Like most chartists, I'm continually on the lookout for quality patterns stacking the odds in my favor while providing favorable risk/reward entries. Entering the market at random times is not only silly, it's usually a one way ticket to the poorhouse. Whether you're an Elliot Wave practitioner, a Fibonnaci fanatic, or a volatility and sentiment analyzer, we're all attempting to find an exploitable edge and bring order to the seemingly random market. All too often traders miss the mark by bouncing from one trading style to another instead of honing in on one approach. Don't make the mistake of becoming a jack of all trades and master of none. As I've mentioned before I'm a simple man when it comes to technical analysis and believe that less is more. Usually the cleaner the chart the better.

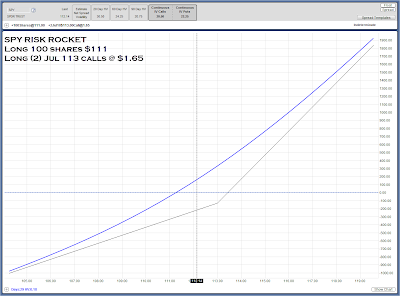

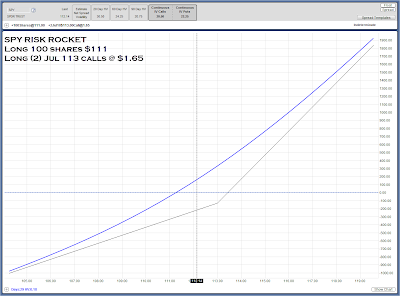

Speaking of strategic entries, I'm thinking the market may have provided participants wanting to join the bullish throng with one such entry point during Tuesday's breakout. I took the opportunity to enter a bullish risk rocket on the SPY during the surge in anticipation of some more upside over the coming days. Suppose we purchased 100 shares at $111 and bought two July 113 calls for $1.65 apiece (click image to enlarge).

As is typically the case with these risk rockets, we're looking for a one average true range (ATR) profit before unloading the stock. At trade inception the SPY had an ATR around $2.50, putting our profit target at $113.50 (111+2.50). Once the target is reached and the gain on the stock locked in, we'll consider rolling the remaining calls to some type of risk free spread. I'll follow up with an update when needed.

[Addendum: The exit for today's SPY Risk Rocket can be found here]

For related posts, readers can check out:

Adjustment Thinking and the Salvation Syndrome

The Sling Shot

Risk Rocket

Market News and Data brought to you by Benzinga APIsSpeaking of strategic entries, I'm thinking the market may have provided participants wanting to join the bullish throng with one such entry point during Tuesday's breakout. I took the opportunity to enter a bullish risk rocket on the SPY during the surge in anticipation of some more upside over the coming days. Suppose we purchased 100 shares at $111 and bought two July 113 calls for $1.65 apiece (click image to enlarge).

As is typically the case with these risk rockets, we're looking for a one average true range (ATR) profit before unloading the stock. At trade inception the SPY had an ATR around $2.50, putting our profit target at $113.50 (111+2.50). Once the target is reached and the gain on the stock locked in, we'll consider rolling the remaining calls to some type of risk free spread. I'll follow up with an update when needed.

[Addendum: The exit for today's SPY Risk Rocket can be found here]

For related posts, readers can check out:

Adjustment Thinking and the Salvation Syndrome

The Sling Shot

Risk Rocket

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Posted In:

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in