Okta, Inc. OKTA reported better-than-expected second-quarter financial results after Wednesday’s closing bell.

Okta reported quarterly earnings of 72 cents per share, which beat the analyst consensus estimate of 61 cents by 18.03%. Quarterly sales came in at $646 million, which beat the consensus estimate by 2.06% and represents a 16.19% increase from the same period last year.

"Okta is setting the standard for identity security by focusing on relentless innovation and expanding our product offerings within the Workforce Identity Cloud and Customer Identity Cloud," said Todd McKinnon, CEO and co-founder of Okta.

Okta sees third-quarter earnings of between 57 cents and 58 cents per share, versus the 55-cent estimate, and revenue in a range of $648 million to $650 million, versus the $639.13 million estimate. The company expects fiscal year 2025 earnings between $2.58 and $2.63 per share, versus the $2.42 estimate, and fiscal year revenue in a range of $2.555 billion to $2.565 billion, versus the $2.54 billion estimate.

Okta shares fell 0.5% to close at $96.54 on Wednesday.

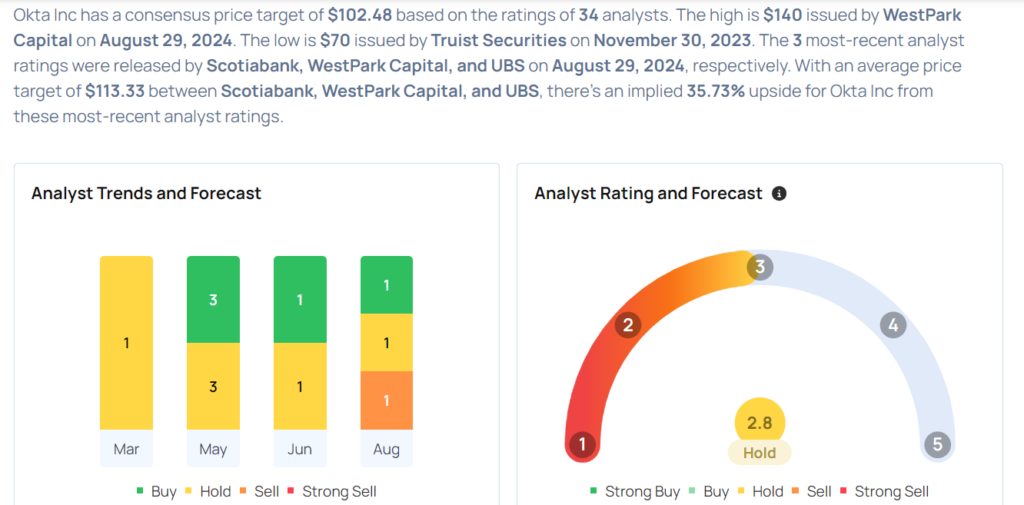

These analysts made changes to their price targets on Okta following earnings announcement.

- Baird analyst Shrenik Kothari maintained Okta with an Outperform and lowered the price target from $108 to $105.

- B of A Securities analyst Madeline Brooks downgraded the stock from Buy to Underperform and lowered the price target from $135 to $75.

- Wells Fargo analyst Andrew Nowinski maintained Okta with an Equal-Weight and lowered the price target from $100 to $90.

- UBS analyst Roger Boyd maintained the stock with a Buy and lowered the price target from $120 to $108.

- Scotiabank analyst Patrick Colville maintained Okta with a Sector Perform and lowered the price target from $104 to $92.

Considering buying OKTA stock? Here’s what analysts think:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.