Get MarketClub's Free Daily Video Market Updates Here

Follow me on Twitter!

Market News and Data brought to you by Benzinga APIsFollow me on Twitter!

Each week I publish stocks to watch for the upcoming week as potential momentum trades. The stocks below all have a 50k minimum average daily share volume and traded at a 52-week high on strong volume, with a minimum of two times relative volume on Friday, April 29. In addition, stocks were required to close Friday higher than the open price.

Last week's list of 69 stocks returned an average of -2.67& versus -1.63% for SPY. Purchasing the entire list of stocks may not be feasible for individual investors. However, with this list we can identify stocks with high price momentum that may be viable short to intermediate term trading candidates, and, in some cases, long-term investments.

This week we have 25 stocks and ETFs qualifying for the top momentum securities. This tells us that positive price momentum has waned in the equity market. There is also a variety of industries on the list. However, we can sort the list based on the closing price change to identify some stocks with the highest price momentum headed into the weekend.

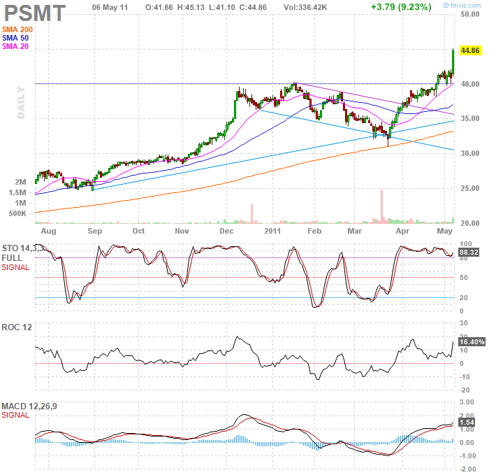

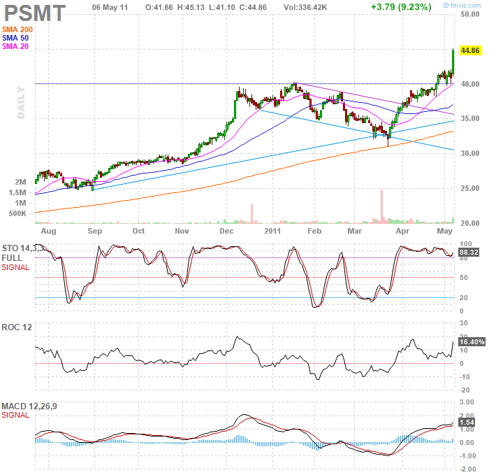

Two stocks on the list which finished the week and day strongly were PROS Holdings (PRO), which provides pricing and margin optimization software worldwide, and PriceSmart (PSMT), which owns and operates warehouse clubs in the United States, Latin America, and the Caribbean.

PRO jumped over 17% after reporting earnings after the close on Thursday. According to the company's release "Total revenue for the first quarter of 2011 was $21.4 million, which exceeded the high end of the Company's revenue guidance for the quarter, and increased 24% from the first quarter of 2010." In addition, the company guided revenues of $23.3-$23.7 million for the second quarter. Two analysist covering the stock upgraded the company after earnings to "buy" and "outperform", with $18-$19 price targets.

On Friday PSMT announced via press release " April 2011 net sales increased 37.0% to $141.7 million from $103.4 million in April a year earlier. For the eight months ended April 30, 2011, net sales increased 23.4% to $1,098.5 million from $890.3 million for the eight months ended April 30, 2010." The company has grown sales and earnings the past year and 5 years at a double digit rates and is projected to continue double digit growth rates this year and next. It currently trades at a 19.42 forward P/E and has a low debt/equity ratio of .18.

From a technical perspective, PSMT has no overhead resistance. If the company can keep sales and earning growth momentum, then $40 could serve as a solid support level for further advances. Given the company's history or earnings and sales growth and technical breakout, it is a stock worth watching.

Data and Chart Source: Finviz

The entire list of 25 stocks as well as the current performance can be viewed on the right hand side of Scott's Investments.

Last week's list of 69 stocks returned an average of -2.67& versus -1.63% for SPY. Purchasing the entire list of stocks may not be feasible for individual investors. However, with this list we can identify stocks with high price momentum that may be viable short to intermediate term trading candidates, and, in some cases, long-term investments.

This week we have 25 stocks and ETFs qualifying for the top momentum securities. This tells us that positive price momentum has waned in the equity market. There is also a variety of industries on the list. However, we can sort the list based on the closing price change to identify some stocks with the highest price momentum headed into the weekend.

