Spotify Technology S.A. SPOT reported downbeat earnings for its third-quarter on Tuesday.

Spotify reported quarterly earnings of $1.46 per share, which missed the analyst consensus estimate of $1.76. The company reported quarterly sales of $3.99 billion which missed the analyst consensus estimate of $4.02 billion and is an increase over sales of $3.65 billion from the same period last year.

"The business delivered strong third quarter results, as all of our KPIs met or exceeded guidance and profitability reached record levels," the company wrote in a letter to shareholders.

Spotify shares gained 2.2% to close at $419.39 on Tuesday.

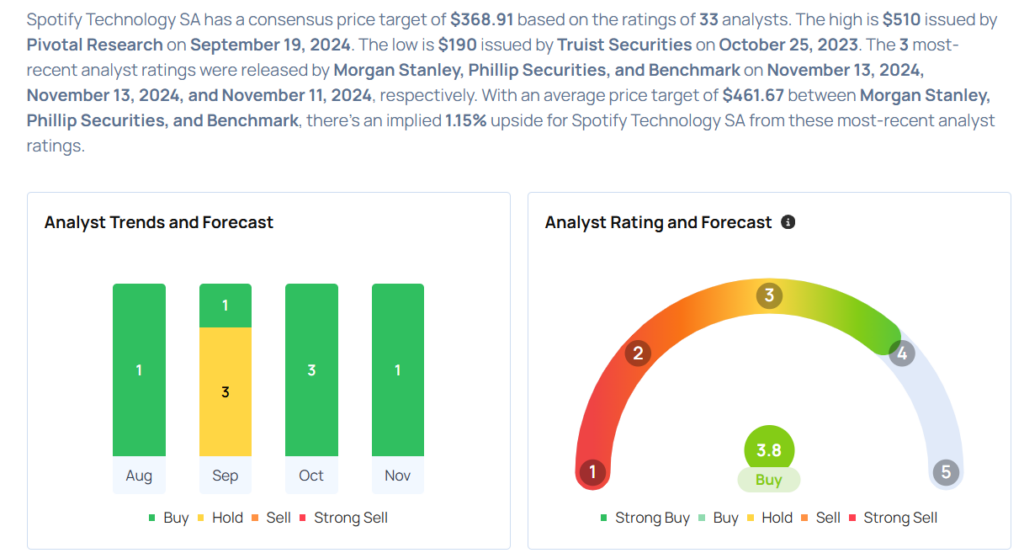

These analysts made changes to their price targets on Spotify following earnings announcement.

- Phillip Securities analyst Jonathan Wolleben downgraded Spotify Technology from Buy to Accumulate and raised the price target from $420 to $485.

- Morgan Stanley analyst Manan Gosalia maintained Spotify with an Overweight and raised the price target from $430 to $460.

Considering buying SPOT stock? Here’s what analysts think:

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.