The number of gamma squeezes throughout the market is continuing to decrease with current totals standing at 1,451; down from the recent heights of 2,500 at the start of March, 2023, and the record-breaking peaks of over 3,000 in June and September, 2022. A decreasing number of gamma squeezes is associated with future bullish market performance.

When an individual equity experiences a gamma squeeze, the most common outcome is a drop in price nearing 5% prior to recovery. In other words, knowing when a gamma squeeze starts or ends can prove price-predictive for any equity.

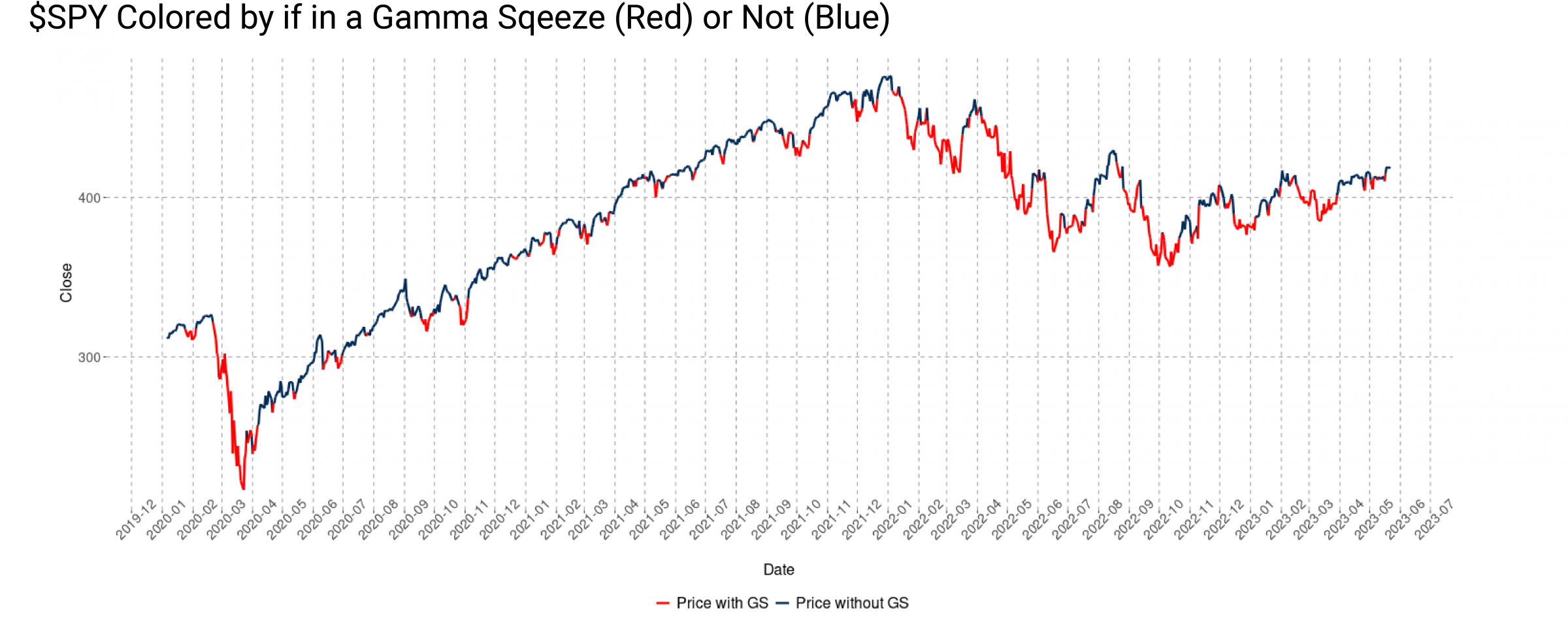

A gamma squeeze’s consequences extend from the individual equity to ETFs as well. For instance, when SPY is in a gamma squeeze, its average decline in price is -3.19% (median: -1.74%) versus when $SPY is not in a gamma squeeze, its average move (until the next gamma squeeze) is 5.51% (median: 4.28%).

Extending this effect from ETFs to the market-at-large is straight forward due as well, due to the instability that gamma squeezes provide to the market (by way of forcing options dealers to sell when the price lowers and buy when the price rises) when in aggregate. The market is most performant when both the number of gamma squeeze is low, and when the growth-rate is negative (that is, when more gamma squeezes are being closed rather than opened).

Recently, the market has acquired both states: the number of gamma squeezes has been decreasing with current counts below the 2-week average (1,560), and the number of gamma squeezes that are closing is greater than the number of gamma squeezes that are opening. These two data prints point towards a higher S&P 500.

Financial disclaimers: The author holds long positions on the S&P 500.

Deep Dive Stocks serves to provide statistically significant data about the stock market, including daily updates to the number of gamma squeezes throughout the market. More information can be found at https://deepdivestocks.com.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.