By RoboForex Analytical Department

Gold prices have soared to an all-time high of 2288.00 USD per troy ounce, while silver reached its highest in two years, driven by speculation surrounding the US Federal Reserve's monetary policy. This surge followed comments from two Fed officials, Mary Daly of the FRB San Francisco and Loretta J. Mester of Cleveland. Both anticipate three rate cuts by the Fed in 2024, although they emphasised there is no immediate need for these adjustments.

The anticipation of a more accommodative monetary policy has been the primary driver behind gold's significant 11% price increase this year, demonstrating substantial gains for what is typically considered a conservative investment. However, this optimism is somewhat tempered by the current US economic data, which presents a complex backdrop for the timing of these expected rate cuts.

Investors and market watchers are now eagerly awaiting remarks from the US Fed Chair Jerome Powell, who is expected to provide further insights into the Federal Reserve's monetary policy outlook soon.

Precious metals traditionally benefit in low-interest-rate environments since they do not offer yields like interest-bearing assets. This dynamic underscores the current rally in gold and silver prices.

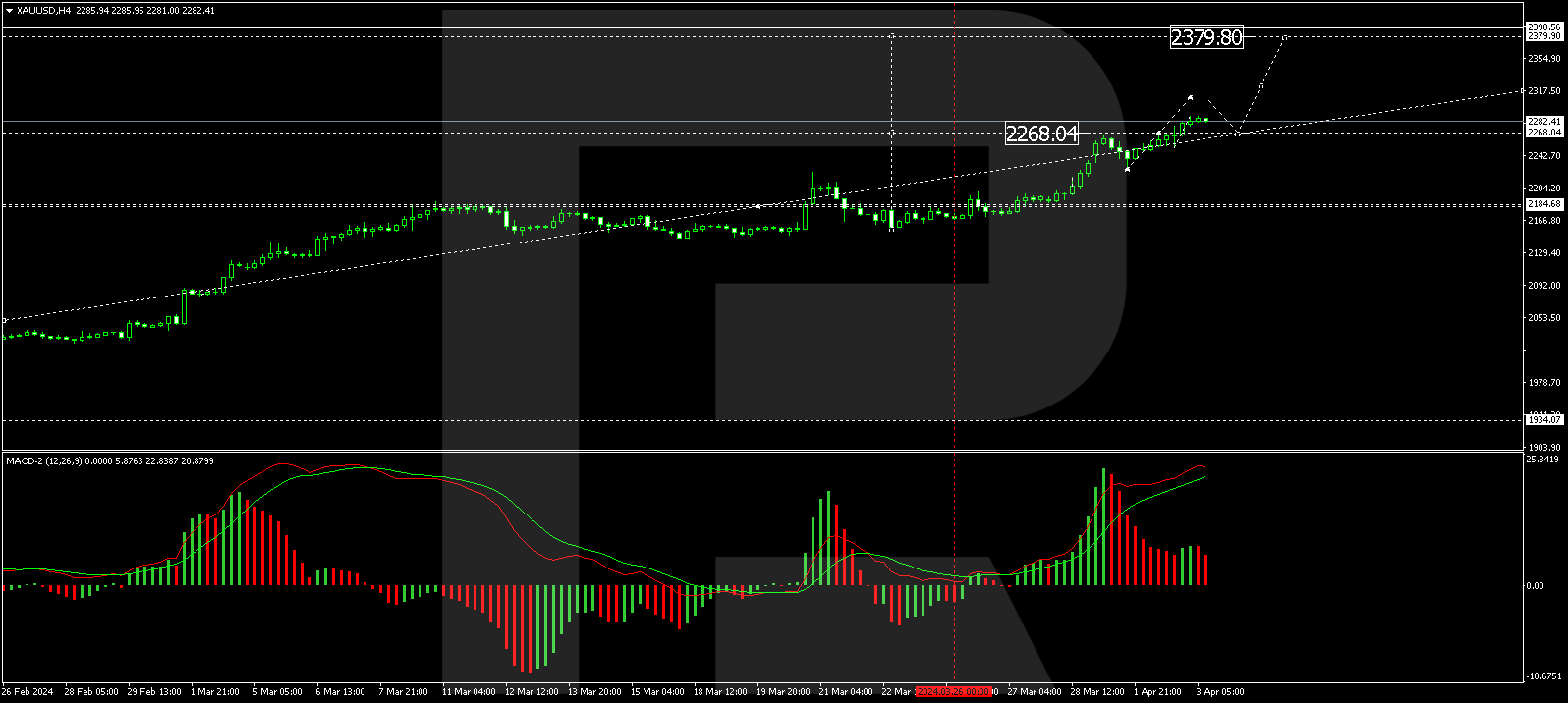

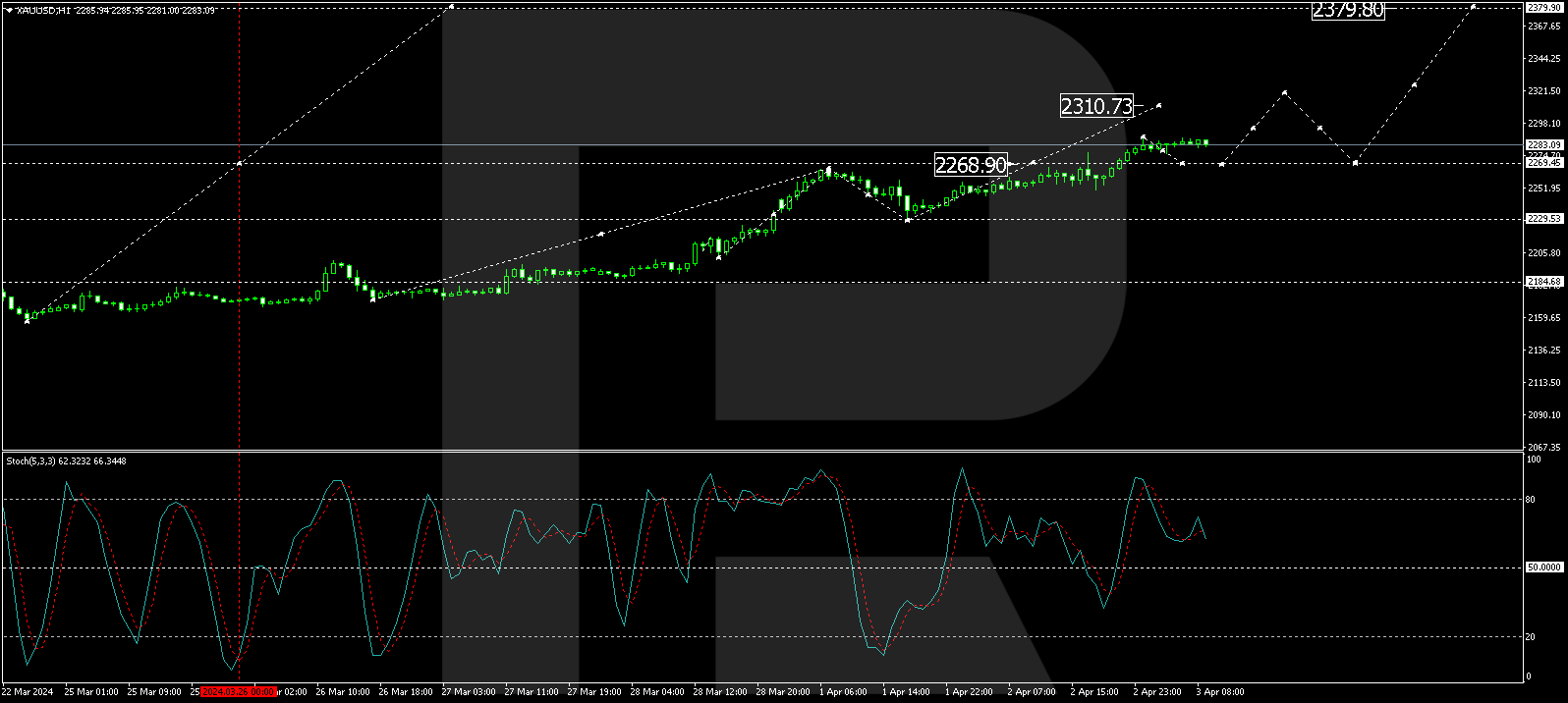

Technical analysis of XAU/USD

H4 chart analysis: the XAU/USD pair has corrected to 2230.00 USD and initiated a new upward wave targeting 2379.80 USD. Following this target, a correction towards 2270.00 USD is anticipated before the price potentially moves towards 2430.00 USD. The MACD indicator, with its signal line well above zero and trending upward, supports this bullish scenario.

H1 chart analysis: on the H1 chart, XAU/USD has experienced a growth wave, reaching 2266.80 USD, with the market updating this peak today. A consolidation phase around this level is expected, with a breakout potentially leading to a further rise to 2310.73 USD and possibly extending towards 2379.80 USD. The Stochastic oscillator, currently below 80 and poised to drop to 50 before rising again, aligns with this forecast.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.