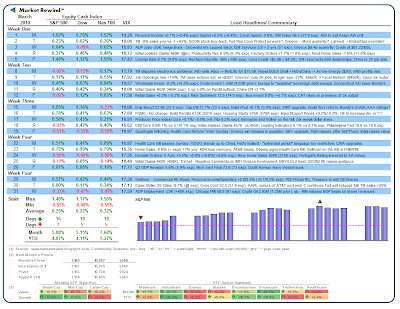

March 2010 Rewind - Marching Along

Marching Along was an apt descriptor indeed for last month's consistently bullish market behavior with up days outpacing down by more than two to one. The powerful move left US equities at fresh rally highs with the VIX at lows not seen in years.

The S&P 500, Dow Jones Industrials and NASDAQ 100 cash indices finished higher across the board by +5.88%, +5.15% and +7.68%, respectively. As we get set to wrap up the first full week of April, no storm clouds appear imminent in spite of mixed economic readings and earnings season just on the horizon....

Sentiment: Positive

Volatility: Consistently Low (VIX 16-20)

Direction: Highly Positive

The Style-Box was calculated using the following PowerShares™ ETFs: Small-Growth (PWT), Small-Value (PWY), Mid-Growth (PWJ), Mid-Value (PWP), Large-Growth (PWB), and Large-Value (PWV). The Sector-Ribbon was calculated using the following Select Sector SPDR™ ETFs: Materials (XLB), Industrials (XLI), Energy (XLE), Staples (XLP), Discretionary (XLY), Financials (XLF), Technology (XLK), and Healthcare (XLV). The Standard & Poors 500, Dow Jones Industrial Average and NASDAQ 100 may be traded through ETF proxies, including the SPY or IVV, DIA and QQQQ, respectively.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.