Yesterday rare earth stocks sold off quickly. The timing was perfect as I wrote a bullish article on this sector, suggesting that these stocks had further to run. For those who are invested in this space, or are looking to add exposure, days like yesterday when many of these stocks are off 10 percent, or more, are a great time to add exposure.

This is still a high risk, high reward area to invest. Make no mistake - the mania surrounding rare earths is not purely driven by supply demand fundamentals. As I wrote the other day:

And in October I wrote:

The eye-popping runs of these stocks is providing the media no shortage of attention grabbing headlines - after all it's pretty attractive to consider investing in stocks that are up 100, 200, or even 5,000 percent over the last two years, right?

The reality is that bull markets, and bubbles, can run much longer than anyone, even blind perma-bulls, ever expect. So add exposure, mind your stops, and operate with the understanding that these aren't 'buy and forget about them' stocks right now.

Enough about what I think - let's open up the floor and hear what you have to say.

"One question on the recent rare earth spike - it would seem that these (now quite frothy) stocks owe their run up purely on Chinese policy. What would happen if the Chinese government simply did a U-turn on this policy and reversed their earlier decision on export ban/restriction of rare earth elements? I'd hate to be long on say Molycorp when that particular piece of news hit the wires! After all - can we really trust the Chinese government in this regard; in that having effectively manipulated the price of rare earth elements (and the stocks of producers) with this policy, a well timed reversal would surely reap huge dividends for them - assuming they wouldn't flinch at steadily dumping prior to the decision announcement. I'd be interested to hear your thoughts regarding the potential for this to occur." - Dave

Dave brings up a good point and this is certainly a valid concern and a real risk. Chinese policy is anything but easy to predict, and if Beijing suddenly says it is reversing the export ban I would expect these stocks to sell off. However, I think there is a valid concern that over the long haul the world doesn't want to be dependent on China for these elements. The expansion programs of mining outfits in the U.S., Canada, Australia, etc. support this.

Stan writes, "Are you compensated in any way from the companies you recommend?"

No, not in any way. All of our research is independent. If members of our staff own shares of companies that we write about you will see this in a disclosure either in or at the bottom of the article.

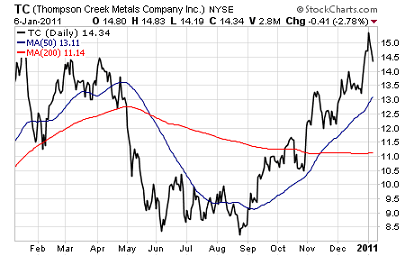

"Thompson Creek (NYSE: TC) Mines [molybdenum] in Idaho, and processes it in Pa. Now, this year - currently. I just wonder why it garners so little attention." - Mike

Good call Mike. Thompson Creek mines molybdenum, gold, and copper and is actually a profitable company. The stock currently trades with a forward PE of 10.8 and analysts expect sales and earnings growth to come in at 40 percent and 20 percent in 2011.

Since China has reclassified molybdenum as a “national mining resource” it's likely that Thompson Creek will continue to grow revenues and earnings at a nice clip. The stock has enjoyed a run along with other mining stocks, but isn't as stretched as some of the more speculative names.

"I am having a problem finding a broker to purchase {some rare earth stocks}..." - Les

Les is referring to the fact that many brokers have specific markets that investors can buy shares on, and some that they can't. For instance, TD Ameritrade AMTD clients can only buy some Toronto listed shares through the Pink Sheets, whereas E*Trade ETFC clients can buy these directly on the Toronto exchange.

I can't give advice on what brokers are best, but I can point you in the right direction to get a good comparison. Check out Barron's 2010 Online Broker Review, it will tell you which brokers offer access to foreign exchanges, as well as all the other relevant information you'll want for selecting an online broker.

***I've received a lot more emails, including some interesting reports on particular companies that I haven't covered in the past. I'm going to read these over the weekend, and will discuss next week.

Right now, Small Cap Investor PRO lead research analyst Tyler Laundon and I are wrapping up a special report on emerging opportunities in the oil and natural gas markets. We'll be rushing this report out to subscribers to Small Cap Investor PRO within the next couple of days, so if you're interested in this resource sector take a chance to get your trial subscription in advance.

You can get started immediately with our silver mining report, Sierra Madre Silver Profits, and then you'll get our oil and gas special report within a few days as a subscriber. You'll have 5 great emerging resource companies to invest in, all with huge upside potential.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.