Last week we concluded the central bank's policy decisions. The Federal Reserve has come out more hawkish than the market would have expected. The “higher for longer” seems to be crystallizing, reverting that bullish sentiment that had been building on the back of the soft landing narrative.

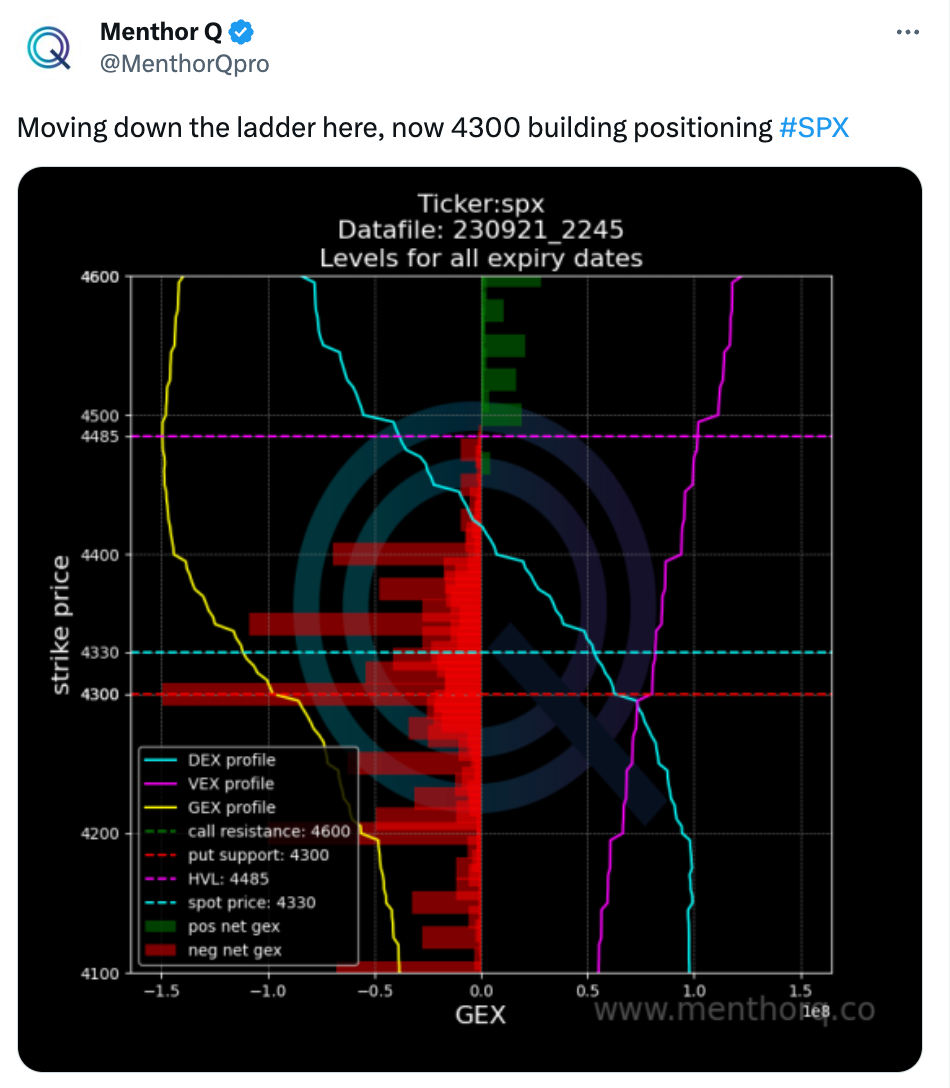

In terms of option chain positioning, we have had a series of negative days that drove the spot price right next to the Put Support Level. That is the level with the highest hedging activity. You can see in the below chart how close we are to that. The Q-Table shows the distance of spot price to the various key levels including the Put Support.

The 4400 level was a very important level that we had been pointing out for weeks. That level was important for two reasons. One because of the gamma positioning.

By looking at the Net GEX, for over a month we could see big gamma sitting there confirmed by increasing volumes and open interest.

Source: Menthor Q Liquidity Model

Menthor Q CTAs Positioning

The other important point to keep in mind, that 4400 had become an important trigger level for systematic funds. As you can see here for example, CTAs Funds were going long/short around that key level.

Once we broke below that level, CTAs started shorting aggressively the index accentuating that bearish move.

Source: Menthor Q Liquidity Model

What To Expect Next?

We clearly cannot predict the future, but what we can do is analyze the option chain to gauge sentiment.

What we know at this point is that we are definitely starting to see more accumulation around the 4300 strike level. We can see that by looking at the Net GEX.

Source: Menthor Q Liquidity Model

Macro Update

From a macro perspective, we can see that US bonds have been heavily shorted. That was the result of soft landing, central banks. The hard landing narrative will be driving bonds higher and yield lower, and that will be negative for stocks.

Oil has taken a hit, once again the macro headwinds are bearish on the assets in the short term. We had been talking about how it was over extended and needed a pull back. Earning season will be coming up, and that will be very important. So all in all, without going too deep on the macro front we have a fairly bearish scenario.

Yet, we are in the business of trying to understand those short term price movements. As we said earlier on, the market is very close to the Put Support Level.

That level is where the market is more hedged with Puts. So while 4300 is important, we are also aware that a technical move is possible. When spot hits the Put support levels, puts tend to get monetized/closed by investors.

An investor buys a put to hedge its portfolio. If the price goes against his length, he wants to be able to monetize those puts. That drives a repositioning for market makers.

Market makers are shorting to stay delta hedged in these cases. If those puts are rolled down, that is when we see the put support rolled over and bearish price action. Meaning, if the investors monetize the puts, but then rolled them down, let’s say to 4300, then price can follow down.

Yet, if the investors close the puts and don’t re-open them at lower levels, the market makers' repositioning will drive prices higher as market makers close the shorts.

To conclude, there are definitely bearish signs in the market. Yet, in the short term, we may see an upward move in the market, and as investors being able to read option data can give us a good advantage for our trading or risk management.

About the Publisher: Menthor Q is a leading TradeTech company that specializes in developing advanced quantitative models for active investors. The team is made of industry experts, and is dedicated to making the financial markets more accessible and understandable to active investors. Menthor Q's models leverage the power of Big Data and AI to offer actionable and operational models to retail investors. For more information about the publisher.

Disclaimer: Menthor Q LLC is a Publisher. We are not registered as a broker-dealer or financial advisor. The information, services, and materials published are purely for informational and educational purposes. It's important to note that Menthor Q LLC does not provide personalized recommendations, and any information provided should not be considered as such.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.