Daily Bars

Prepared by Jamie Saettele, CMT

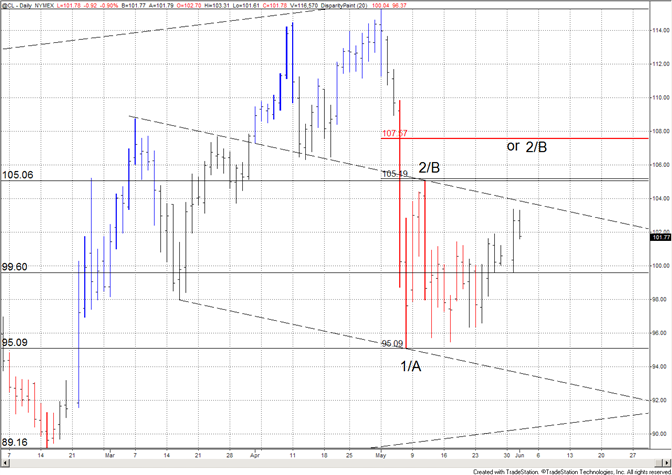

“The break higher may be from a wave b of B triangle. The implications are for a sharp c of B rally (to complete wave B) towards 105.06. I would be a seller in the event of a rally to there.” Continue to look higher as long as price is above 99.60. A drop below there would negate the short term bullish structure.

Support/Resistance Index (M,W,D) – (6), 2, 2

Jamie Saettele publishes Daily Technicals every weekday morning, COT analysis (published Monday), technical analysis of currency crosseson Wednesday and Friday (Euro and Yen crosses), and intraday trading strategy as market action dictates at the DailyFX Forex Stream. A graduate of Bucknell University, he holds the Chartered Market Technician (CMT) designation from the Market Technician Association. He is the author of Sentiment in the Forex Market. Send requests to receive his reports via email to jsaettele@dailyfx.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.