October 2009 Rewind - A Stop in the Road

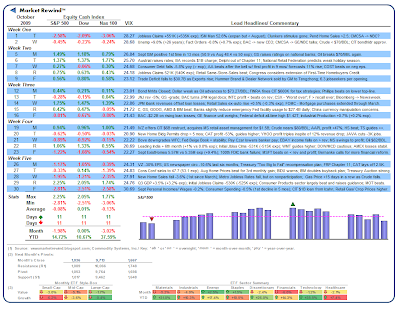

October finally put a halt in the road for equities' historic seven-month run off of the March lows, leaving the S&P 500, Dow Jones Industrials and NASDAQ 100 cash indices mixed at -1.98%, +0.00% and -3.02%, respectively. The month also ended with the VIX back in the low thirties for the first time in a while.

October finally put a halt in the road for equities' historic seven-month run off of the March lows, leaving the S&P 500, Dow Jones Industrials and NASDAQ 100 cash indices mixed at -1.98%, +0.00% and -3.02%, respectively. The month also ended with the VIX back in the low thirties for the first time in a while.

With the majority of third quarter earnings entered into the record books, the pullback came on nascent dollar strength, a key rate increase in Australia, higher energy costs and mixed economic reports. Small (IJK) and Mid-Caps (IWS), Financials (XLF) and Materials (XLB) led the retreat, while Energy (XLE) and Consumer Staples (XLP) were able to eek out positive returns. Ten days into the decline, traders in early November will be looking to the FOMC and the monthly jobs report to put the rally back on track.

Sentiment: Mixed

Volatility: Wide Ranging (VIX 20-30)

Direction: Flat

The Style-Box was calculated using the following PowerShares™ ETFs: Small-Growth (PWT), Small-Value (PWY), Mid-Growth (PWJ), Mid-Value (PWP), Large-Growth (PWB), and Large-Value (PWV). The Sector-Ribbon was calculated using the following Select Sector SPDR™ ETFs: Materials (XLB), Industrials (XLI), Energy (XLE), Staples (XLP), Discretionary (XLY), Financials (XLF), Technology (XLK), and Healthcare (XLV). The Standard & Poors 500, Dow Jones Industrial Average and NASDAQ 100 may be traded through ETF proxies, including the SPY or IVV, DIA and QQQQ, respectively.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.