The Nasdaq 100 Index, often seen as the barometer of the U.S. tech sector’s health, is poised to conclude a remarkable year, marking its best performance in nearly a quarter of a century.

Let’s delve into the factors fueling this extraordinary surge, from the rise of artificial intelligence (AI) to the Federal Reserve’s pivotal role.

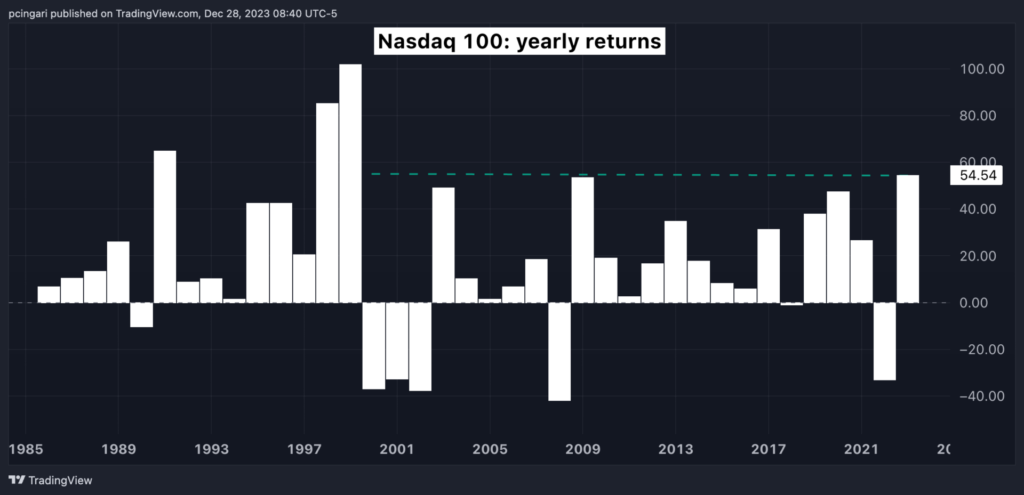

The index, which tracks the largest non-financial companies trading on the Nasdaq Stock Market, has seen a 55% increase in its performance since the start of the year, surpassing the 54% return in 2009.

To find a stronger annual return, you’d need to rewind to 1999, when the tech index soared by a staggering 102%, fueled by the exuberance surrounding the growth of tech stocks during the dot-com revolution.

Investors eagerly embraced the tech rally in 2023, injecting $8.6 billion into the tech-heavy Invesco QQQ Trust QQQ and a substantial $42.2 billion into the SPDR S&P 500 ETF Trust SPY, a stark contrast to the outflows observed in the previous year.

Chart: Strongest Year Since 1999

AI: The Catalyst Behind Nasdaq Boom

Industries like generative AI, natural language processing, computer vision, robotics, fintech, gaming, machine learning, and deep learning are all basking in the AI-driven growth of U.S. tech stocks.

It’s not surprising that among the top 25 best-performing stocks in 2023, six companies belong to the semiconductor industry, which has experienced an unprecedented surge in demand for chips.

Top 25 Performers In 2023

| Name | Industry | Price Chg. % (YTD) |

|---|---|---|

| NVIDIA Corporation NVDA | Semiconductors and Semiconductor Equipment | 238.1% |

| Meta Platforms, Inc. META | Interactive Media and Services | 197.3% |

| CrowdStrike Holdings, Inc. CRWD | Software | 144.3% |

| Advanced Micro Devices, Inc. AMD | Semiconductors and Semiconductor Equipment | 125.2% |

| Palo Alto Networks, Inc. PANW | Software | 113.2% |

| MongoDB, Inc. MDB | IT Services | 112.5% |

| Tesla, Inc. TSLA | Automobiles | 112.2% |

| DoorDash, Inc. DASH | Hotels, Restaurants and Leisure | 106.2% |

| Broadcom Inc. AVGO | Semiconductors and Semiconductor Equipment | 101.4% |

| Zscaler, Inc. ZS | Software | 101.0% |

| Intel Corporation INTC | Semiconductors and Semiconductor Equipment | 92.0% |

| Lam Research Corporation LRCX | Semiconductors and Semiconductor Equipment | 89.1% |

