Zinger Key Points

- Investors have yearned for the Comcast demerger announcement, says Craig Moffett

- 'Makes sense to carve off that piece of the business and highlight the remaining part of Comcast'

- The ‘Trade of the Day’ is now live. Get a high-probability setup with clear entry and exit points right here.

Analysts are seeing Comcast Corp‘s CMCSA plan to restructure its media empire as a positive for investors. Craig Moffett, the senior managing director at MoffettNathanson has said that “investors have yearned for this” and carving off the cable television business will be good for its growth prospects.

He also said how the decline in the cost of capital to set up the cable infrastructure, is the only revolutionary aspect of this sector because building fiber in lower-density areas was “enormously expensive.”

What Happened: Comcast Corp will be spinning off most of its cable television networks including MSNBC and CNBC into a separate publicly traded company.

The new company, to be led by current NBCUniversal Media Group chairman Mark Lazarus as CEO, will house popular channels including USA, Oxygen, E!, Syfy, and Golf Channel. NBCUniversal will retain control of Bravo, the NBC broadcast network, Peacock streaming service, NBC Sports, and Universal theme parks, reported CNN.

Also read: Comcast Plans Major Cable Networks Spinoff, MSNBC And CNBC To Form New Public Company: Report

The move comes as traditional cable networks face increasing pressure from streaming services. Travis Hoium, the founder at Asymmetric Investing, in an X post, highlighted how Comcast’s total domestic video customers have declined from 19.4 million in March 2021 to 12.8 million viewers in September 2024. This represents a total decline of 33.69% or 11.06% on an annualized basis, over these 14 months.

Despite industry headwinds, these channels remain profitable contributors to Comcast's bottom line. The spinoff is being positioned as a growth opportunity, with potential for future acquisitions in an industry primed for consolidation.

Why It Matters: "Cable is in secular decline, so it makes sense to try to carve off that piece of the business and highlight the remaining part of Comcast, which has a much better growth profile," said Moffett in an interview with Barron, who rates the stock as a Buy, with a price target of $57, indicating a 35% upside.

Moffett, a telecom, cable and satellite analyst in a LinkedIn post also said that the “cost of building wired infrastructure is still the dominant aspect of competition.”

“Building infrastructure in lower-density environments is enormously expensive. What is revolutionized is not the bendable fiber but the cost of capital which has fallen over the last decade. It has suddenly made it possible to imagine that you can build infrastructure in a lot of places that never would have made sense before,” he added.

Also read: The Analyst Verdict: Comcast In The Eyes Of 15 Experts

Price Action: Shares of Comcast Corp were up 0.98% to $43.41 in the pre-market hours on Thursday, whereas were up by 0.26%, according to data from Benzinga Pro.

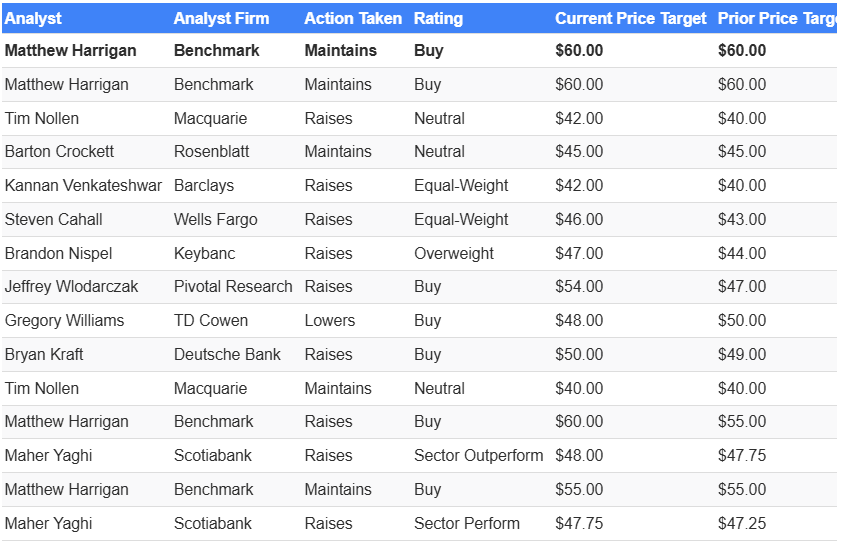

As per Benzinga’s recent report, fifteen analysts have shared their evaluations of Comcast during the recent three months, expressing a mix of bullish and bearish perspectives.

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $49.65, a high estimate of $60.00, and a low estimate of $40.00. Witnessing a positive shift, the current average has risen by 3.01% from the previous average price target of $48.20.

Photo via Wikimedia Commons

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.