Ride of the "Volkeries"

Credit Suisse Managing Director Zoltan Poszar offered a stark warning to investors in his latest note, likening what the Fed has in mind for the stock market to the Air Cavalry's attack on the hapless village in Apocalypse Now.

Before we get to Pozsar's analysis, a bit about his background, for those unfamiliar with him. Prior to joining Credit Suisse in 2015, Poszar worked at the U.S. Department of the Treasury where he developed a framework to monitor risk and collateral intermediation activities in the financial eco-system and evaluate their impact on macro-financial conditions. He was also the Treasury’s liaison to the Financial Stability Board on matters of financial innovation. Prior to that, he worked at the Federal Reserve Bank of New York, where he led the effort that backstopped the securitization of markets in the aftermath of Lehman, and pioneered the mapping and understanding of the shadow banking system.

Here are Pozsar's key points.

Forget The Fed's Official Dual Mandate

The Fed's dual mandate, of course, is to control inflation and maximize employment. In addition, as Poszar notes, it's tasked with ensuring financial stability (as during 2008). Poszar says that inflation is so bad now, and the Fed is so far behind the curve, that only fighting inflation matters to it now. Poszar quotes a recent statement by President Biden saying fighting inflation is his top economic priority and expressing support for the Federal Reserve to point out that the Fed has the political license to do whatever it takes to rein in inflation.

Poszar doesn't mention it, but the outcome of November's midterm elections being considered largely a fait accompli also would seem to give the Fed license: if the incumbent party is already predicting doom, the Fed can't be blamed for it.

The Fed Needs Stocks to Fall

This is what they actually mean when they talk about the need to "tighten financial conditions". In support of this claim, Poszar cites a Bloomberg column by his former boss, former NY Fed President Bill Dudley, ominously titled, "If Stocks Don't Fall, The Fed Needs To Force Them". The Fed also needs real estate to fall and (more controversially), unemployment to rise, per Poszar.

This all makes sense intuitively, if you think about it. You just need to invert the status quo since the Fed last conquered inflation in the early '80s under Paul Volker. After that, and up until the COVID lockdowns, the Fed's primary concern was deflation, rather than inflation. In a deflationary environment, consumers are hesitant to spend, because they're waiting for prices to drop further. That, in turn, can fuel more deflation. One way to encourage consumers to spend is though the wealth effect. If they see their IRAs and 401(k)s balances rise, they feel richer, and are more inclined to spend money.

If rising stocks make consumers want to spend more, heating up inflation with their demand, what would make them want to spend less, cooling inflation down? Correctamundo, readers: falling stocks is the answer. How much will they need to fall? After saying he won't offer a precise target, Poszar offers this guidance:

At 4,000, the Fed does not seem content, and in the grand scheme of things, this is where the Fed would change its tune if it would still be writing a put. At 3,500, we would have lost all of the post -pandemic gain s in market wealth, but that level for stocks still feels like a put option, just with a lower strike price. At 2,500, we would lose not only all of the post -pandemic gain s, but would eat into some of the pre -pandemic gains too. And if something indeed happened to the supply of labor post -pandemic (and some of that is wealth related), then to cool price pressures, maybe a pre -pandemic wealth level is appropriate indeed.

The Commodity Question

One question left unanswered by Zoltan is how effective the Fed will be in limiting commodity spikes in the near term. My guess is: not very, for two reasons. First, because commodity prices aren't driven just by demand side inflation but also by supply side inflation: hangovers from the lack of production during the COVID lockdowns, and shortages as a result of the war in Ukraine and the sanctions in response to it. And second, because demand so far seems fairly inelastic despite the spikes, judging from lines at Costco when I go to fill up my car at record gas prices.

Investment Considerations

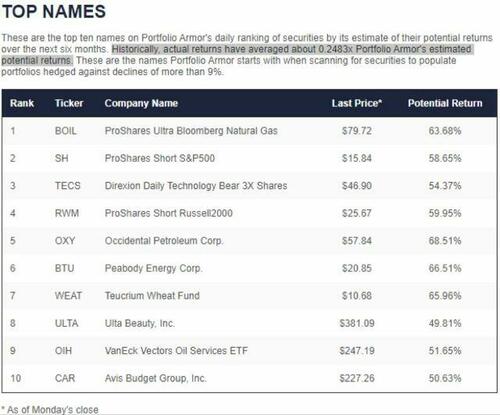

If Poszar is right, it would seem you'd want to be short stocks now, with the possible exception of companies benefiting from demand-side inflation like oil majors. With that in mind, take a look at Portfolio Armor's top ten names from May 9th.

Screen capture via Portfolio Armor on 5/9/2022.

As regular readers know, our system doesn't consider the macro picture when selecting its top names. Instead, it gauges stock and options market sentiment to estimate which securities are likely to perform the best over the next six months. Nevertheless, that bottoms-up approach often paints a clear picture, and the one it painted last Monday seems fairly well aligned with Poszar's thesis: Three of our top ten names were bets against stocks: the ProShares Short S&P500 SH, Direxion Daily Technology Bear 3X Shares TECS, and ProShares Short Russell2000 RWM. Five of the other seven top ten names were in the commodity space: ProShares Ultra Bloomberg Natural Gas BOIL, Teucrium Wheat Fund WEAT, VanEck Vectors Oil Services OIH, Occidental Petroleum Corp. OXY, and Peabody Energy Corp. BTU.

What About Those Last Two?

OXY and BTU are stocks, so it's a reasonable question whether they'll fall too if Poszar's right. I don't know, but it's worth noting that both of those stocks have forward P/E ratios in the low-to-mid single digits now. So, despite their recent run-ups, on a valuation basis they're both pretty cheap already.

How Those Top Names Are Doing So Far

On average, last Monday's top ten are up 6.55% versus SPY which was up 0.48% over the same period.

With SPY up, the three short names, SH, TECS, and RWM were unsurprisingly down, but if Poszar's right, they should do well over the next several months. As always, we suggest that if you buy one of our top names, you consider hedging in case we end up being wrong, or the market goes against us.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.