September 2009 Rewind - Back to School for Bears

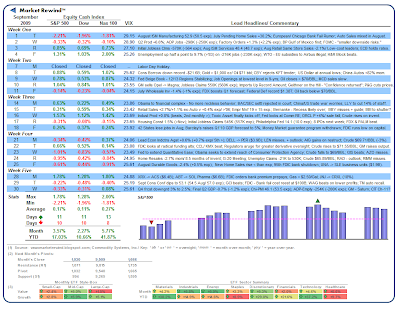

Last month I questioned whether equities were "Running on Empty," and perhaps I could pose that very same question this early October after a rash of less than stellar economic reports. Nevertheless, September undeniably put in more healthy returns for the year with the S&P 500, Dow Jones Industrials and NASDAQ 100 cash indices up +3.57%, +2.27% and +5.77%, respectively.

Last month I questioned whether equities were "Running on Empty," and perhaps I could pose that very same question this early October after a rash of less than stellar economic reports. Nevertheless, September undeniably put in more healthy returns for the year with the S&P 500, Dow Jones Industrials and NASDAQ 100 cash indices up +3.57%, +2.27% and +5.77%, respectively.

Mid-Caps, Industrials and Technology led the charge, while Health Care and Large-Cap Value stocks lagged somewhat, although clearly all of the tracked indices came out to the positive. After the strongest quarter in decades and third-quarter earnings just ahead, will the bull's good fortune continue to run?

Sentiment: Positive

Volatility: Narrow (VIX 23-29)

Direction: Higher

[Click to Enlarge/ Weekly ETF Analyses]

The Style-Box was calculated using the following PowerShares™ ETFs: Small-Growth (PWT), Small-Value (PWY), Mid-Growth (PWJ), Mid-Value (PWP), Large-Growth (PWB), and Large-Value (PWV). The Sector-Ribbon was calculated using the following Select Sector SPDR™ ETFs: Materials (XLB), Industrials (XLI), Energy (XLE), Staples (XLP), Discretionary (XLY), Financials (XLF), Technology (XLK), and Healthcare (XLV). The Standard & Poors 500, Dow Jones Industrial Average and NASDAQ 100 may be traded through ETF proxies, including the SPY or IVV, DIA and QQQQ, respectively.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.