By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

The major currency pair is consolidating around 1.1360 at the beginning of the week. Global markets are a bit calmer today than usual – the US is celebrating Presidents’ Day.

At the same time, there is a local demand for the “greenback” at times of geopolitical escalations. Investors use the American currency as a “safe haven” asset.

Later this week, there will be some interesting macroeconomic reports, for example, the US GDP for the fourth quarter of 2021, and also the data on durable goods orders and personal spending/income.

In addition to that, financial markets remain very sensitive to any comments that come from politicians.

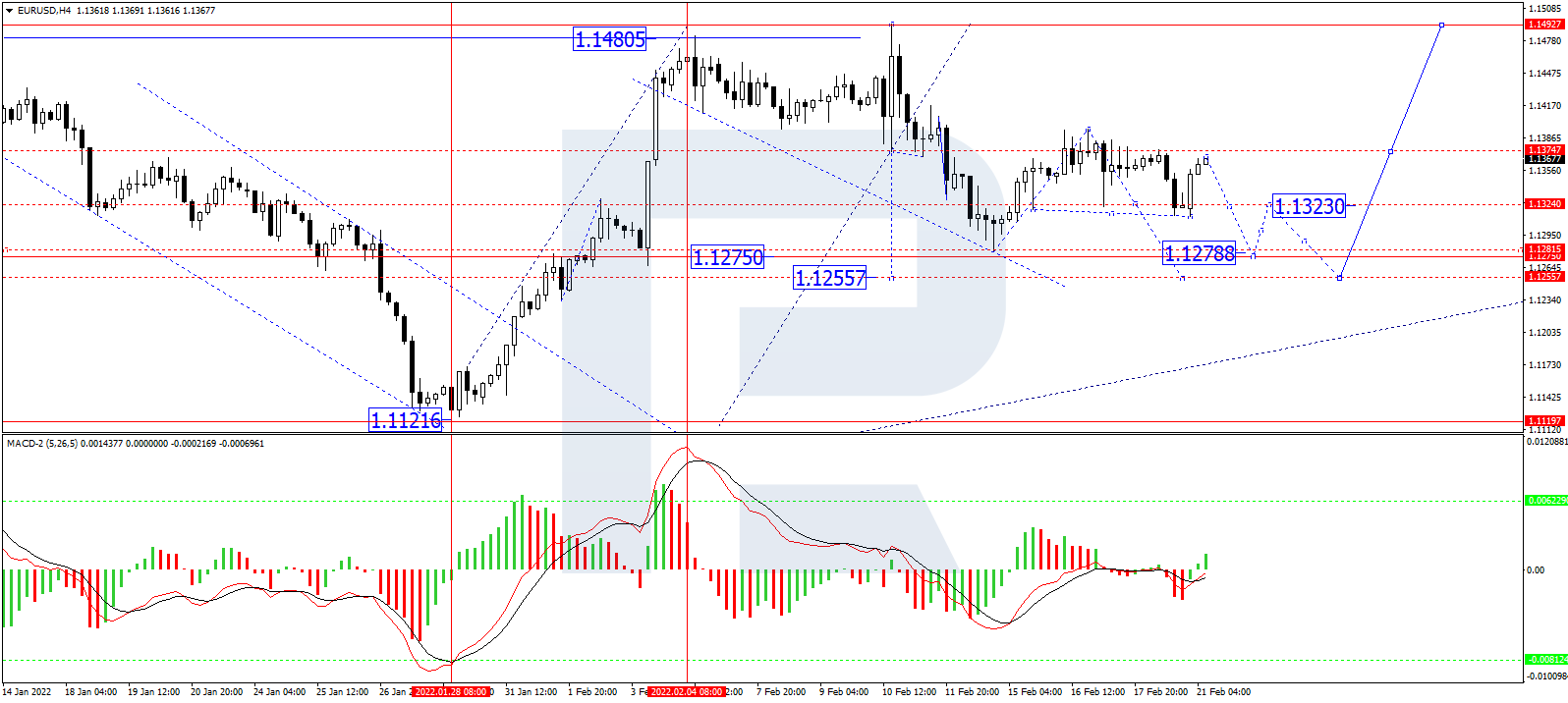

In the H4 chart, having finished another descending wave at 1.1313 along with the correction towards 1.1360, EUR/USD is consolidating below the latter level. If later the price breaks this range to the upside, the market may start another growth towards 1.1404 and then resume falling to break 1.1330. After that, the instrument may continue trading downwards to reach 1.1255 and then form one more ascending wave with the target at 1.1500. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is growing to break 0 and then continue moving towards new highs.

