What Do Long Term Interest Rate Trends Say About Future Stock Market Performance?

When looking at the 'value' of any asset, whether it be cash, equities, fixed-income, gold, or real estate, interest rates are a major determinate.

If interest rates are very low, holding real estate, gold, equities, and older fixed income become advantageous. An investor is not 'giving anything up' when holding these other assets, since holding cash yields nothing. Also when projecting future NPV values with a very low interest rate, values get inflated since there is little opportunity cost.

The opposite, is of course also true. If interest rates are very high, equities get less attractive on a risk adjusted basis, real estate values should go down (all else equal) as mortgage rates go up, and gold becomes unattractive as no interest is earned on the metal. Meanwhile owning newly issued fixed income and cash become better 'low risk' stores of value.

But what are more important, current interest rates or future interest rate trends? My opinion is future trends. Look at the following chart:

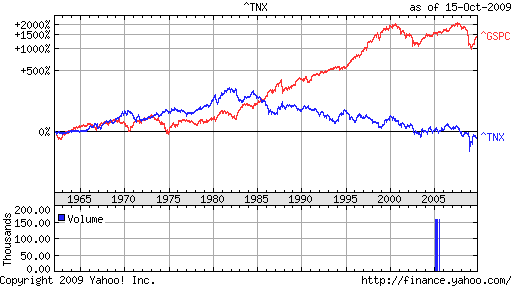

The blue line represents the yield on a 10 year Treasury bond, while the red line is the S&P 500.

One can clearly see that from the early 1960s through early 1980s the equity market, although slightly higher, was very muted compared to other periods. During this time frame the yield on a 10 Year Treasury bond went from 4% to near 16%, while the S&P 500 returned a cumulative 86% (ignoring dividends). This produced a monster headwind to market returns and paltry annualized returns over this 20 year period.

Now we’ll look at the period from the early 1980's to the early 2000's. During this time interest rates went from near 16% on the 10 Year Treasury bond to near 1%. This produced a huge tailwind for the equity market, and it indeed responded. The S&P 500 returned 1100% (again ignoring dividends) in this time period.

To be sure, many other factors are involved here. Technological advances, economic growth, etc. are all variables that affect returns but it seems interest rate trends play a very large role.

So what does this say about future equity returns? Well interest rates are near 0% currently with only one way to go (to any large extent). Regardless of how growth, sentiment, and technology affect future returns a significant interest rate trend headwind should be present.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Interest Rate Trends Interest Rates Opportunity Cost Stock Market PerformanceEconomics Markets