Bloomberg: Coal Rally on Chinese Demand Sparks $59 Estimates

A lot of mixed message coming out of China on the commodity front... a potential excess of copper [Feb 9, 2010: China Copper Imports to Halve] and steel [Feb 10, 2010: China to Curb "Maverick" Steelmaking as Costs Rise], but lacking in coal. Of course coking coal being one of the components that go into steel...hmm.

Via Bloomberg

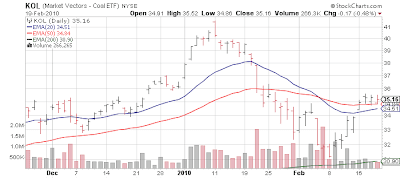

- A rally that has boosted coal prices 21 percent from their lows last year may have further to go as the coldest U.S. winter in nine years and China’s record imports increase demand and drain stockpiles. Prices will average $59.28 a ton this year, up 17 percent from $50.75 as of Feb. 19 on the New York Mercantile Exchange and 41 percent more than last year’s low in April, according to the median of 11 analyst estimates in a Bloomberg News survey.

- Stockpiles at utilities swelled last year after a mild summer and the economic recession reduced power demand.

- China, the world’s biggest coal user, imported 16.4 million metric tons in December, a sixfold increase from a year earlier, customs data show. [May 13, 2009: Commodities - It's China's World: We Just Live in It]

- “We’re definitely bullish for a confluence of factors,” said Jeremy Sussman, senior coal analyst at Brean Murray Carret & Co., a New York-based boutique investment bank. “We can see the light at the end of the tunnel in the U.S. The weather has definitely had an impact. The international market is front and center.”

- Hedge funds have been buying energy producers, mining companies and airlines, a sign that managers from Louis Bacon to David Tepper are convinced the economy will accelerate. Duquesne Capital Management LLC, led by Stanley Druckenmiller, bought 6.2 percent of coal miner Massey Energy (MEE), whose earnings are projected to double this year. Massey is the sixth-largest U.S. coal company.

- The increased U.S. and Chinese consumption prompted Michael Dudas, an analyst at Jefferies & Co. in New York, to raise his 2010 price target for coal to $70 per ton, a figure he originally forecast for 2011. “The weather and better electricity generation have pushed stockpiles lower than people anticipated,” said Dudas, who has followed coal for a decade. “It’s really just accelerating that price.”

- “The cold weather is the best thing they can get right now that’s not a full economic recovery,” said Daniel Scott, an analyst at Dahlman Rose & Co. in New York. “People are no longer scared to talk about thermal coal.” The 2009-2010 winter season, which began Dec. 1, is the coldest since the 2000-2001 season and ranks in the coldest third of winters in the past 115 years.

- Utilities have 57 days worth of coal on hand, down from more than 70 days at the start of winter, according to Genscape Inc., a Louisville, Kentucky-based energy data provider.

- U.S. steel capacity utilization tumbled to 68 percent as of Feb. 15 from 91 percent in August 2008, according to the American Iron and Steel Institute, as unemployment climbed to 10 percent and consumers reduced spending 3 percent on appliances in December from a year earlier.

- Prices plunged 66 percent to $48.15 per ton at the end of 2009 from a record $143 on July 1, 2008, the steepest decline in at least eight years, according to data compiled by Bloomberg.

- The risk to forecasts for higher coal prices is a glut of natural gas in the U.S. and prospects for the economy to stumble as the Federal Reserve boosts interest rates for the first time since June 2006. “If the economy tanks again, that changes the outlook,” according to James Rollyson, senior coal analyst at Raymond James Financial Inc. in Houston. “The economy and particularly this year natural gas prices are the variables. Coal lost market share to natural gas because we averaged $4 gas for the year.”

- The U.S. relies on coal for about half of its power generation, compared with about 20 percent for gas. Gas has to stay above $5 per million British thermal units to prevent it from being more attractive to utilities at the expense of coal. Natural gas for March delivery fell 12.8 cents, or 2.5 percent, to $5.044 per million Btu on Feb. 19. Rollyson estimates that through November coal lost about 40 million tons worth of demand to gas.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.