The Dogs of the Dow

What is it?

The Dogs of the Dow is an investing strategy that focuses on investing in the top 10 highest dividend-yielding stocks in the Dow Jones 30 index every single year. The Dow Jones Industrial Average Index, also known as The DIJA or just “The Dow”, is an index of only 30 large companies, weighted by price. The index is the 2nd oldest among US market indices and was created by Mr. Charles Dow, the editor of The Wall Street Journey and co-founder of Dow Jones & Company.

Here are some of the companies included in the Dow Jones.

- American Express Co AXP

- Apple Inc AAPL

- Boeing Co BA

- Caterpillar Inc CAT

- McDonald’s, MCD

- Johnson & Johnson JNJ

- Walt Disney Co. DIS

And 23 others.

Here’s How It Works

Companies listed on the Dow are determined to be “blue-chip stocks” meaning they’re well-established and financially sound businesses with market caps in the billions. These companies don’t alter their dividend policies very often, if at all.

Because dividend yield is a function of share price (see the formula below), when a stock’s yield is high, it could mean that its share price has fallen but the dividend has remained the same.

Essentially the Dogs of the Dow strategy aims to pick stocks with a high yield that are at or near the bottom of their business cycle (or share price), also known as undervalued companies. By consistently cycling through the top 10 stocks by dividend yield every year, the strategy states that the companies near the bottom of the business cycle will see their share price appreciate faster than other companies near the top of their business cycle.

This strategy works by providing investors with a high dividend yield (bang for your buck) coupled with upside growth potential in the share price. Put those two together and you have a solid wealth-building combination.

How To Implement The Strategy

Step 1: At the start of the year, an investor will allocate the capital they have in their portfolio to the top 10 yielding stocks of the Dow. If you have $100,000, then you would allocate $10,000 to each of the 10 stocks.

If you want a complete list filtered by dividend yield, click here.

Step 2: At the end of the year, re-evaluate the top 10 yielding stocks in the Dow. You should always re-allocate your funds evenly. For example, if at the end of the year, your portfolio is now worth $110,000 (an increase of 10%) then you would sell off the stocks and reallocate $1,000 to each of the new top 10 stocks.

