Earnings season got off to a somewhat rocky start. Revenue misses from Alcoa and Bank of America drove the S&P 500 below the 50-day moving average and even briefly below the important support/resistance area of 1,301.

When revenues fall, investors interpret it as a sign that demand is weak and, therefore, that the recovery is losing momentum.

Fortunately, Intel INTC and other tech stocks posted stellar numbers during the second week of earnings and quickly stamped out the bearish "slowing demand" fears. The S&P has rallied 53 points since the intra-day low at 1,294 on Wednesday, April 18. Just before those stellar financials I completed a report that highlights my three favorite technology stocks. To receive a copy of this technology report click here.

Yesterday, it was Ford's F turn to give stocks a lift. Ford posted a 22% year over year profit increase, the best performance from the company since 1998. 3M MMM and UPS UPS also reported excellent numbers and helped push the percentage of companies beating earnings forecasts to 79%.

With profit growth and productivity so strong, and with demand steady at worst, it's hard not to be bullish on stocks. Ahh, but what about the looming budget debate in Congress? What if oil keeps moving higher? What happens when QE2 ends?

*****The end of QE2 is perhaps the biggest question mark right now. It might be the perfect ironic outcome if Treasury bonds rally after the Fed let's its Treasury buying program end.

The Fed was deliberately attempting to prop up the stock market with QE2, driving money out of bonds and into stocks. That's the "risk on" trade, appropriate for when the Fed is backstopping assets.

I see the potential for the "risk off" trade to resume wants the Fed ends QE2, as money heads back into the relative safety of Treasuries. And we may get a hint of what the Fed s thinking from its policy statement today, and Bernanke's first post FOMC press conference this afternoon.

Whatever the outcome, May should be an interesting month. I expect we'll see some kind of stock market correction as the old adage "sell in May" coincides with positioning for the end of QE2.

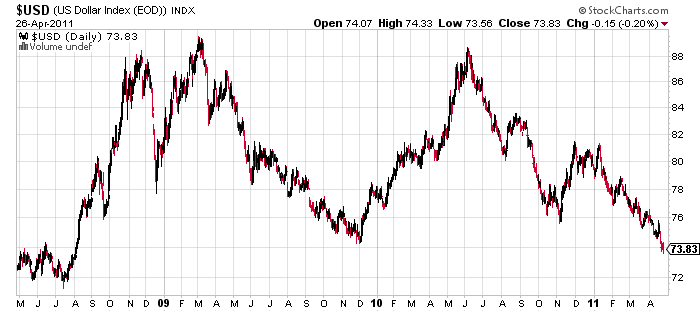

*****Nobody expects the U.S. dollar t rally. But the U.S. dollar index is at support levels where it has rallied before. Perhaps that's why precious metal stocks have not fully participated in the recent rally for metals.

We've seen the same behavior from oil stocks. They have not blasted higher as oil prices have pushed above $110 a barrel. It's likely not a coincidence that oil is also dollar denominated.

A rally for the dollar would certainly push oil and metals lower. It would also make Treasury Secretary Geithner look a little less silly for continuing to say that the Fed and Treasury favor a strong dollar. That's clearly not true. And if it is, they are doing a very poor job of supporting the dollar.

*****The data stock I mentioned as a potential winner on Monday, Savvis SVVS, is up 8% after reporting a strong quarter last night. Just thought you'd want to know...

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.