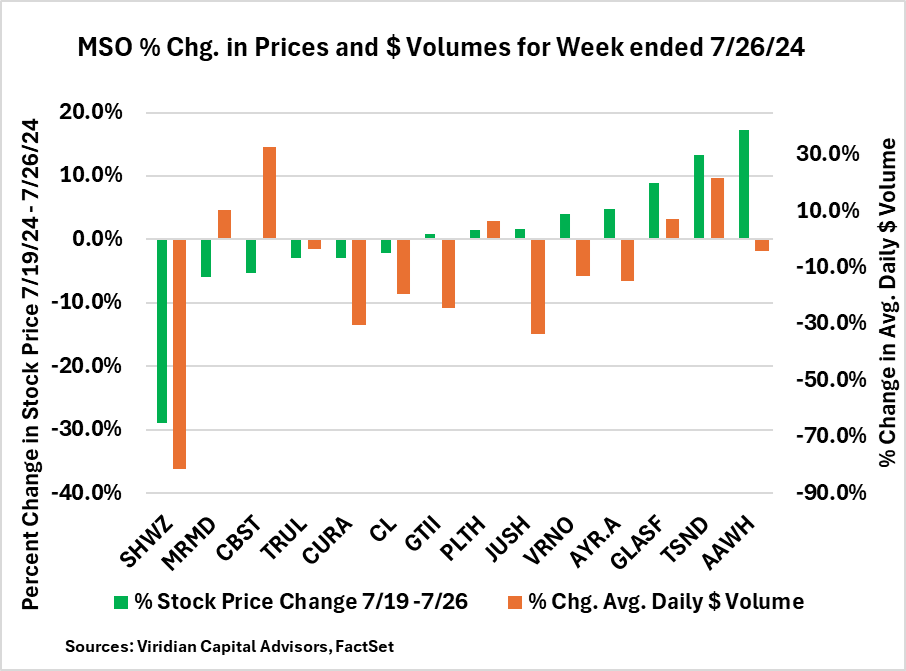

The Viridian Chart of the Week looks at the percentage changes in stock prices and average daily dollar volume from the week ended 7/19/24 to the week ended 7/26/24.

The green bars (measured on the left axis depict the percent price change from 7/19/24 to 7/26/24. The graph is arranged in increasing order of percentage price changes.

The orange bars (measured on the right axis) show the percentage change in average weekly dollar volume for the week ended 7/26/24 compared to the week ended 7/19/24.

The week had two major news stories: Joe Biden’s exit from the Presidential race and the end of the DEA comment period on rescheduling.

Most analysts, ourselves included, believed that both of these events were solidly positive for cannabis. Harris is thought to have a much better chance of beating Trump and is also considered to be a staunch cannabis advocate.

Similarly, the comment period for rescheduling ended, and reportedly, over 90% of the comments were pro-rescheduling. The industry worked its way into another Twitter firestorm over how rescheduling was on its way any day now.

Given these events, it seemed reasonable to expect a significant uptick in trading volume, propelling prices sharply higher.

But this is cannabis, where well-founded theories and expectations go to die. The average price increase percentage for the group was 0.2%, and the aggregate average daily trading volume was down nearly 14%. Six of the 14 companies had price declines, and 9 of the 14 had lower average dollar volume.

What went wrong? Cannabis investors have been burned too many times and are unwilling to bet on speculation. Will Harris be positive for cannabis? Who knows? It depends a lot on her winning, right? Similarly, no news is not good news when it comes to cannabis regulatory/legislative events. We’ll believe it when we see it.

Still, despite the lackluster reception, we continue to be bullish. No other sector offers the catalyst-driven capital appreciation potential that cannabis does. Just don’t expect this market to behave like you expect it to!

The green bars (measured on the left axis depict the percent price change from 7/19/24 to 7/26/24. The graph is arranged in increasing order of percentage price changes.

The orange bars (measured on the right axis) show the percentage change in average weekly dollar volume for the week ended 7/26/24 compared to the week ended 7/19/24.

The week had two major news stories: Joe Biden’s exit from the Presidential race and the end of the DEA comment period on rescheduling.

Most analysts, ourselves included, believed that both of these events were solidly positive for cannabis. Harris is thought to have a much better chance of beating Trump and is also considered to be a staunch cannabis advocate.

Similarly, the comment period for rescheduling ended, and reportedly, over 90% of the comments were pro-rescheduling. The industry worked its way into another Twitter firestorm over how rescheduling was on its way any day now.

Given these events, it seemed reasonable to expect a significant uptick in trading volume, propelling prices sharply higher.

But this is cannabis, where well-founded theories and expectations go to die. The average price increase percentage for the group was 0.2%, and the aggregate average daily trading volume was down nearly 14%. Six of the 14 companies had price declines, and 9 of the 14 had lower average dollar volume.

What went wrong? Cannabis investors have been burned too many times and are unwilling to bet on speculation. Will Harris be positive for cannabis? Who knows? It depends a lot on her winning, right? Similarly, no news is not good news when it comes to cannabis regulatory/legislative events. We’ll believe it when we see it.

Still, despite the lackluster reception, we continue to be bullish. No other sector offers the catalyst-driven capital appreciation potential that cannabis does. Just don’t expect this market to behave like you expect it to!

The Viridian Capital Chart of the Week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy. The Deal Tracker is a proprietary information service that monitors capital raise and M&A activity in the legal cannabis, CBD, and psychedelics industries. Each week the Tracker aggregates and analyzes all closed deals and segments each according to key metrics:

● Deals by Industry Sector (To track the flow of capital and M&A Deals by one of 12 Sectors - from Cultivation to Brands to Software) ● Deal Structure (Equity/Debt for Capital Raises, Cash/Stock/Earnout for M&A) Status of the company announcing the transaction (Public vs. Private) ● Principals to the Transaction (Issuer/Investor/Lender/Acquirer) Key deal terms (Pricing and Valuation) ● Key Deal Terms (Deal Size, Valuation, Pricing, Warrants, Cost of Capital) ● Deals by Location of Issuer/Buyer/Seller (To Track the Flow of Capital and M&A Deals by State and Country) ● Credit Ratings (Leverage and Liquidity Ratios) Since its inception in 2015, the Viridian Cannabis Deal Tracker has tracked and analyzed more than 2,500 capital raises and 1,000 M&A transactions totaling over $50 billion in aggregate value.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving—don’t get left behind!

Curious about what’s next for the industry and how to stay ahead in today’s competitive market?

Join top executives, investors, and industry leaders at the Benzinga Cannabis Capital Conference in Chicago on June 9-10. Dive deep into market-shaping strategies, investment trends, and brand-building insights that will define the future of cannabis.

Secure your spot now before prices go up—this is where the biggest deals and connections happen!