Meme highlighting how the WHO skipped two Greek letters in naming the latest COVID variant: Nu to avoid confusion with "new", and Xi to avoid embarrassing China's President Xi Jinping.

Fear Of Another Lockdown

As the chief economist of First Trust Portfolios pointed out, the contrast between the market meltdown on Friday and college football attendance on Saturday suggests people aren't afraid of the new COVID variant as much as they are of the government's possible response to it.

At least one expert shared college football fans' lack of fear about the new COVID variant. Physician and virologist Peter Hotez, of Baylor University's School of Tropical Medicine, noted that initial reports indicate Omicron isn't worse than Alpha or Delta.

Motivations For Another Lockdown

In its post on Goldman Sachs's note on Omicron (Goldman Slams Omicron Panic), ZeroHedge pointed out a few possible attractions of another lockdown for for politicians:

Alas, that would not help politicians who kill a lot of birds with just one brand new and "horrifying" variant, including getting a carte blanche for trillions in new vote-buying stimmies, enforcing even more ruthless and authoritarian government restrictions a dream come true for all liberal fans of big government, and most importantly forcing another round of mail-in ballot elections one year from today.

Another possible motivation would be to temporarily cool down inflation, particularly gas prices. But politicians would be betting that another lockdown will anger voters less than the current wave of inflation, which was largely caused by the last lockdown.

Investment Considerations

Goldman Sachs said in its note that "we do not think that the new variant is sufficient reason to make major portfolio changes". We would agree with that.

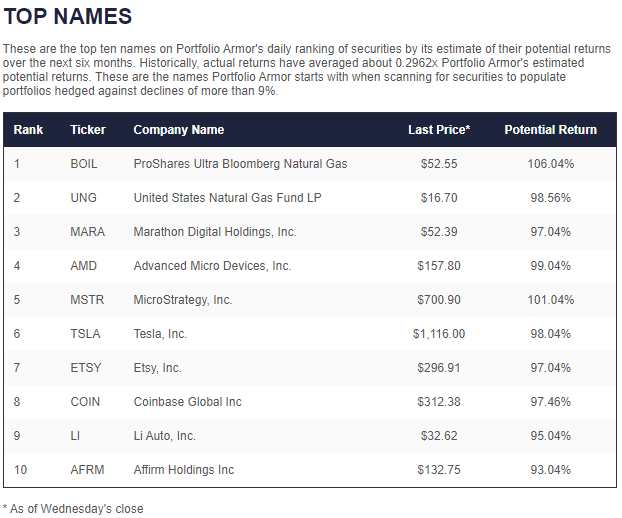

As regular readers may recall, our system gauges stock and options market sentiment to estimate potential returns over the next six months for thousands of securities each day the market is open, and posts its top ten names from that ranking on our website and our app. On Wednesday, these were our system's top names.

Screen capture via Portfolio Armor on 11/24/2021.

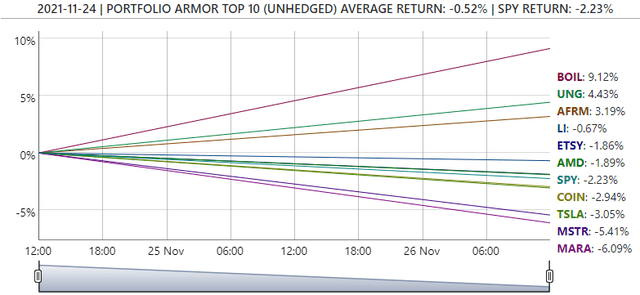

On Friday, that top ten was down, but less than the market.

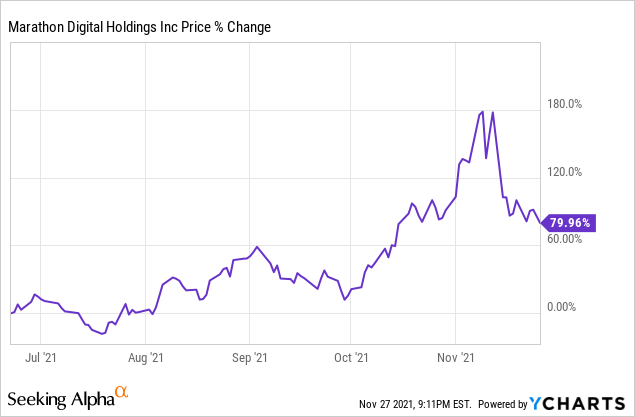

If you agree with Goldman Sachs that the market rally is likely to continue, and you're looking to add a position here, you might consider Marathon Digital Holdings, Inc. MARA, the worst performer so far from our 11/24 top names cohort. As we noted in our previous post (A Bitcoin Miner Buying Opportunity), we first wrote about MARA here in June. Since then, it's up about 80%, but it's had a significant pullback this month.

As always, we suggest that if you buy one of our top names, you consider hedging in case we end up being wrong, or the market goes against us. You can use our site or our iPhone app to scan for optimal hedges.

Top Names Performance Update

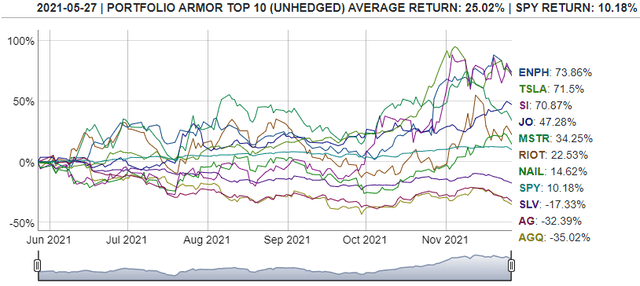

After six months, we post the final performance of one top names cohort per week on our website. Here's the final performance of our May 27th top names.

On average, they were up 25.02%, versus 10.18% for SPY over the same time frame. Outperformance by Enphase Energy, Inc. ENPH, Tesla, Inc. TSLA, and Silvergate Capital Corporation SI more than made up for negative returns from silver names.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.