RODNAE Productions/Pexels

Using A Bitcoin ETF To Hedge Bitcoin Exposure

Back in October, when options first started trading on the ProShares Bitcoin Strategy ETF BITO, we wrote a post about using it to hedge bitcoin exposure (A New Way To Hedge Bitcoin Exposure). At the time, Bitcoin BTC/USD was trading near its all time highs, so we addressed the question of why bulls ought to consider hedging it:

Why Hedge If You're Bullish On Bitcoin?In a nutshell, because Bitcoin is likely to have another steep pullback in the future, and if you own puts on the Bitcoin Strategy ETF when it tanks, you'll have dry powder in the form of appreciated put options to buy more of the ETF, or more Bitcoin itself.

Finding Optimal Hedges On BITO

In the video below, we used our iPhone app to demonstrate how to scan for optimal hedges on the Bitcoin Strategy ETF.

How Hedging Helped Bitcoin Longs

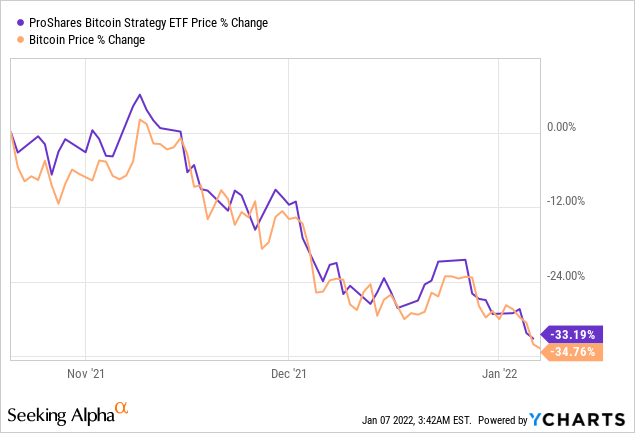

Since we posted that video, both Bitcoin and the ProShares Bitcoin Strategy ETF have lost about a third of their value.

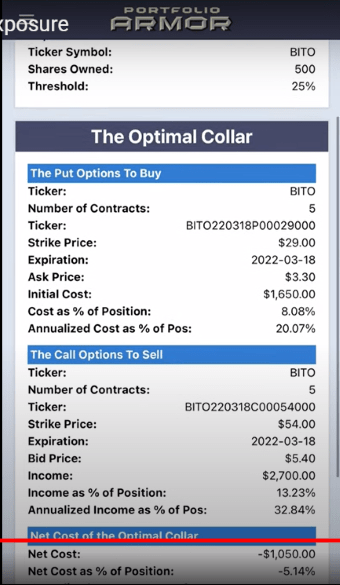

Let's look at how far down you'd be if you had held bitcoin or the ETF tracking it and hedged. This was an optimal collar we presented to hedge against a greater-than-25% decline in 500 shares of BITO by March 18th, 2022 while not capping your upside at less than 30% over the same time frame.

The net cost of that hedge was negative, meaning you would have received a net credit of $1,050, or 5.14% of position value when opening the collar. If you hedged that way, on October 21st you had $20,415 in BITO, $1,650 in puts, and if you wanted to sell-to-close your short call position, it would have cost you $2,700 to do so. So your net position value was ($20,415 + $1,650) - $2,700 = $19,365.

As of January 6th, your BITO shares were worth $13,640, your put options were worth $2,400, and your call options were worth $112.50, so your net position value was ($13,640 + $2,400) - $112.50 = $15,928. So you were down about 17.8% instead of being down 33.19%.

Hedging Out To 2024

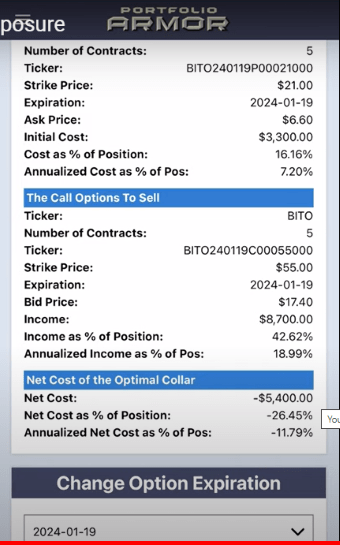

In that video, we also showed a hedge with the same parameters except that the expiration date went out to January 19th of 2024. Let's look at how that one would have protected you.

Net position value on October 21st: ($20,415 in BITO + $3,300 in puts) - $8,700 in calls = $15,015.

Net position value on January 6th: ($13,640 in BITO + $3,675 ) - $2,835 = $14,480. So you were down about 3.6% instead of being down 33.19%.

The comparison between the effects of the two hedges is a good illustration of the impact of time value on hedging with negative cost, or credit collars.

What To Do Now

That depends on what your prediction is for bitcoin's trajectory from here. If you're a long term bull, you can buy-to-close the short call leg of your collar to eliminate the upside cap. If you don't think bitcoin has much further to fall, you could even sell your appreciated puts and buy more of it. On the contrary, if you're now bearish on the original cryptocurrency, you can close out your positions for a (much, in the case of the second hedge) smaller loss than you'd have if you weren't hedged.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.