These graphs were produced by Capital Market Labs. Learn how the company is bringing the power of living data to the world of finance.

Chipotle Mexican Grill, Inc. CMG reports earnings after the market close on February 3. Up almost 30 percent over the last year, Chipotle has been one of the best-performing stocks in the S&P 500, easily outpacing its 13.4 percent gain over the last year.

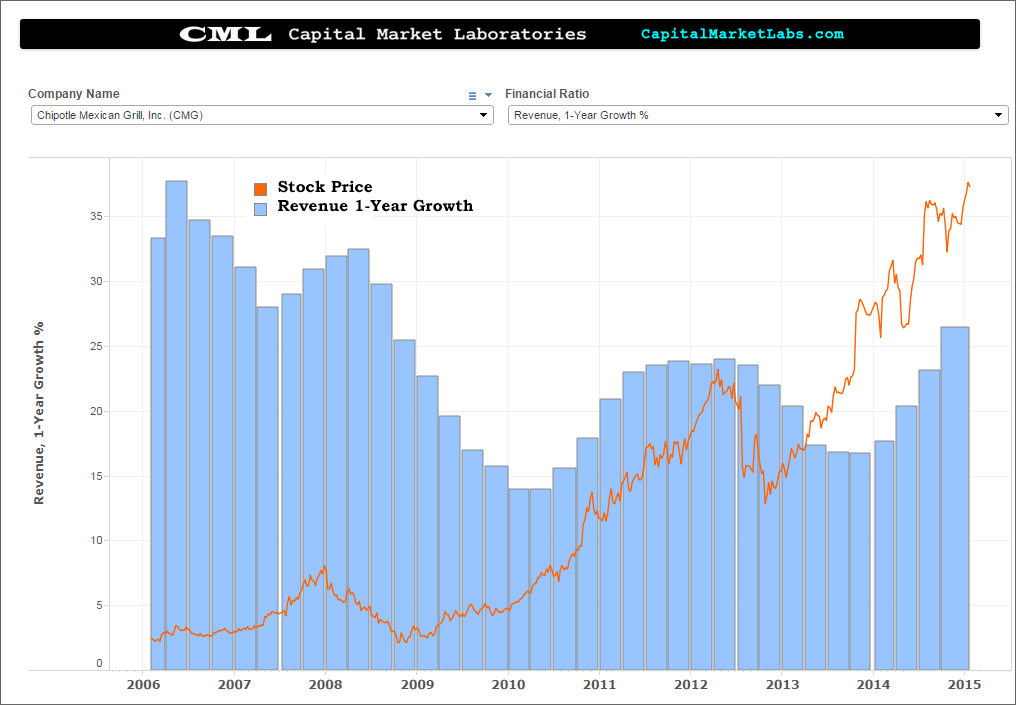

Chipotle is one of the great growth stories of the past 10 years, as this time series chart of revenue attests. Revenue has grown from $495 million in 2005 to $3.8 billion for the quarter ending September 30, 2014 -- that’s a CAGR of almost 24 percent. Growth isn’t slowing down, as year over year revenue was up 26.5 percent last quarter.

Despite a decade of remarkable growth, Chipotle’s star still shines bright when one examines growth rates among restaurants.

Here, let's plot Revenue Growth on the x-axis and Same Restaurants Sales Growth on the y-axis. Only El Pollo LoCo Holdings Inc LOCO posted higher Same Restaurant Sales Growth than Chipotle’s 5.6 percent, and only Habit Restaurants Inc HABT topped Chipotle’s 26.5 percent total revenue growth.

This time series of Revenue Growth and Stock Price shows how highly correlated the two are. With Chipotle, it’s all about the top-line growth.

Chipotle has been very adept at timing its share repurchases, buying the dips.

Revenue and Net Income Growth are actually accelerating. In addition to the 26.5 percent gain in Revenue, Net Income increased 30.6 percent year over year last quarter.

Chipotle’s acceleration in Net Income growth is in stark contrast to some of its peers like Panera Bread Co PNRA and Buffalo Wild Wings BWLD.

What To Expect

Revenue: The consensus estimate is for $1.07 billion for 2014 Q4, or $4.11 billion TTM. This would be a 27.9 percent increase year over year. The high estimate is for $1.11 billion, $4.14 billion TTM which would be a 28.9 percent increase year over year.

EPS: The consensus estimate is for $3.79, with a high of $4.00.

Historically, investors have been most attuned to the rate of revenue growth at Chipotle. If the stock hits the consensus estimates, it will once again drive its one-year growth in revenue even higher. However, the last time Chipotle recorded revenue growth this high was 2008, and revenues were just a fraction of current revenues.

For large companies, revenue growth can hard be to sustain, much less increase. At some point, does Chipotle’s success begin to work against it when it comes to meeting investor expectations?

Tom White can be found on Twitter @tbwhite67

Image credit: Amicon, Wikimedia

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.