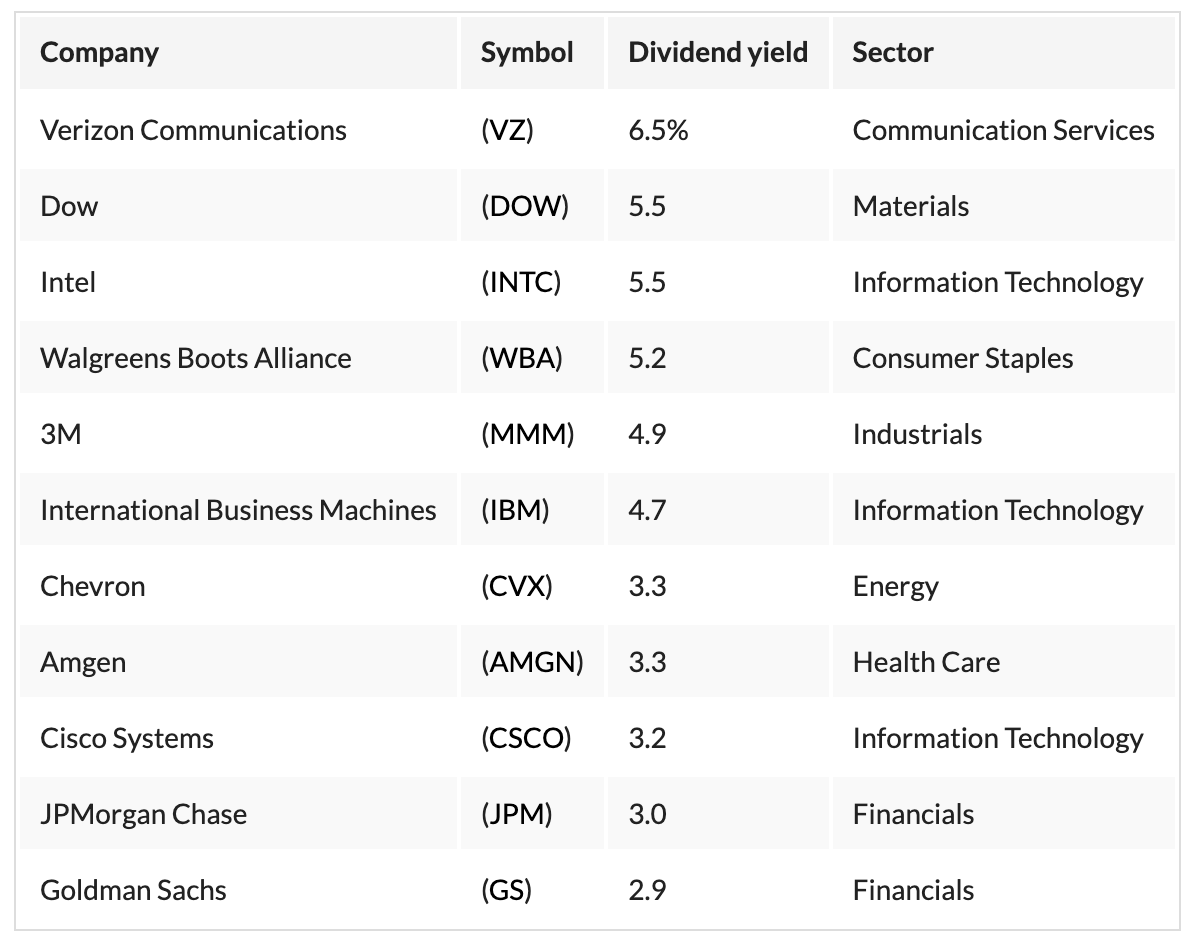

Here Is The Full List of The Dogs for 2023

How Did This Strategy Perform In 2022?

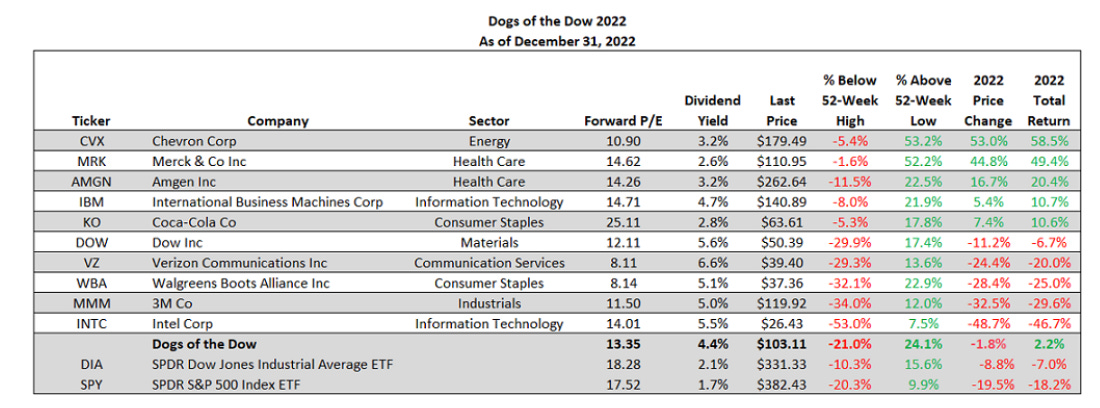

As you can see below, the Dogs of the Dow saw about 50% of the stocks increase in price, with the other 50% decreasing by as much as 46.7% (poor Intel).

With that being said, the 2022 Dogs of the Dow’s change in price was -1.8% as a whole, but the total return came out to 2.2% (including dividends).

Let’s face it, 2022 was a tough year in the stock market. But the Dogs of the Dow outperformed the S&P 500, which saw a -19.5% change in price in 2022 with a -18.2% total return (including dividends).

