The Deficit: How To Protect Yourself

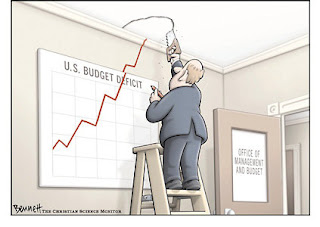

Its another brilliant day in America's capital. Unlike the sun shining outside, the fiscal news in Washington is somewhat more gloomy. As you are probably well aware, the Federal government is projected to rack up an additional $1.6 billion dollars in debt this year.

If you're watching the red ink, you may be somewhat concerned about the impact this could have on your own personal finance. A recent article in the Wall Street Journal covered this topic in some depth. The WSJ comes out with some pretty good stuff, so I'll share the main points:

To protect your finances against rampant government debt, they recommend doing the following:

1) Be Wary of Long Term Bonds: A possible policy response to a large debt level might be to increase the supply of money to make the deficit more manageable. While the relationship between the supply of money and inflation from a scientific standpoint is still somewhat unclear, inflation remains a very real possible policy option. If you are holding long term bonds you'll be at the wrong end of the inflation stick. One possible way around this is to buy shares in an inflation protected mutual fund. The Vanguard group generally sells good financial products and has an inflation protected securities fund, check ticker symbol, VIPSX.

2) Diversify: The Journal recommends that you put some of your wealth outside of the United States. The way they recommend doing this is buying shares in U.S. based multinationals like Exxon Mobile or Kraft foods. This is sound. American equity markets have good laws governing disclosure and financial reporting. Also, if you buys shares in a US multinational, you get defacto exposure to international markets and currency. In addition to Exxon and Kraft, you might consider the General Electric corporation (GE) and the Coca Cola Corporation (KO). Both of these are established blue chips with a high degree of international exposure.

3) Maximize Your Sheltered Investments: A concern with the debt is sooner or later Washington will be pressured to raise taxes. In light of recent headlines regarding the middle class "stealth tax" in recent White House budget proposals, this argument makes sense. So, if you have access to a 401k, Roth IRA, regular IRA or other sheltered account, you should make use of it. Provided that you aren't worried about inflation, you might also consider some type of tax free investments such as various classes of municipal bonds. Schwab had a good write up on the pros and cons of this strategyhere.

In addition to the WSJs recommendations, you could also consider:

1) Gold and Silver: Being a respectable publication, the Journal piece didn't advocate buying precious metals. That said, consider getting your hands on this asset class. Gold and silver tend to hold their value during inflationary times and you only have to pay taxes on these metals when you buy and sell. These asset class have historically been good stores of value as well. That said, don't go overboard on gold, you'll never get rate of growth you will with stocks.

2) Deferral: To the maximum extent possible, you should consider ways to defer taxation on your investments. Deferral is tricky, but there are several ways to do it. Three are: 1) transferring your wealth to a lower earning family member. 2) Maxing out specific accounts which allow deferrals and 3) purchasing assets than can be tax deferred. For 3, some master limited partnerships have tax deferrable dividend payments. Get more info (here).

What to avoid. Provided the Feds to start to inflate the currency and raise taxes, here are some retail assets you DON'T want to be holding.

1) Series EE savings bonds. The EEs are great because you can get them for only $25 dollars. On the other hand, they aren't inflation protected, so you'll see the value of these bonds decline if there is any real inflation. The interest on EEs is taxed as regular income, so if income taxes increase, you'll get stuck with a higher bill.

2) Cash. Balances in money market, checking and savings accounts will get a double whammy of both higher taxes on interest and suffer from the effects of inflation. Obviously you need some cash to run your life but that $10,000 in your savings accounts should probably be allocated elsewhere.

Its never easy to predict the future, but in an era of high deficits, its a fair bet that government will come looking for more tax revenue or will try to inflate the currency to pay for the borrowing. In either case, it pays to consider how you can protect yourself.

Best,

James

Disclosure: the author owns shares in both GE and KO.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.