ASHR, which traditionally have only been available to mainland Chinese investors, has proven to be a strong performance story as well. Over the last six months, ASHR has outperformed FXI by a stunning margin of 57 percent.

Another competitor in this space is the PowerShares China A-Share Portfolio CHNA, which is an actively managed fund. The different approach in CHNA is that it tracks futures contracts of the SGX FTSE China A50 Index rather than direct investment in a basket of stocks. This ETF has recently picked up heavier volume as China A-shares have soared.

Lastly, the Deutsche X-trackers Harvest CSI 500 China A-Shares Small Cap ETF ASHS is a complimentary way to play the burgeoning A-share trend through smaller companies on the Shanghai exchange. ASHS has gained 8 percent over the last six months and offers an additional way to diversify in this country.

Many investors are cautious about emerging markets in general because of hard hit areas such as Russia and Brazil. However, China has continued to buck the trend of its peer group and is one country to watch closely in 2015.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.