Alight, Inc. ALIT reported better-than-expected third-quarter sales results and issued fourth-quarter adjusted EPS guidance with its midpoint above estimates on Tuesday.

Alight posted adjusted earnings of 9 cents per share, in-line with market estimates of 9 cents per share. The company's quarterly sales came in at $555.000 million versus expectations of $539.685 million.

“Alight delivered third quarter results that exceeded our expectations on both revenue and profitability,” said CEO Dave Guilmette. “As the market-leading services provider for employee benefits and wellbeing, Alight is uniquely positioned to guide the world’s largest and most complex clients on their people strategy journey. The value we now bring as a simplified company is driving momentum in our go-to market strategy and delivering stronger profitability. Our confidence in continued execution, alongside strong cash flow, is enabling a meaningful commitment to capital return, demonstrated by today’s initiation of a quarterly dividend program.”

Alight said it sees fourth-quarter revenue of $665 million to $685 million versus analysts' estimates of $680.98 million. The company expects adjusted earnings of 22 cents to 27 cents per share, versus expectations of 22 cents per share.

Alight shares fell 0.9% to trade at $8.39 on Wednesday.

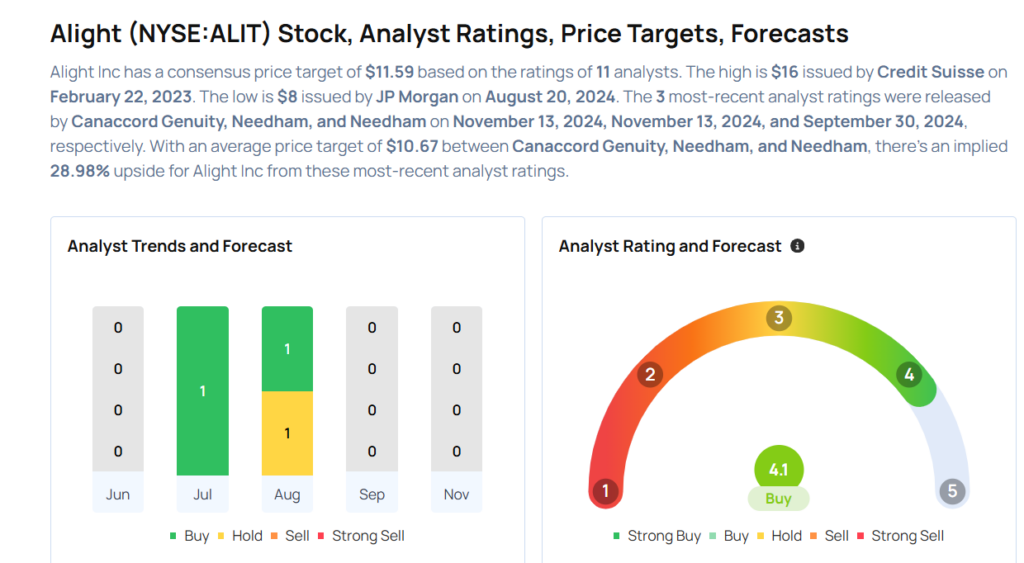

These analysts made changes to their price targets on Alight following earnings announcement.

- Needham analyst Kyle Peterson maintained Alight with a Buy and raised the price target from $9 to $11.

- Canaccord Genuity analyst Joseph Vafi maintained the stock with a Buy and raised the price target from $11 to $12.

Considering buying ALIT stock? Here’s what analysts think:

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.