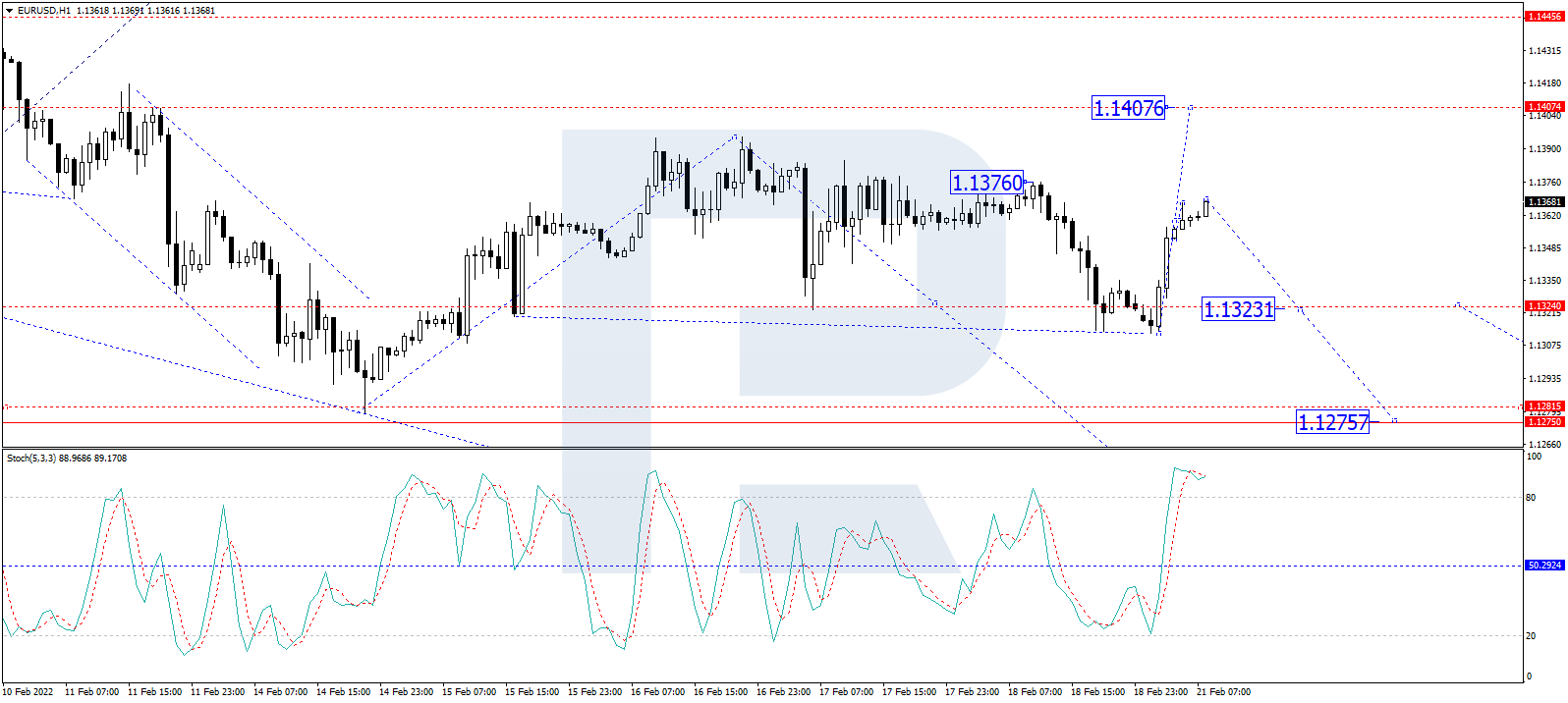

As we can see in the H1 chart, after rebounding from 1.1313, EUR/USD is forming a new ascending impulse and may soon reach 1.1360. After that, the asset is expected to consolidate around the latter level and break the range upwards to reach 1.1390. Later, the market may resume falling to return to 1.1360 and then start another growth towards 1.1404. In the future, the instrument may form a new descending wave with the target at 1.1330. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving above 80 and may resume falling to reach 50. Later, the line may rebound from 50 and start a new growth to return to 80.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.