Two stocks on the list which finished the week and day strongly were PROS Holdings (PRO), which provides pricing and margin optimization software worldwide, and PriceSmart (PSMT), which owns and operates warehouse clubs in the United States, Latin America, and the Caribbean.

PRO jumped over 17% after reporting earnings after the close on Thursday. According to the company's release "Total revenue for the first quarter of 2011 was $21.4 million, which exceeded the high end of the Company's revenue guidance for the quarter, and increased 24% from the first quarter of 2010." In addition, the company guided revenues of $23.3-$23.7 million for the second quarter. Two analysist covering the stock upgraded the company after earnings to "buy" and "outperform", with $18-$19 price targets.

On Friday PSMT announced via press release " April 2011 net sales increased 37.0% to $141.7 million from $103.4 million in April a year earlier. For the eight months ended April 30, 2011, net sales increased 23.4% to $1,098.5 million from $890.3 million for the eight months ended April 30, 2010." The company has grown sales and earnings the past year and 5 years at a double digit rates and is projected to continue double digit growth rates this year and next. It currently trades at a 19.42 forward P/E and has a low debt/equity ratio of .18.

From a technical perspective, PSMT has no overhead resistance. If the company can keep sales and earning growth momentum, then $40 could serve as a solid support level for further advances. Given the company's history or earnings and sales growth and technical breakout, it is a stock worth watching.

Data and Chart Source: Finviz

The entire list of 25 stocks as well as the current performance can be viewed on the right hand side of Scott's Investments.

| Ticker | Company | Industry | Trend | 52-Week High | Relative Volume | Price |

| PRO | PROS Holdings, Inc. | Application Software | Here | 9.66% | 2.41 | 17.37 |

| LXU | LSB Industries Inc. | General Building Materials | Here | 5.86% | 5.59 | 43.52 |

| CCIX | Coleman Cable, Inc. | Industrial Electrical Equipment | Here | 8.80% | 3.37 | 11.37 |

| SAPE | Sapient Corp. | Business Software & Services | Here | 2.60% | 6.47 | 13.79 |

| IMMR | Immersion Corporation | Computer Peripherals | Here | 2.17% | 6.23 | 8.02 |

| WCG | WellCare Health Plans, Inc. | Health Care Plans | Here | 5.81% | 2.97 | 47.33 |

| PSMT | PriceSmart Inc. | Discount, Variety Stores | Here | 6.58% | 2.07 | 44.86 |

| OFIX | Orthofix International NV | Medical Appliances & Equipment | Here | 4.69% | 3.57 | 36.62 |

| MHK | Mohawk Industries Inc. | Textile Industrial | Here | 4.49% | 2.83 | 67.48 |

| HOTT | Hot Topic Inc. | Apparel Stores | Here | 5.88% | 3.21 | 7.74 |

| UFS | Domtar Corporation | Paper & Paper Products | Here | 3.00% | 3.47 | 99.81 |

| SIRI | SIRIUS XM Radio Inc. | Broadcasting - Radio | Here | 2.30% | 2.78 | 2.22 |

| KLIC | Kulicke & Soffa Industries Inc. | Semiconductor Equipment & Materials | Here | 3.10% | 3.14 | 11.98 |

| CPA | Copa Holdings SA | Regional Airlines | Here | 3.77% | 2.84 | 64.48 |

| ONXX | Onyx Pharmaceuticals Inc. | Biotechnology | Here | 2.23% | 3.41 | 39.81 |

| SFUN | SouFun Holdings Ltd. | Internet Information Providers | Here | 2.42% | 2.15 | 26.2 |

| WMG | Warner Music Group Corp. | Entertainment - Diversified | Here | 0.37% | 48.93 | 8.18 |

| GPK | Graphic Packaging Holding Company | Packaging & Containers | Here | 0.53% | 2.63 | 5.69 |

| DPZ | Domino's Pizza, Inc. | Restaurants | Here | 2.38% | 2.04 | 21.94 |

| VRSN | VeriSign Inc. | Application Software | Here | 2.21% | 2.33 | 35.57 |

| GTXI | GTX Inc. | Biotechnology | Here | 0.37% | 2.36 | 5.4 |

| OXM | Oxford Industries Inc. | Textile - Apparel Clothing | Here | 0.78% | 2.01 | 36.18 |

| RDNT | RadNet, Inc. | Medical Laboratories & Research | Here | 0.75% | 2.15 | 4.03 |

| RAH | Ralcorp Holdings Inc. | Processed & Packaged Goods | Here | -0.25% | 2.58 | 90.34 |

| VCIT | Vanguard Interm-Tm Corp Bd Idx ETF | Exchange Traded Fund | Here | -0.02% | 2.24 | 80.87 |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in