| Atlassian Corporation TEAM | Software | 88.8% |

| MercadoLibre, Inc. MELI | Broadline Retail | 87.9% |

| Amazon.com, Inc. AMZN | Broadline Retail | 82.5% |

| PDD Holdings Inc. PDD | Broadline Retail | 77.1% |

| Adobe Inc. ADBE | Software | 77.1% |

| Splunk Inc. SPLK | Software | 76.6% |

| Booking Holdings Inc. BKNG | Hotels, Restaurants and Leisure | 75.3% |

| Micron Technology, Inc. MU | Semiconductors and Semiconductor Equipment | 73.3% |

| Cadence Design Systems, Inc. CDNS | Software | 70.9% |

| Applied Materials, Inc. AMAT | Semiconductors and Semiconductor Equipment | 68.6% |

| Datadog, Inc. DDOG | Software | 68.1% |

| Netflix, Inc. NFLX | Entertainment | 66.7% |

| Marvell Technology, Inc. MRVL | Semiconductors and Semiconductor Equipment | 65.3% |

Federal Reserve’s Year-End Fireworks

The Federal Reserve, too, played a decisive role in the rally.

In the final months of 2023, Fed Chair Jerome Powell and fellow policymakers adopted a more accommodative stance, welcoming the declining trend in inflation and paving the way for potential interest rate cuts in 2024.

And the tech sector thrives when it anticipates lower future interest rates. U.S. Treasury yields have dropped significantly as the market started to price in a series of rate cuts in 2024, and stock investments became more attractive relative to bonds.

This development significantly boosted the valuations of technology sector companies.

These high-growth companies, often projecting cash flows well into the future, have seen their stock values rise primarily due to the effect of lower interest rates, which are used to discount their future revenues into the present. The lower the rate, the higher the current valuation.

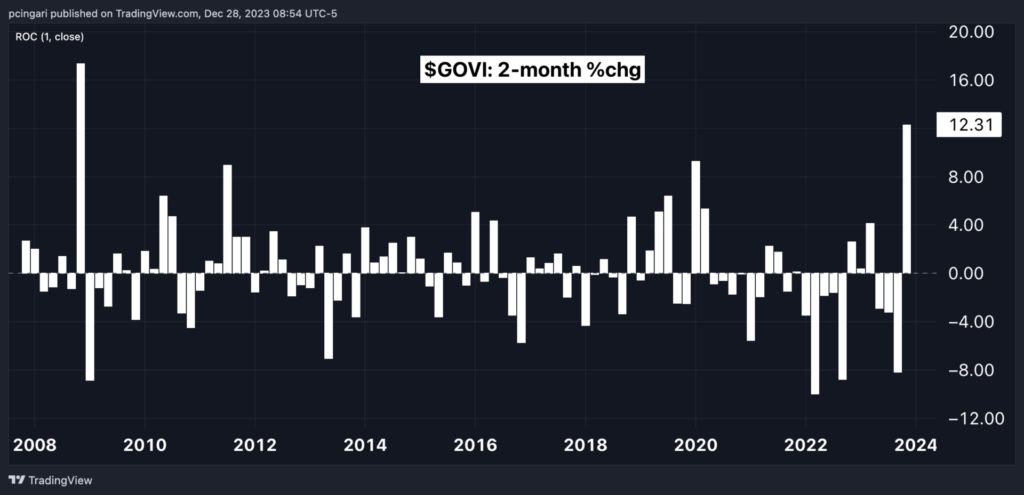

Treasury On Track For Strongest 2-Month Rally Since 2008

In tandem with the surge in technology stocks, the bond market has witnessed its most robust 2-month rally in over fifteen years.

The Invesco Equal Weight 0-30 Year Treasury ETF GOVI, representing an equally-weighted investment across various Treasury maturities, has posted an impressive 12.3% gain in the past two months.

To find a stronger two-month performance, you have to travel back to November 2008 when, following the collapse of Lehman Brothers, the flight to safe-haven Treasuries triggered a 17% surge over two months.

Read More: Treasury ETF And Real Estate Sector Rise Together As 30-Year Yields Dip Below 4%

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.