Expedia Group, Inc. EXPE reported better-than-expected third-quarter adjusted EPS results on Thursday.

Expedia Group reported quarterly earnings of $6.13 per share which beat the analyst consensus estimate of $6.04 per share. The company reported quarterly sales of $4.06 billion which missed the analyst consensus estimate of $4.11 billion.

“Our third quarter results exceeded our expectations on gross bookings and earnings with revenue landing in-line. We accelerated bookings growth in our consumer business for the second consecutive quarter, and our advertising and B2B businesses continue to deliver strong double-digit growth,” said Ariane Gorin, CEO of Expedia Group.

Expedia shares gained 4.8% to trade at $182.45 on Friday.

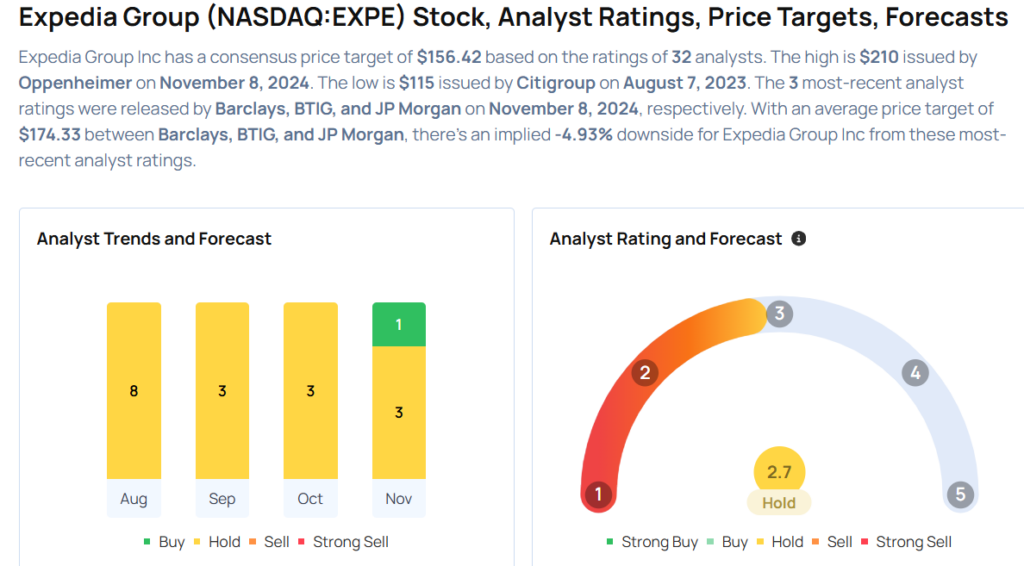

These analysts made changes to their price targets on Expedia following earnings announcement.

- Benchmark analyst Daniel Kurnos maintained Expedia with a Buy and raised the price target from $180 to $200.

- Wedbush analyst Scott Devitt maintained the stock with a Neutral and raised the price target from $130 to $180.

- Oppenheimer analyst Jed Kelly maintained the stock with an Outperform and raised the price target from $155 to $210.

- JP Morgan analyst Doug Anmuth maintained Expedia Group with a Neutral and raised the price target from $135 to $170.

- BTIG analyst Jake Fuller maintained the stock with a Buy and boosted the price target from $175 to $200.

- Barclays analyst Trevor Young maintained Expedia with an Equal-Weight and raised the price target from $134 to $153.

Considering buying EXPE stock? Here’s what analysts think:

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.