Alibaba Group Holding Ltd BABA and PDD Holdings Inc PDD stand as titans in China’s dynamic e-commerce arena.

They both operate with distinct business scales and trajectories that have shaped their market positions and investor sentiments.

But despite Alibaba’s commanding 50.8% market share in China’s e-commerce, recent developments have seen PDD surpassing it in market capitalization, underscoring a noteworthy shift in perceptions and market dynamics.

In terms of sheer scale, Alibaba towers over PDD in revenues, boasting over $125 billion in revenue across twelve months compared to PDD’s $27 billion. This difference is mirrored in revenue per share, where Alibaba doubles PDD’s figures, and Alibaba’s net income nearly triples that of PDD’s.

Alibaba, a seasoned player founded in 1999 by Jack Ma, faces uphill battles amid restructuring endeavors.

The abandonment of the cloud business spin-off and the pause in the supermarket unit’s listing, attributed partly to U.S. restrictions on chip exports, have impeded Alibaba’s restructuring efforts. The scrapped cloud IPO plans, management shakeup, and regulatory interventions reflect challenges for the company.

Related: Alibaba’s Future Hangs In Balance As Shares Drop 75% From 2020 High And Cloud IPO Cancellation

These recent setbacks have cast shadows on Alibaba’s once-dominant position. Douyin‘s success, akin to TikTok, and PDD’s appeal as a platform for bargain hunting, have posed challenges to Alibaba’s dominance.

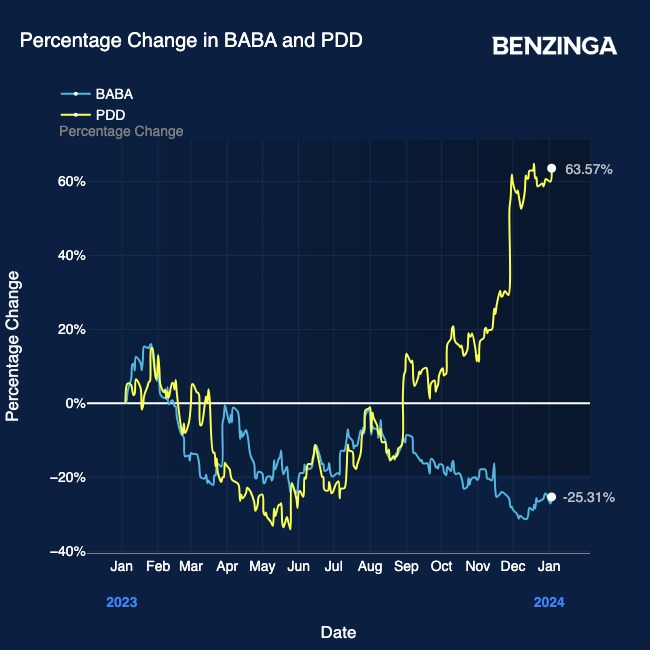

Alibaba’s stock value has consequently plummeted (chart above), signaling struggles exacerbated by regulatory crackdowns, economic slowdowns, and internal restructuring hurdles.

Related: Alibaba Hit with Billion Yuan Fine: JD.com Triumphs in Landmark Monopoly Lawsuit

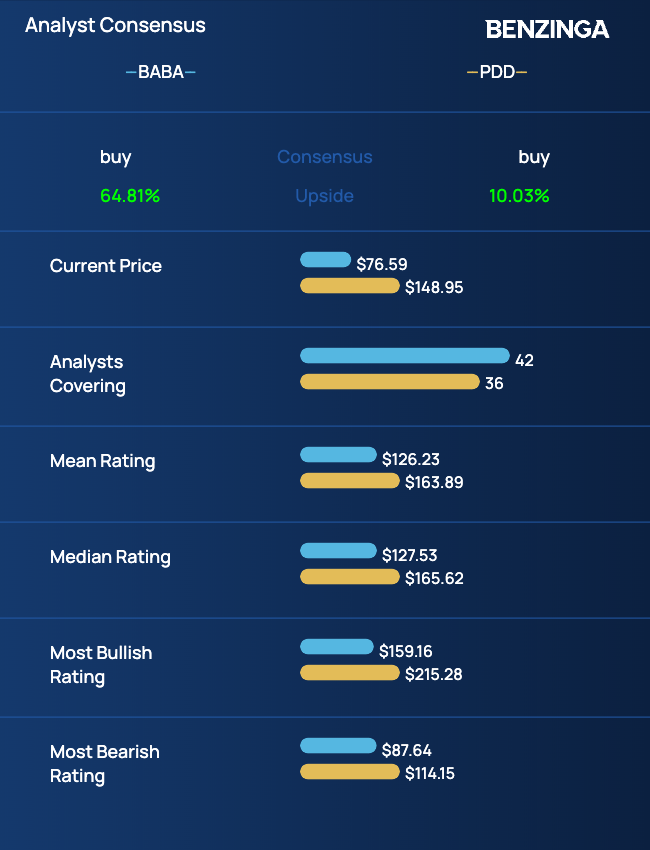

Conversely, Pinduoduo’s rise in market cap reflects its strategic forays into livestream sales and bargain-centric consumer preferences. However, on the valuation front, BABA appears to be trading in deep value territory relative to PDD.

As the dynamics continue to evolve, Alibaba’s journey to navigate these challenges will not only redefine its own trajectory but will also shape the narrative of the broader Chinese tech industry.

Now Read: China Vs. Emerging Markets: Opportunity Or Value Trap For Investors In 2024?

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.