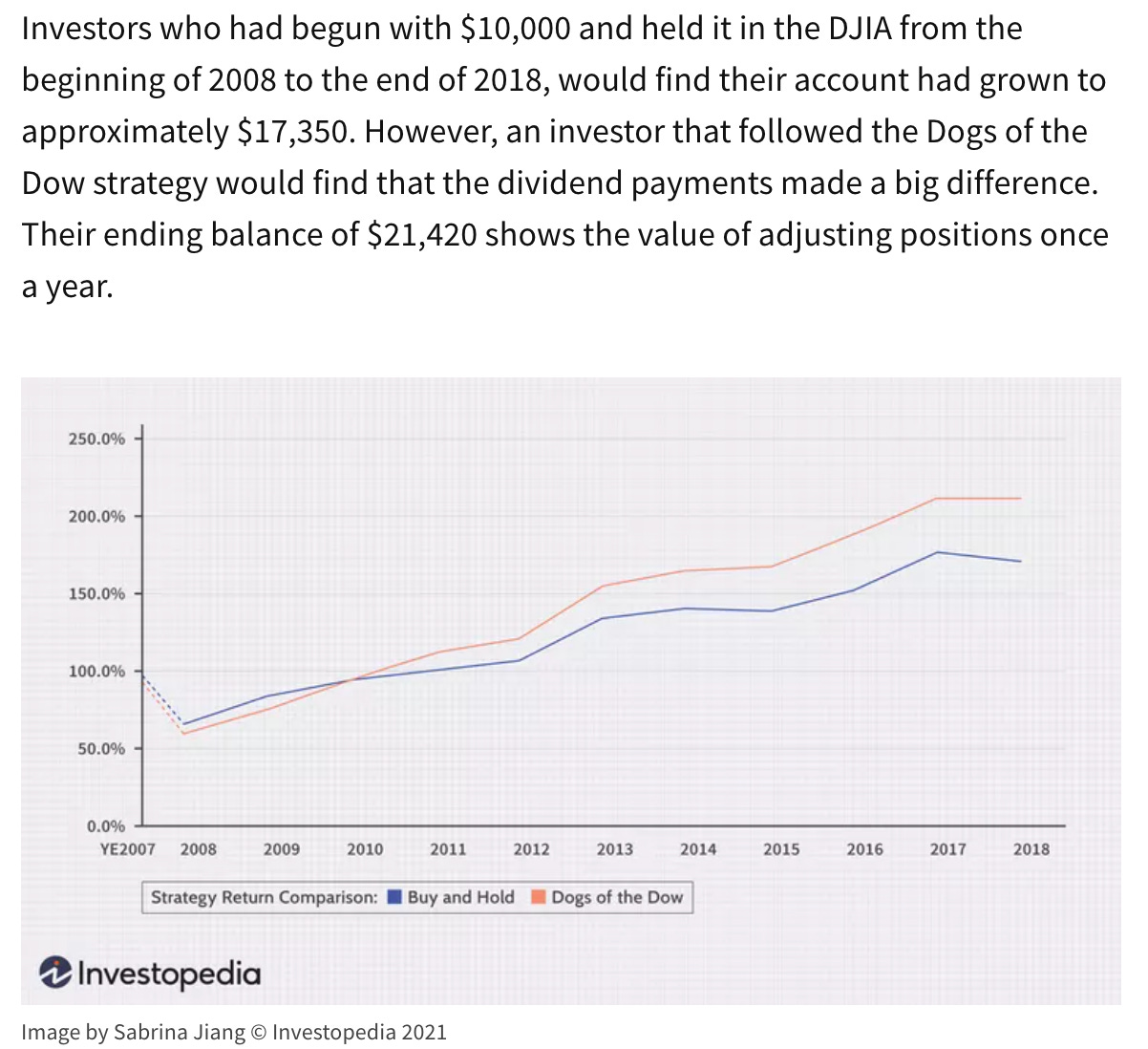

If you had invested $10,000 in the Dogs of the Dow from 2008-2018.

This is a simple strategy that requires very little maintenance or ongoing research. Just buy at the beginning of the year, hold, collect your dividends and reinvest everything you earn.

The strategy is very much hands-off but requires a bit more tolerance to risk as you are investing in individual companies so high volatility can very much be in effect.

If you enjoyed this post, you're going to love my weekly newsletter. I send out a post every Monday morning filled with actionable investing tips, up-to-date market news, portfolio management strategies, and more.

It's a 5-minute read that will make you a more well-rounded investor.

Click here to join 11,000+ future millionaires and sign up for a 14-day free trial.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.