Zinger Key Points

- Baidu shares surged over a year high due to Apollo Go interest.

- 48,000 call options traded, six times the 20-day average.

- Get 5 stock picks identified before their biggest breakouts, identified by the same system that spotted Insmed, Sprouts, and Uber before their 20%+ gains.

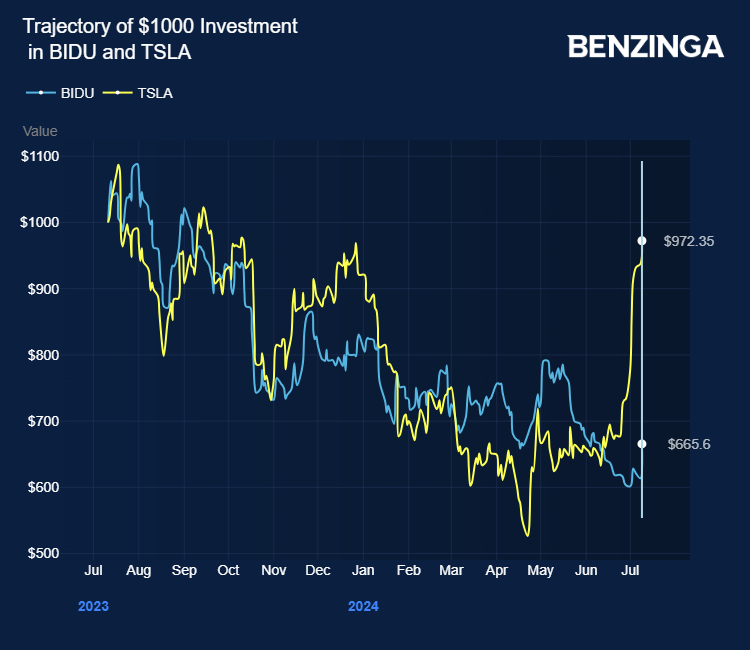

Baidu Inc BIDU saw its shares surge by the most in over a year, driven by growing interest in its Apollo Go robotaxi service in China.

Baidu’s stock climbed as much as 13% in Hong Kong, following an 8.5% rise in the U.S. on Tuesday. The stock is trading higher Wednesday.

Traders are optimistic that robotaxis will gain further support following Beijing’s recent announcement that it will back them for ride-hailing and car rental services, Bloomberg reports.

Also Read: Alibaba and Baidu Slash AI Prices Amid Fierce Competition: Report

Guotai Junan International analyst Li Muhua told Bloomberg, “Autonomous driving will turn into a key trade in the coming three months, aided by Tesla Inc’s TSLA launch of its robotaxi next month.”

Li expects Baidu’s Apollo Go to break even in Wuhan in 2024 and become profitable in 2025 with fleet expansion.

Phil S. Lee, head of Asia-Pacific research at Mirae Asset Global Investments in Hong Kong, stated, “Baidu is one of the leading autonomous driving system providers. Its key advantage is that it’s open to many brands and can operate in China, where the government promotes autonomous driving.”

BIDU Stock Prediction For 2024

Equity research analysts on and off Wall Street typically use earnings growth and fundamental research as a form of valuation and forecasting. But many in trading turn to technical analysis as a way to form predictive models for share price trajectory.

Some investors look to trends to help forecast where they believe a stock could trade at a certain point in the future. Looking at Baidu, an investor could make an assessment about a stock's long term prospects using a moving average and trend line. If they believe a stock will remain above the moving average, which many believe is a bullish signal, they can extrapolate that trend into the future using a trend line. For Baidu, the 200-day moving average sits at $107.81, according to Benzinga Pro, which is above the current price of $95.4. For more on charts and trend lines, see a description here.

Traders believe that when a stock is above its moving average, it is a generally bullish signal, and when it crosses below, it is a more negative signal. Investors could use trend lines to make an educated guess about where a stock could trade at a later date if conditions remain stable.

Price Action: BIDU shares were trading higher by 2.53% at $97.81 in the premarket session at the last check Wednesday.

Also Read:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Wikimedia Commons

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.